Weather: Seems strange writing about weather with what is going on externally. Rostov Oblast is, according to the Euro model, getting back down to minus 5°C towards the back of the 15-day forecast after posting a recent high of 20°C. Winterkill will become a discussion again. Divergence exists in the US weather model; some snow is forecast mid month for Kansas.

Russian wheat fob price in US$ per tonne versus Chicago wheat May25 contract. The spread has widened, presently about $50/t Russian premium over Chicago, and returned to levels seen after the first tanks rolled over the border. Source: Bloomberg via Lachstock. Click expand.

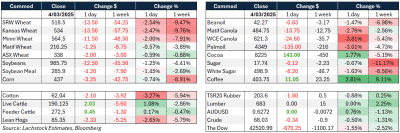

Markets: Where to start. A sea of red this am post the tariffs kicking in but, as has been the case throughout this administration, there are increased soundbites about tariff relief already. The spread in wheat price between Russian cash and the US markets continues to widen, back to levels seen not long after the first tanks rolled over the border.

Australian Day ahead: Defensive – the domestic trade has plenty to sift through this morning. Alfred is looming, US futures continue their slide and demand is difficult at best. Expect values to be back a little today until the dust settles.

Offshore

China hit back, imposing levies of up to 15pc on American agricultural goods. Its customs agency suspended imports of US soybeans from Louis Dreyfus, CHS and EGT.

President Zelenskyy took to twitter seemingly to offer an olive branch to the US, indicating that no one wants peace more than Ukraine. I am sure you are all over the decision of President Trump to pull all support and, according to many news wires, increase his dialogue with President Putin who has offered to help him disarm Iran. You cannot make this up.

US Commerce Secretary Howard Lutnick was quick to indicate that the Trump administration may announce a pathway for tariff relief on Mexican and Canadian goods. A US-Mexico-Canada trade pact was mentioned. In approximate terms Canadian exports to the US accounts for 19pc of their GDP, Mexico around 37pc. American exports the other way account for just under 3pc of the US GDP. Knife to a gun fight.

I’m flirting with conspiracy theory here – buuut – a BlackRock-led consortium is in the process of buying a controlling stake in the Panama ports along with a larger unit that has operations in 23 countries.

President Donald Trump delivered an address to a joint session of Congress on Tuesday, March 4, 2025, at 9:00 p.m. Eastern Time (1:30 p.m. on Wednesday, March 5, 2025, in Adelaide, South Australia). This is his first major speech to both chambers since returning to office in January.

India’s wheat millers are urging the government to reduce or remove the 40pc import duty on wheat due to shrinking inventories. They propose that the duty cut take effect after farmers have sold this year’s crop, anticipating that 2–3 million tonnes (Mt) of imports into southern India would be viable. The lobby group expects wheat production for the year ending in June to reach 110Mt and is also advocating for unrestricted exports of wheat products, including refined flour.

Australia

Canola up, grains down – a constant theme lately. Unwrapping the what-ifs associated with the tariff war and how it relates to Australian values is not an easy process. Canola is even more complex when you add the outright demand erosion this could cause and the fact this veg oil demand in the US would need to be replaced with something. Gut feel is Trump works out a solution with Canada but it is going to be a bumpy ride.

Rainfall outlooks for Australia are now looking more encouraging with the back end of the forecast covering most of the country. SA is in the conversation, which is desperately in need of rain for livestock dam water in many parts of the state. How far west the Qld event will stretch will be interesting. There is some talk BOM may actually bump Cyclone Alfred up to a category 3.

HAVE YOUR SAY