The day ahead

The day ahead

Weather – Lack of snow cover throughout Russia is the concern. There is a very low correlation between January conditions and final yield, a fact not lost on the market, yet global values seem more sensitive to this event given the stock levels. A perfect spring would still produce a historically massive crop, but weather events will be traded from now on. Argy looking at some decent rainfall – 40-70mm over the next 2 weeks depending on the model, but also record temps.

Markets – The wheat yo-yo was forced down on Wednesday by grower selling, last night was all about fund buying. At some point, the short had to be moved from the spec to the farmer, especially in light of the northern hemisphere crop conditions – maybe that is simply what is happening.

Australian day ahead – Spec buying, in my humble opinion, carries more weight than grower selling. We have long been focused on fundamentals which have, to this point, largely been ignored. If the spec grabs hold of this story, there is not enough risk premium in futures markets. However, the Australian exporters phone is not ringing and that, ultimately, will set the tone for local pricing. A push for me today with continued interest in delivered feed grain home.

Offshore

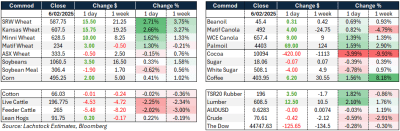

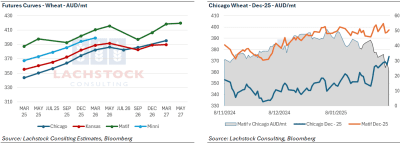

Australian-dollar-denominated wheat price, forward curves (left) and the December 2025 contract price comparisons Chicago and Matif (right). Source: Bloomberg data via Lachstock. Click expand

Fund buying was seen as the main driver last night as Chicago wheat took out Wednesday’s high and settled just below the 200-day moving average (Dec-25 contract). Is the spec short nervous that Trump strikes a trade deal with China? This seems more logical than them jumping out due to Russian weather, as they have largely ignored that to date. Technicals matter – with the funds trimming their bearish bets, a close above the 200-day moving average would fuel more buying. Conversely, if it fails, incentive to continue to pair positions could wane. USDA will release its WASDE report on Feb 11 which is then next key data point. South American row crop estimates are the main numbers at this time of year but some focus will be on export estimates in the different wheat classes.

Listed US agricultural companies have unilaterally downgraded their outlooks, citing uncertainty stemming from policies of President Trump. While these companies’ profitability is linked to underlying commodity values, additional uncertainty around biofuel policy creates a level of bearishness to their prospects. Always an interesting dynamic given the reddest of states tend to be farming areas yet, should there be a significant shift in the Renewable Fuel Standard, corn and beans would ultimately suffer.

Wheat Weather:

- North America: Wheat remains dormant in generally good condition across the Central and Southern Plains, with limited precipitation but continued warmth. Recent rainfall has benefited dormant SRW wheat in the Delta and Midwest.

- Eastern Black Sea: Winter wheat is dormant but in poor condition.

- Europe: Scattered rain in Spain and Italy supports vegetative wheat, while excessive rainfall affects northwestern Europe. Southeastern Europe remains dry and needs more rain.

- North Africa: Showers have returned, improving wheat development and gradually improving conditions.

- China: Winter wheat is dormant and mostly in favourable condition.

Japan bought 97k of wheat from the US and Canada. South Korea bought 30kt of milling wheat from the same suppliers.

One impact of the current DOGE review of foreign aid spending by the US is a complete halt on grain purchases for food aid programs.

Australia

Western Australian canola was solid bid around $870 and new crop working slightly higher at $805. Wheat was bid around $375 and new crop was bid $390 with barley bid $340 for current season.

Through the east of the country canola was $765, with cereals unchanged wheat at $343 and barley $315.

The last of the chickpea exports are due to leave within the next month with bids holding firm around $905 delivered Brisbane for prompt delivery.

Rainfall through eastern parts of NSW and Vic over the next week continues to increase with 15-50mm for larger parts of these states, heavier falls should see growers confidence on the 25/26 season increase and a few spray rigs pulled out of the sheds.

HAVE YOUR SAY