The day ahead

Weather – Lucky weather is boring with everything else going on in the markets. US getting rainfall and more to come – it is getting a little fresh over there, however, so growth would be slowing. Rain increasing in the back end of the Russian forecast but, as with the US, things are chilly. Central Ukraine has been missing out on the small daily totals that the Russian southern region has been getting. However, nothing market-driving in weather today.

Markets – Dust settles on the US election. For the most part, the most post the Trump win gains were largely held onto. The Dow closed unch, still up just under 5pc for the week. Ag mkts were once again driven by the veg oil complex. AUD back in the mid 0.66’s.

Markets – Dust settles on the US election. For the most part, the most post the Trump win gains were largely held onto. The Dow closed unch, still up just under 5pc for the week. Ag mkts were once again driven by the veg oil complex. AUD back in the mid 0.66’s.

Australian day ahead – Hot in the north, cold in the south. Harvest trying to gain momentum but, based on price action alone, growers are focused on getting it off, not marketing. Aussie market will have one eye on what Trump has to say leading into the 20 Jan inauguration. Clearly, he will have plenty to say but Ag markets will be most interested in his plans for China. Albo in the press this am indicating he wants stronger ties withe Beijing. Canola up, cereals unchanged is my call.

Offshore

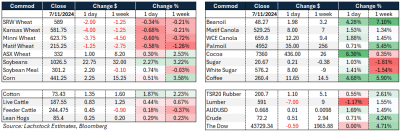

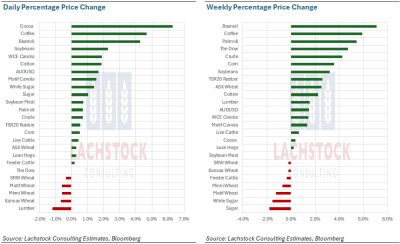

Market changes amid the election turmoil at the beginning of the week mostly have been sustained towards week’s end. Click on image to expand.

The US Federal Reserve cut rates in the US by 25 basis points, smack on expectations. Fed chairman indicated that more cuts should come but that will depend on the data, a subtle shift from last update which was more favourable to faster cuts.

It is almost a footnote now, but Trump is due to be sentenced on 26 Nov for the hushmoney, falsifying documents trial in New York. Many now speculate that this will not happen. It is unclear if this will be thrown out or deferred until after his 4-yr term. There are three other criminal cases that were due to be heard but now look like they will be thrown out.

Chinese crude imports are down 3.4pc year to date. The market is trying to weigh up the clear directive by the new administration to stem the flow of Chinese goods vs the other directive of stemming Iran’s oil production. It certainly feels like the Chinese economy was more robust last time Donald pulled out the tariff pen.

Another massive week for US corn exports, pumping out 2.76Mt, putting them at 28.5Mt this year. Wondering why vegoil is strong? US weekly soyoil exports posted a 12-year high for any week at 114.3kt. Meanwhile, India’s palmoil imports surged 59pc in Oct to a 3-month high month on month driven by restocking demand and strong festival demand.

Australia

In the west, canola bids were up A$20 to be bid $866, with GM at $765. Wheat was bid $375 and barley $322.

The east of Australia saw similar canola gains, with bids up nearly $20 to be bid $806. Wheat and barley bids were largely unchanged.

Delivered Darling Downs markets have been well supported in the last week, with wheat bids around $344 yesterday, up $16 from the start of the month. Barley has risen $6 so far for the month to be bid around $319. This is likely driven by slow grower selling and end users looking to secure cover for Jan+.

Harvest in Qld is coming to a close, with winter crops 98 percent harvested. The sorghum harvest is now around the corner, with earlier crops likely to begin harvest in late January.

HAVE YOUR SAY