Weather: Dry weather in China threatens wheat and rice production, with delays in rice planting and poor wheat crop conditions in key regions like Henan, Jiangsu, and Shaanxi. Good conditions through the US corn belt with moisture and warm temperatures will see good planting progress and area planted for US corn and soybeans.

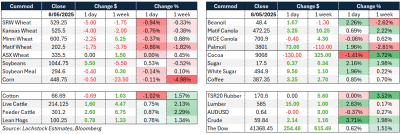

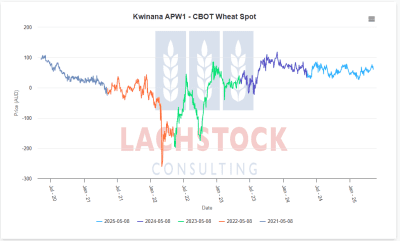

Markets: Wheat demand improved a little as reflected in export sales, but wheat still worked lower weighed down by lack of weather concerns global and good production prospects. Oilseed markets were flat to slightly stronger with the canola balance sheet tight and strong demand for bean oil lifting the soybean complex.

Australian Day Ahead: Rinse and repeat, while global wheat values continue to edge lower the lack of rainfall and nothing for the next 10 days will not inspire anyone to take a position. Aussie wheat basis remains solid as it should given the outlook. Feed demand won’t be going anywhere and that will be enough to support domestic values through the east coast. Canola is supported but there’s only a hat full left and new crop sales are brave at this point.

Offshore

US weekly export sales for wheat were impressive. New crop sales were 492,978t which is a marketing year high and more than double the previous week. South Korea was a major buyer accounting for 100,800t, and the much talked about over the past week – Morocco was down for 30kt of HRW. Old crop sales showed 69,659t, which was bang in the middle of the expected range.

US wheat down across the board despite export sales above expectations with corn weighing on wheat with ideal plating conditions through the corn belt with warm temps and ample moisture for most parts.

StatsCan reported overnight, total wheat stocks were down 1.2pc year on year to 15.4 million tonnes (Mt) as of March 31, 2025. Non durum wheat stocks were 13.4Mt, the second lowest since 2019 due to usage from Aug to Dec near a record high driven by exports.

In a recent tender, the Taiwan Flour Millers’ Association acquired approximately 99,200t of milling wheat from the US, as reported by European traders.

Other Grains and Oilseeds

StatsCan reported canola stocks were down 39pc year on year to 5.9Mt as of March 31, 2025. Canola on-farm stocks were down 43pc to 4.6Mt and commercial stocks were down 18pc to 1.3Mt. Barley stocks were basically unchanged year on year at 3.1Mt.

Corn markets remained capped ahead of the USDA’s May 12 supply and demand update as good US planting conditions offset support from tighter Canadian stocks, which were down 13pc year-on-year to 7.2Mt, and stronger-than-expected weekly US export sales of 1.66Mt.

The US Department of Agriculture also reported additional private export sales of 225,000t of soybeans to Pakistan this morning.

China has reached an agreement with Argentine exporters to purchase US$900 million in soybeans, corn, and vegetable oil, reinforcing its decision to bypass US suppliers amid ongoing trade disputes under President Trump’s administration.

Macro

A breakthrough trade deal between the US and UK was finalised, with provisions to reduce UK automobile tariffs from 5.1pc to 1.8pc and eliminate US tariffs on UK steel and aluminium. The deal also grants reciprocal access for US beef and ethanol, although it does not address all long-term trade challenges.

Financial markets responded positively to the deal, with UK mid-cap stocks rising and the British pound holding steady. However, broader economic trends may not see significant change from the deal’s limited scope.

US-China trade negotiations are back in focus as Treasury Secretary Scott Bessent and US Trade Representative Jamieson Greer head to Geneva for talks with Chinese officials. President Trump expressed optimism, stating that tariffs, currently at 145pc, cannot go higher and will likely come down. However, he emphasised that the US would dictate the terms of the deal, which may prolong negotiations.

China has introduced a substantial stimulus package worth 2.1 trillion yuan (~$291 billion) to stabilise its economy in the face of trade tensions. Despite these efforts, high tariffs on US agricultural exports are expected to continue for the next 6–12 months.

Australia

It was more of the same in the west yesterday, with bids largely unchanged: canola at A$790 and GM a little firmer at $730. Wheat held steady at $349, and barley at $342.

Through the east of the country, canola was unchanged. Current crop was $771 and new crop $790. GM bids remain firm, driven by strong demand for the limited seed still available. Barley was a little stronger at $342, and wheat lifted to $351.

Lupins are as scarce as hen’s teeth through Victoria and South Australia, with feedlots paying around $680 delivered — pulling them out of central NSW.

Australian beef exports hit a record 127,172t in April, up 21pc YoY — the highest April volume on record. Grainfed exports surged 27pc to a record 37,037t. North America led demand, with US exports up 37pc to 37,213t and Canada up 40pc to 3,322t. China remained the top grainfed market, up 62pc to 12,151t.

As we move into mid-May and get a line of sight on the forecast to month’s end, it remains uninspiring for all of southern Australia, with no decent rainfall expected. This is likely to keep a floor under wheat and barley markets through SA, Vic and NSW. Expect we see an uplift in barley hectares as growers look for lower inputs and later planting windows now.

HAVE YOUR SAY