Planting soybeans in the Corbelia district in the Brazilian state of Parana. Photo: Amauri via Notícias Agrícolas

DRYNESS in the Black Sea region and delays to planting of the next winter crop, particular in Russia, have been dominating grain-market discussions and social media in recent weeks. However, the lack of spring precipitation in South America is playing havoc with its row crop-planting program, and has the potential to have a greater impact on global grain markets in the next six months.

And it is not just a case of being dry, with temperatures across the central areas of Brazil reported to have pushed as high as 43 degrees Celsius last week, further depleting soil-moisture reserves. There are hints of rain through the same regions this week, but the forecast models have dialled back the quantity and expected coverage.

Dry November forecast

The November forecast is not inspiring, with below-average rainfall expected across most of Argentina, Uruguay, Paraguay and southern Brazil, which will undoubtedly stress the early sown crops in those regions. Most of northern and central Brazil is forecast to receive average to slightly above-average precipitation across the month of November, improving the soil-moisture profile and the establishment of both corn and soybean crops.

The below-average precipitation trend is forecast to continue into December for Argentina and Uruguay, but the picture is better for Brazil, with close to average rainfall anticipated across most of the major growing areas. Brazilian farmers are proceeding with their corn and soybean planting programs at this stage, despite the extremely dry seedbed, in the hope the season turns around, and substantial beneficial rains are forthcoming over the next couple of weeks. Seeding pace will drop if the dry continues into the second half of October.

Brazilian agricultural marketing consultancy AgRural reported last week that around 31 per cent of the summer corn crop was in the ground, which is bang on the five-year average, but most of it has insufficient moisture to germinate. It is early days for the soybean planting program, yet it is already behind schedule at 2pc completed, compared to the five-year average of 5pc. This is not expected to improve in the coming weeks. Seeding in the state of Parana State is reported to be the slowest in the past five years, with 8pc completed as of 5 October versus 22pc at the same time last year.

Soybeans crop of choice

Brazil’s National Food Supply Company (Conab) has pegged the 2020-21 soybean crop at 133.7 million tonnes (Mt), well above 124.8Mt last season. This is off an area of 38.5M hectares (Mha), up 4.3pc from 36.9Mha in 2019. Conab is calling new-crop corn production 105.2Mt versus 102.5Mt for the old crop.

The increased soybean area is a direct result of record high domestic prices. This has encouraged the clearing of more land, and planting of soybeans in preference to alternative cropping options. The depreciation of the Brazilian Real against the United States dollar, higher futures prices, and insatiable Chinese demand mean the Brazilian farmer is getting double the soybean price of a year ago.

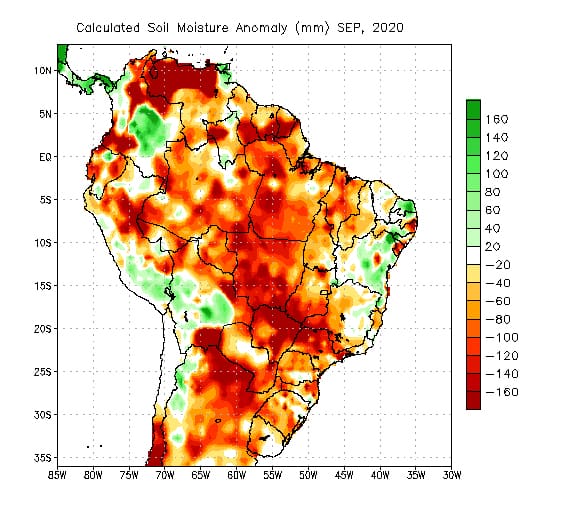

Soil moisture was in deficit last month in major South American summer-cropping zones. Map: US National Oceanic and Atmospheric Administration

This is an enormous incentive to plant soybeans, and farmers don’t care if they are planted late. So even if the dry weather and the planting delays continue, Brazilian farmers will sow as many hectares to soybeans as possible, and as late as possible.

The record prices have also been encouraging the Brazilian farmer to pull on their selling shoes. They are reported to have already sold almost 66Mt, or more than 50pc, of their forecast 2020-21 production, even though most of it is yet to be planted. This is a record for the proportion of the crop sold at this point in the production cycle, and is almost double the historical average of 26.7pc for early October.

Drier in Argentina

The drought situation in Argentina is even worse, but just like in Brazil, the farmers are optimistic, and planting is proceeding at the moment in the hope that the usual spring and rains arrive. The Buenos Aires Grain Exchange (BAGE) has dramatically decreased its 2020-21 soybean crop forecast to 46.5Mt against the USDA estimate of 54Mt. BAGE has also revised its corn crop estimate down 8.7pc year on year to 47Mt.

The concern at this stage is not so much that the South American summer crops won’t get planted; it is more around the impact of the delayed crop on global supply, in particular soybeans. With the delay in bean planting in Brazil comes a delay to harvest, so it is almost assured that there will be a global shortage of soybeans in February next year when the US export program is winding down.

Brazil’s biggest farming state is Mato Grosso, and by the end of January this year, it had already harvested 9Mt of soybeans, or 25pc of the state’s total crop. Given the current scenario, it is very tough to see any more than one-third of that being in the bin by the end of January next year. That will substantially decrease stocks available for export from Brazil in February.

Chinese buying continues

The domestic soybean consumer in the US should be praying pretty hard that the weather pattern changes very soon in Brazil and Argentina and the spring rains arrive. Chinese soybean demand is currently more than 2Mt per week. Every day the planting program is delayed means another five or six cargoes of Chinese imports that will have to come from the US in February, adding to the expected tightness in the US soybean balance sheet.

The soybean futures market has already rallied, and many analysts feel that prices could go even higher if the lack of rain and planting delays persist. US futures have now risen more than 7pc since the most recent low on 29 September, much of it on the back of the South American issues. And the rise over the past two months is now almost 23pc or around AU$100 per tonne.

The Chinese have come back from their Golden Week holiday in the mood for shopping. This has coincided with a sharp drop in ocean freight. Soybean sales to China now total 17.5Mt this season compared to 3.9Mt at the same time in 2019. And US-reported sales to “unknown” (read China) are now 10.7Mt versus 4Mt a year ago. Chinese buyers are cognisant of the weather issues that Russia, Brazil and Argentina are currently experiencing, and what it could do to prices over the next six months. Expect the Beijing buying binge to continue for some time yet.

HAVE YOUR SAY