Weather: Cyclone Alfred is taking its sweet time but should hit in earnest on Saturday morning. Heat is smashing through Argy but they have plenty of moisture. India also pretty warm over the next 10 days. Same same in the Black Sea – temps now forecast to stay warm so we should have broken dormancy.

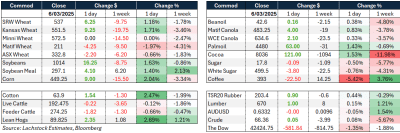

Markets: Don’t call it a comeback. Markets found some footing in the afterglow of President Trump’s delay of Mexican and Canadian tariffs. At the same time, Trump tipped into Prime Minister Trudeau – no love lost there.

Australian Day ahead: What matters? During the Trump-led US futures cleanout Russian cash has been rock solid. The global volatility however would have most in the trade somewhat nervous and domestic values will be a little defensive.

Offshore

- Temporary Exemption for USMCA Goods: President Trump temporarily exempted Mexican and Canadian goods covered under USMCA from his new 25 percent tariffs until April 2, 2025, to minimise disruptions, particularly in the auto industry. However, most Canadian energy products (62pc) and about half of Mexican imports will still face tariffs.

- Tariffs Tied to Border Security & Drug Crackdown: The exemptions follow negotiations with Mexico and Canada, who pledged to intensify efforts against illegal immigration and fentanyl trafficking. Trump warned the relief is short-term and plans to introduce broader “reciprocal duties” and sector-specific tariffs after April 2.

- Agricultural Secretary, Brooke Rollins indicated she was hopeful that Ag products could be carved out if and when the 25pc tariffs actually come into play.

- Global Crop & Supply Updates: Rain is expected in key Brazilian crop areas, potentially affecting corn and soybean harvest. The upcoming WASDE report is expected to show tightening U.S. corn supplies, while soybean and wheat stocks remain steady. Meanwhile, drought conditions persist across major U.S. crop-producing regions, impacting future planting decisions.

- China Increases Grain Stockpiling Budget: In response to escalating trade tensions, China has raised its 2025 grain production target to around 700 million tonnes and increased its agriculture stockpile budget by 6.1pc to 131.66 billion yuan ($18.12 billion). This move aims to enhance food security and reduce dependency on grain and soybean imports, mainly from the US and Brazil. The increased budget will support storage facilities, agricultural insurance subsidies, and the expansion of crop cultivation, including oilseeds and sugar crops.

Australia

How far west will the rain push is the main focus of the trade today – any Brissy based traders will be home taping up windows so we are probably in for a slow day.

Canola took a break yesterday but, given Trump announced the Canadian stay of execution post the close of the futures markets, maybe the Aussie trade will been keen to own some.

The AUD has gone from sell mode, based on the idea that tariffs are inflationary for the US to buy mode on the idea that Trump is going to kill the US economy. This gremlin needs constant feeding – but its hard to predict if the next sound bite will be bullish or bearish.

HAVE YOUR SAY