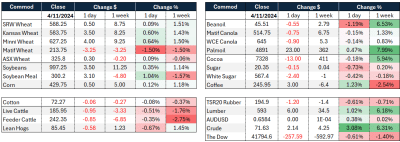

Market changes overnight were small, except MATIF wheat which eased 1 percent.

- Chicago December 2024 wheat up US0.75c/bu to 568.75c/bu;

- Kansas Dec 2024 wheat up 4.25c/bu to 571c/bu;

- Minneapolis Dec 2024 wheat up 5.25c/bu to 605c/bu;

- MATIF wheat Dec 2024 down €3.25/t to €213.75/t;

- Corn Dec 2024 up 2c/bu to 416.5c/bu;

- Soybeans Nov 2024 up 4.75c/bu to 987.25c/bu;

- Winnipeg canola Jan 2025 down C$0.90/t to $645/t;

- MATIF rapeseed Feb 2025 down €1/t to €516/t;

- ASX Jan 2025 wheat up A$0.30/t to $325.80/t;

- ASX Jan 2025 barley down A$1/t to $275/t;

- AUD dollar up 25 points to US$0.6585.

The day ahead

Weather – US saw 4 inches and counting in parts of OK with good falls through the Panhandle and into southern KS. Rains in southeastern Russia – around half an inch yesterday. Nothing concerning on the global weather front.

Markets – Pre-election fun and games. Big ranges with reports that the pro Trump trading strategies, ie long commods, long USD were being paired back. Not sure how true that is, but the race to the White House seems closer than first predicted.

Australian day ahead – Uncertainty. Not sure the trade will want to take a big position with the geopolitical risks in play. Definitely feels like we are closer to pricing export flow but there is simply nothing on the weather front to spark concern. Same story, different day – canola supported, cereals watching the race.

Offshore

GASC tendered overnight. Offer values were higher but, given this is a cnf offer, it’s a little hard to gauge on a fob level.

It is an interesting game of chicken with Egypt indicating it will not pay more than $240 and Russia saying it wants to enforce its $250 floor. Long story short – values are up. Not sure if any business was booked or, according to unsubstantiated Twitter reports, it cancelled the tender.

The market expects the RBA to leave rates unchanged today with the curve suggesting a status quo until Feb next year. All eyes (ears?) will be on the tone in the RBA wording post the rate announcement – Q3 CPI is in line with RBA targets which should lead to a more neutral stance.

US election speculation has seemingly increased. The ultimate worst case scenario for markets would be a long drawn-out affair, with the result being challenged. A selection of the few truly independent polls still has the Democrats slightly in front but acknowledge there are as many as 93 votes in the wind. Remember, the successful presidential candidate would need 270 votes to win.

China’s top legislative body has reviewed a proposal to shift some of the off-balance-sheet debt held by local governments onto their official accounts, with the aim of alleviating their financial strain—an initiative previously hinted at by officials. During a Monday morning meeting, the National People’s Congress Standing Committee discussed a plan to raise the debt ceiling for local governments, allowing them to replace their hidden debt. According to state media, Bloomberg News previously reported that China might allow local authorities to issue up to 6 trillion yuan in bonds by 2027 to refinance this hidden debt.

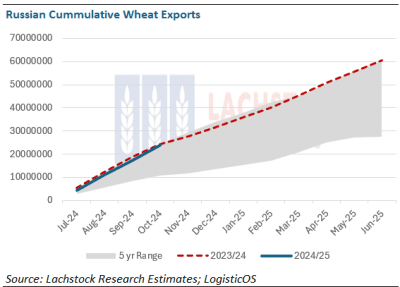

While the southeastern part of the Russian wheat belt managed to get a drink, cold temps will undoubtedly be slowing growth. Stavropol is set to fall to -4°C over the next 2 days, probably not enough to cause any meaningful damage but certainly will put the brakes on any more growth.

Australia

Canola started the week softer in Western Australia, with conventional bids around $850 and GM $760. Wheat started the week bid at $370 and barley at $320.

In the east of Australia, canola was bid at $800, back about $10 from Friday’s number; wheat was bid at $344 and barley at $293.

Barley delivered Darling Downs is up nearly $20 from the September lows of $295, now bid $312 for January+, but this rise hasn’t been enough to bring forward any considerable grower selling, with May 2024 highs of $400 still front of mind.

With reports coming in of high percentages of BAR2 and BAR3 through central NSW, and with the MLA heavy lamb indicator up close to 50c in the last month to $8.43/kg, this makes feeding lambs a viable option at current levels.

HAVE YOUR SAY