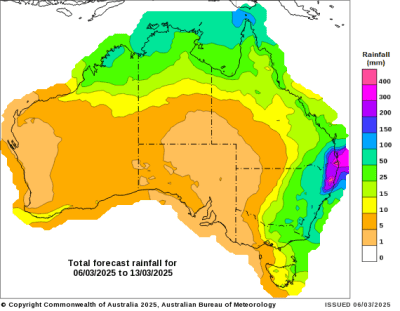

Weather: Cyclone Alfred is slowing its approach and is now due to make landfall in SE Qld tomorrow night, we wish all our readers & staff from that region the best for safe outcome. The aftermath of the cyclone’s impact on infrastructure at the ports and rail to the ports will need to be assessed, likely causing some short delays on shipping. Whilst further inland the rainfall down the eastern seaboard will benefit a dry interior. Depending on how far west and south it gets, it could set up a flurry of early plantings in Australia and give confidence to the NSW wheat crop in 2025.

Markets: The tariff saga continues, only moments after the tariffs were reinforced, the Trump administration talked about providing exemptions for a month to the Mexico and Canadian automakers through the USMCA. Following which, you can expect every other industry body pleading their case for a further extension. Then soon after, talk of relief that the tariffs placed on Canada and Mexico could be forthcoming even this week! Commerce Secretary Howard Lutnick saying “that the president will “probably” scale back the tariffs if certain conditions are met”. Still no certainty on this stuff and we are going to keep digging holes and filling them back in as the sentiment changes daily!

Australian Day ahead: Farmer selling has ticked higher with the forecast rain and with global uncertainty remaining, including its yo-yo effect on the AUD this week, we can expect a cautious approach from both sides of the market at the moment.

Offshore

Rusagrotrans has lowered Russia’s wheat export forecast for the 2024-25 season to 40.5 million tonnes (Mt), 1.5Mt below its previous estimate (USDA @ 45.5Mt). February exports were 1.95Mt, the lowest for this month in five years, and March exports are expected to fall further to 1.5-1.6Mt, a four-year low.

President Donald Trump has called on American farmers to remain patient as new tariffs threaten their business amid a prolonged farm downturn. Retaliatory tariffs from China, Canada, and Mexico have wiped out gains for corn and soybeans, with cash crop revenue expected to decline for a third consecutive year in 2025. The US has raised tariffs on China, Canada, and Mexico, contributing to a record $49 billion agriculture trade deficit.

While some industry leaders see potential for new trade deals, concerns persist about higher input costs, export market losses, and the impact on farm incomes. Despite financial hardships, Mr Trump has promised further support, similar to the $28 billion aid provided in his first term.

He rolled out his “drill baby drill” slogan again overnight and oil markets took it on the chin as a result.

The USDA’s next WASDE report on Tuesday next week (11th of March) is going to provide some challenges for the analysts when they think about Canada and Mexico.

Stocks of ethanol in the U.S. have fallen back from a recent high hit last week, although they remained above the 27million barrel mark.

7-day forecast rainfall would benefit agriculture in eastern Australian inland, though coastal forecasts of rain from Cyclone Alfred are extreme. Source: Bureau of Meteorology via Lachstock. Click expand.

Canola markets recovered on oversold sentiment with Canadian Prime Minister Justin Trudeau speaking with President Trump over the phone discussing fentanyl and tariffs. Although nothing concrete came from the call, the potential for another swing in the tariffs remains.

Australia

Focus is on Cyclone Alfred and how far and wide its tentacles reach. The slower speed of the cyclone has fears it is getting stronger, but at this stage it remains a category 2. With concern for their SE Qld friends and family, famers in the interior of the eastern states are looking for a much-needed drink of rain and have one eye on some promising forecasts on the back of the cyclone.

We can expect a little bit of a bump in canola prices today on the back of the tariff swing, but the ever-changing landscape will keep buyers cautious worried about just having to backtrack during the day when a new comment comes out.

HAVE YOUR SAY