Dry sowing field peas into barley stubble last week in SA’s Murray-Mallee ahead of 10-15mm of ideally timed rain to spark germination. Photo: Bulla Burra

BARLEY from southern New South Wales is pricing into the delivered Downs market this week in a move which is already narrowing the spread between the northern and southern markets considerably ahead of new crop.

The sorghum market has bounced as supplies out of northern NSW and southern Queensland shrink with the end of harvest, while in the southern market, barley and wheat values have drifted lower based on unappealing elevation margins in the face of Northern Hemisphere competition.

Dry conditions centred in northern NSW have some chance of improvement with 10-50mm forecast for all of NSW next week.

However, the best of the past week’s falls have run across southern Australia, with most paddocks in Victoria and South Australia getting a perfectly timed 10-40mm.

| Today | May 25 | New crop | |

| Barley Downs | $430 | $435 | NQ |

| SFW wheat Downs | $412 | $410 | $410 multigrade |

| Sorghum Downs | $395 | $365 | NQ |

| Barley Melbourne | $365 | $353 | NQ |

| ASW Melbourne | $400 | $402 | $410 multigrade |

| SFW Melbourne | $395 | $398 | NQ |

Table 1: Indicative prices in Australian dollars per tonne.

Softer road freight aids north

Cheaper road-freight rates have this week been the catalyst for southern barley to price into the Downs feedlot market in southern Qld.

Sources have told Grain Central that at least two major traders and bulk handlers have not renewed contracts with freight sub-contractors, and per-kilometre rates have dropped accordingly.

“There are some pretty cheap freight rates now at 12c/km versus 15-17c/km not so long ago,” one source said.

“That means there are guys bringing up barley from down south now as far away as Griffith.”

Barley supplies in southern Qld and northern NSW have been very low since harvest, when a much greater than normal proportion of the crop went malting rather than feed.

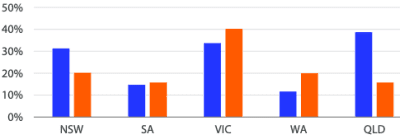

Stocks unsold this year compared to year ago were seen by Rabobank as relatively tighter in Qld/NSW from the situation in the other mainland states, as shown in the chart below.

Chart 1. In Qld and NSW at planting time in 2023 (orange columns) the portion of grain unsold from last harvest was less than a year earlier (blue columns), as compared with the picture in other states. Source: Rabobank. Click image to expand.

Flooding in central NSW reduced its tonnage produced, but barley stocks are believed to be ample in grower, public and private storages in the NSW Riverina, where distance from port has made parcels closer to the coast more attractive to exporters.

Cheaper freight rates are not expected to carry wheat, with sufficient stocks still held in northern NSW and southern Qld, where dry conditions south of the border are of more concern to flour millers than animal feeders.

Trade in sorghum has thinned as the harvest focus shifts north into Central Queensland, and the market has rallied accordingly.

On cottonseed, Woodside Commodities managing director Hamish Steele-Park said more gins have started in the past week, and operations in southern NSW are not far away.

“The market is still hand to mouth as buyers try to get their hands on seed for existing export commitments,” Mr Steele-Park said.

“With ginning starting later than usual this year, there is little seed on the shed floors.”

US cottonseed values remained cheaper than Australian seed values on a c&f basis into export destinations.

Locally, cottonseed is trading at $395-$400/t ex Moree and in the Namoi Valley, while the southern market ex gin is sitting at $435/t.

Showers cheer south

Peters Commodities Riverina-based trader Peter Gerhardy said softer freight rates were being seen in the south, but pricing into the northern market was yet to work from the south-east corner of the NSW grainbelt.

“There are a lot of trucks floating around, and fuel’s snuck back a bit as well; yes, freight has gotten cheaper.”

Traders and growers are watching the weather, and volume offered from both sectors is thing.

“Growers have gone into their shell; they’re finishing sowing, and they’ve got one eye on the weather.

“I don’t think there’s too much trade selling.”

Recent rain in the south’s main regions, excluding much of the southern Mallee, has ensured good establishment of cereal and pulse crops.

However, the likelihood of an El Niño developing by spring remains high, and Mr Gerhardy said that would keep buyers buying hand to mouth, and forward selling cautious, until September.

“The back end of the season’s always the worry for growers.”

Mr Gerhardy said the third-tier market, behind export and regular domestic stockfeed business, could well develop if spring is dry and mixed farmers and opportunity feedlotters start using grain to supplementary feed sheep and cattle.

“If that steps up, all of a sudden that puts a different perspective on things.”

“It’s amazing the amount of grain that consumes…and that can be enough to put a floor in the market.”

Mr Gerhardy’s sentiments were echoed by another trader, who said the local wheat premium reflects concerns about El Niño making the 2023-24 crop a small one.

“Values into Asia equate to $350 delivered Melbourne, and the market’s at $400-$410.

“Despite the international market collapsing, our basis is very strong.”

Growers in most parts of Vic, SA and southern NSW are looking at a good season, at least until spring, if showers keep up.

“I don’t think we’ll see big volumes coming from growers until September.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY