The day ahead

Weather – US wheat weather is nothing short of wet. After the eastern belt got a drink, the west is now set to get 2-3 inches over the next 7 days. Low temps in Russia were 0 to -5°C but should only slow any late growth rather than causing meaningful damage. Copy paste from yesterday, nothing to see here.

Markets – As much as I would love to bang on about the election, I will focus on the market reaction. Seems everything from commodities to bonds remember 2016 – the world had Hillary odds on, Trump won, market puked then spent the next week making new contract highs. While the set up was a little different this time round, the market got in front of some of Donald’s plans. USD rallied, equities firmed but the slightly random one was crude which eventually finished largely unchanged after being down almost 3 percent. More on that later.

Markets – As much as I would love to bang on about the election, I will focus on the market reaction. Seems everything from commodities to bonds remember 2016 – the world had Hillary odds on, Trump won, market puked then spent the next week making new contract highs. While the set up was a little different this time round, the market got in front of some of Donald’s plans. USD rallied, equities firmed but the slightly random one was crude which eventually finished largely unchanged after being down almost 3 percent. More on that later.

Australian day ahead – Lots to deal with – AUD probably the main driver given Ag futures were net higher to unchanged. Veg oil sector will help canola along with some pretty variable yields and low oil. Pulses caught a bid which should also be supported by currency. Unch to firm across the board.

Offshore

Hard to unpack. I know you will all be reaching capacity no matter if you are red or blue so I will skip over the result. Markets will spend some time digesting what is in store – simple view is maybe the easiest way to start. Trump has declared to expand domestic oil exploration/production/refining, shut the border, make America healthy again (RFK) and lower govt spending. But maybe the more interesting directives from a market perspective is his offshore plans. Increase tariffs (China), shut out offshore car manufacturers (China), cut funding to other countries (Ukraine), return sanctions (Iran) and remind global leaders he’s back!

China – clearly, he has unfinished business with China – the difference this time round is China is hurting. Tariffs could arguably hurt more this time round and quantifying how China reacts is impossible. When Indo slapped an import tariff on Chinese finished goods China indicated that they wouldn’t be buying palm from them – not sure this has been the case but shows you where their head is at. China also shut off canola from Canada when they said they wouldn’t be taking their electric cars.

Middle East – Trump is an Israel supporter and is aggressively against Iran and Biden’s relaxed stance on sanctions. During Donald’s last presidency Iran was pumping out around 300k bbls a day, now they are above 2mbbls a day – and he blames the Biden administration so you can imagine he wants to reverse this. Crude rallied off the lows on the belief that Donald will be successful in reducing this supply.

Ukraine – ok, this is a tough one. Trump has been vocal against the funding of Ukraine and has committed to wind this back. He has also said he would end the war with one phone call.

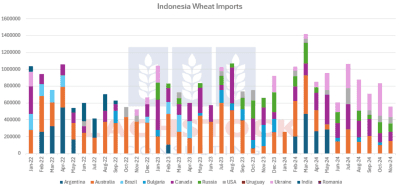

Indonesia wheat import per month by country of origin. Ukraine (pink), US (grey), Russia (green), Canada (purple) and Australia (orange). Click on image to expand.

Russia and Ukraine are currently pumping out record exports so it is hard to see them doing more. It feels like, in the short term at least, this flow could be negatively impacted – however, how the de-funding and subsequent intervention by the US affecting Ag flows is massively significant, particularly in wheat.

Lastly (well probably not) what happens to the renewable fuel standards and the mandated biofuel blends. On one hand Trump is committed to bring manufacturing back to the US, he is anti foreign electric cars and wants more domestic activity = more miles driven = the biofuel blend wall expands. However, last time he was in office he didn’t change the mandates but did hand out a bunch of waivers to the obligated parties which negatively impacted both the blend wall and RIN market. He has committed to reducing the import of used cooking oil which should push more demand back to the likes of beanoil. It is not clear. I haven’t touched on the fact RFK wants to ban/reduce the use of glyphosate and additives in food. This could be a sleeper.

Australia

In the west canola bids trimmed A$10 to be bid $845 for conventional and $752 GM fis. Wheat bids were slightly higher, bid $375, with barley bids at $324 for most port zones.

The east of Australia was a similar story, with canola bids coming off around $10 to be bid $789, with around a $52 spread to GM. Wheat was steady around $344, with barley up a little to be bid $297.

Faba beans were in demand yesterday, with packers chasing beans. Quality and production concerns, coupled with the A$ providing another level of support, saw faba bids up $70 in SA to be bid $625, with delivered GM bids up around $30, bid $590 for harvest delivery.

Rainfall models are building for eastern regions throughout NSW and Qld, where between 15-50mm is forecast in the next 8 days. This will see growers working around the clock to get as much harvested before rain arrives. On the other hand, this rain will be welcomed for what is shaping up to be a big sorghum crop through NNSW and Qld.

HAVE YOUR SAY