The day ahead

The day ahead

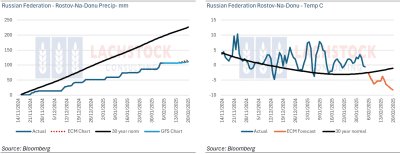

Rostov-on-Don cumulative rainfall, chart on the left, and periodic temperature on the right. Rainfall (dark blue line) is very much below mean (black line). Temperatures have turned lower. The forecast line (red) is the ECM forecast indicating very much below normal temperatures. Source: Bloomberg via Lachstock. Click expand

Weather – Colder temperatures day on day are forecast for Russia. The existence of little-to-no snow cover given recent warm temperatures now is setting up real concern for winter kill in the Feb/March window. Argentinian conditions are not improving with the forecast for the next week little rain and warm temperatures.

Markets – President Trump saying he was not rushing any dialogue with President Xi surrounding the 10 percent tariffs on China looks set to cause some global headwinds and saw markets overnight come off across the board.

Australian day ahead – Global futures were down a little overnight and the Aussie slightly stronger. Expect canola bids to be back a little but cereals likely would remain relatively unchanged supported by strong domestic feed markets.

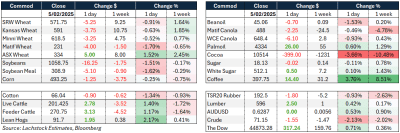

Offshore

Reuters reported trade sources saying China had delayed imports of up to 600,000 tonnes of mostly Australian wheat and offered some of these cargoes to other buyers, because ample domestic supplies in China had reduced import demand.

The EU Commission forecast 2024-25 grain production at 255.8 million tonnes (Mt), unchanged from its December 2024 estimate, being soft wheat 111.9Mt, barley 49.4Mt and corn 59.5Mt.

Black Sea market analyst SovEcon raised its 2025-26 Russian wheat export forecast by 1.9Mt to 38.3Mt. However, that would still be down 4.5Mt from the forecast for the current marketing year.

Russian wheat export duties were cut 11 percent to ₽3,941.6/t (roubles per tonne), barley to 3,012.5/t and corn to 4,255.3/t.

Australia

Western Australian canola bids yesterday were up $10-15 to be bid $870 FIS for current crop and $810 for new. Wheat was firmer around $376 and barley $338.

Eastern Australian canola bids were steady around $768 with new crop bids $743. Wheat was a touch firmer $343 and barley track bids around $315.

Domestically feed grains are being well bid by end users as they look to increase coverage and increase what has been lacklustre grower selling to date. The SA market zone is close to pricing wheat through the western Port Kembla zone.

Griffith market zone prices have increased about $25/t since harvest, with ASW1 bid about $325/t for March delivery. Strong pricing is encouraging grower selling and likely will result in higher protein wheat from this area being fed to livestock because domestic buyers are paying more than an export buyer, calculating its nominal freight spread, can pay.

HAVE YOUR SAY