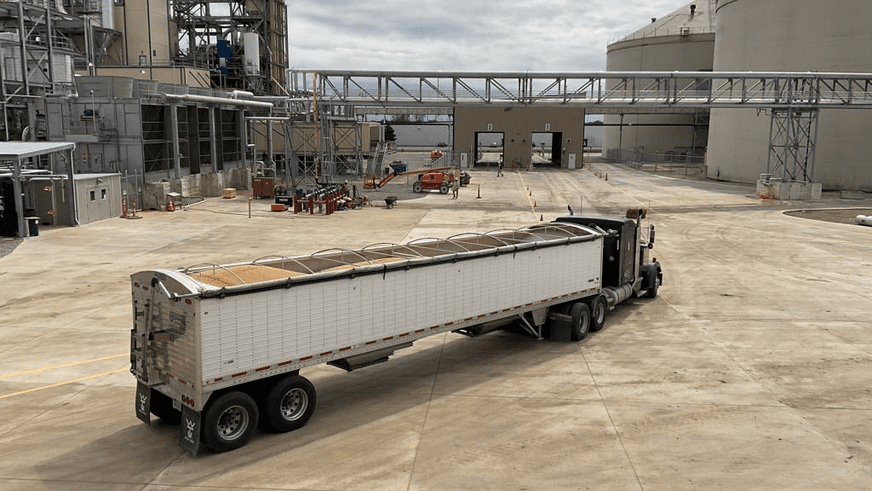

Australian is forecast to export more than 4.5Mt of canola from the harvest now winding up, and China may open as a market for it if shipments of seed from Canada stop. Photo: Barry Haskins, Griffith

AS DONALD Trump’s second term as US President nears, and the war in Ukraine drags on, analysts focused on global grain markets are wrapping their head around how 2025 might look.

Speaking with Grain Central last week, RaboResearch general manager Australia and New Zealand Stefan Vogel said the oilseeds complex presents a mixed bag depending on where US-China and Canada-China relations go on soybeans and canola respectively.

For grain, the possibility that Ukraine may lose ready access to key ports including Odessa under a Russian occupation is the one to watch.

As Trump talks trade with US counterparties ahead of his inauguration in January, Mr Vogel said any impact on Australian markets will be secondary.

RaboResearch’s Stefan Vogel.

“Clearly for grains and oil seeds, it doesn’t mean anything directly for us given that we’re not shipping a lot of grains or oilseeds into that market, but we’re serving some of those that the US is also exporting to like China, like South-east Asia.

“Right now, it seems like the closer geographically you are to the US, the more you are at risk, meaning Mexico and Canada already get the big kind of hammer from Mr Trump,” Mr Vogel said.

For Canada, its exports of beef, pork, canola oil, biofuel, and flour, could all incur tariffs from the US, and push more into Australia’s markets.

“It’s a good thing that we’re far away for Australia; it’s also a good thing that we actually in value terms ship less to them than we buy from them in the US, so that’s what Trump usually likes.”

Watch this soymeal space

Australia imports little soymeal from the US, but Mr Vogel said that may change based on what happened when the previous Trump administration fell out with the Chinese Government, and China as the world’s largest soybean importer stopped buying US product.

It turned South America from a half-year supplier to China from its peak harvesting months of February to April to a full-year supplier.

“When the Chinese didn’t buy from the US, they had to get as much as possible from South America, which meant at that point in time Brazil.”

It saw both Argentina and Brazil exporting more whole beans to China, and shortened the supply of soymeal, of which Australia generally imports around 1 million tonnes for stockfeed and poultry rations.

“When Brazil and Argentina ship soybeans heavily to the Chinese…those that usually got soybean meal supplies out of Argentina had to look a little bit around and pay up for it.

“So there is a bit of a risk.”

The US has recently expanded its soybean crush capacity, including an upgrade at Cargill’s plant in Sidney, Ohio. Photo: Cargill

Mr Vogel said if the second Trump administration fell out with China, and China shut the gate on US soybeans, increased US domestic crushing capacity could well see more US soymeal available for export to destinations including Australia.

“The good news is that the US has increased significantly its capabilities of processing soybean, because of renewable diesel…which requires a lot of vegetable oil.

“The US has actually built over the last few years about 12 or 13 new soybean-processing plants, maybe even more, so that is the biggest expansion…in North America that we’ve probably ever seen in a very short period of time.

“That’s kind of additional volume that could now be shipped…so that can help us.”

Win, loss from Canada seen on canola

As outlined by the Canola Council of Canada, China’s Ministry of Commerce in September issued a Notice of Initiation of an anti-dumping investigation into imports of Canadian canola.

This followed MOFCOM’s preceding announcement of measures against Canada in response to the Canadian Government’s planned tariffs on Chinese electric vehicles, steel, and aluminum.

China is the biggest market for Canadian canola, and Mr Vogel said China could well hit back.

“So basically, the Chinese turned around and said: ‘Well, if you’re not taking my electric vehicles, I’m not taking your canola anymore’, and that is a real big flow, canola out of Canada.”

Mr Vogel said phytosanitary restrictions currently prevent Australian canola from entering China, but these could be resolved if China were keen to open the gate to Australia as a volume exporter.

In the year to September, Australia shipped only 1000 tonnes of canola to China, with the fungal disease, blackleg, limiting volume.

“We have a problem that there are some phytosanitary issues still that doesn’t allow our canola to go over there, but they will hopefully be resolved so that can be good for us in China.”

Mr Vogel said a Chinese ban on Canadian canola was likely to have a knock-on effect in Europe, Australia’s biggest market.

“It might be bad for us in Europe because if the Canadians can’t get anywhere with their canola in China, they will have to try and get more into the European market.”

A challenging season saw the EU harvest only around 17Mt of canola this year, and Mr Vogel said the bloc is likely to import around 6-8Mt from all origins to get it to new crop.

“They’ve taken everything from Ukraine that was available in terms of canola, so now they have to come to the rest of the world and the rest of the world is us and Canada, so that puts us probably in a good position there.”

Precious Ukraine ports at risk

Ukraine supplies around 10pc of the world’s wheat, and is also a major sunflower seed and oil exporter, and shipper of corn, barley, and rapeseed, primarily from ports in the Odessa region.

Black Sea ports such as Mykolayiv are vital for Ukraine in running an efficient bulk export program. Photo: Buhler Group

After many months of trucking and railing grain overland, and out via barges to Romania, Ukraine has for some time been shipping bulk cargoes, despite the threat of attack from Russian forces.

Trump has made no secret of his belief that European nations should be doing more to fund Ukraine’s war effort, and his administration’s intent to do less.

Mr Vogel said the immediate threat looks like being Ukraine’s access to its key Black Sea ports.

“Those ports are only about 130km away from the front line.

“There’s a lot of bombing and shelling happening in the Odessa area, and if Mr Trump, as he said, will reduce the support for Ukraine, it will be very hard for Ukraine probably to resist or slow the Russians further down south.

“With that, Mr Trump maybe doesn’t want Ukraine to lose, but he wants definitely the countries in the European Union to step up to finance the war in the Ukraine stronger.”

If countries including France, Germany, and the United Kingdom do not fill the breach that looks like being left by reduced US support, Mr Vogel said Ukraine’s ability to export grain efficiently could well be a casualty.

“I think for Ukraine, it gets tougher to keep the resistance as high as it was in the past.”

If ports on its eastern Black Sea shore fall into Russian hands, returning to the practice of trucking, railing, or barging grain out is an option, but not an attractive one for a country relying on bulk shipments to earn export income.

“It will be very difficult for Ukraine to export any sizable volumes of grains and oilseeds anymore to the world market.

“We basically create a second Kazakhstan which…would need to go through Russian territory or Russian-occupied regions to get to the world market, and that will likely not be easy.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY