DEMAND for imported barley is rising faster than production, according to the International Grains Council (IGC) November crop report released last week.

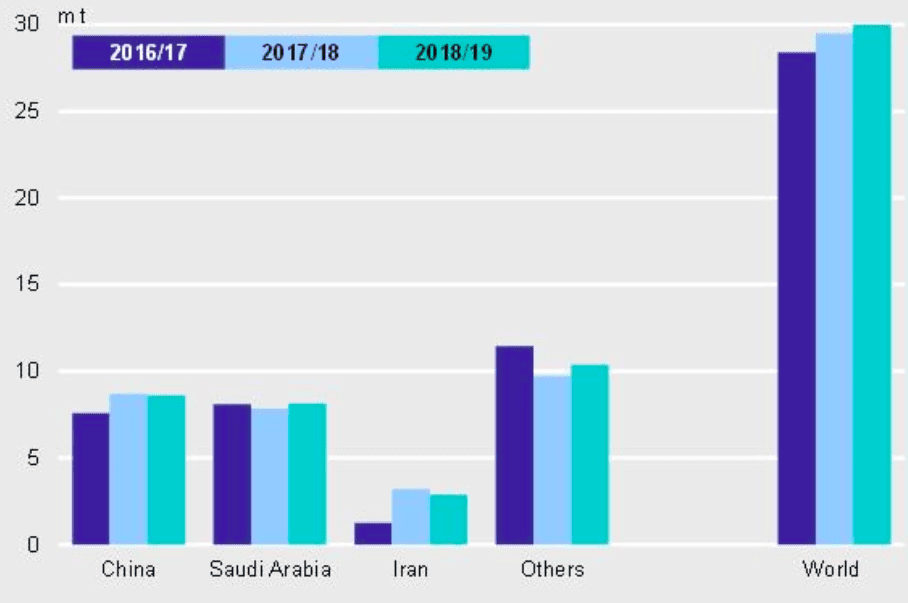

Chart 1: Despite a tight supply outlook, global barley trade in 2018/19 (Jul/Jun, excluding malt) is forecast at 30 million tonnes, which is 500,000t higher than last year and 6pc higher than the 5-year average. Source: IGC

Some very low EU barley yields last summer cut 2018/19 world barley production to 140 million tonnes (Mt), compared with the average of the five previous years of 146Mt.

IGC has predicted demand by users in China and Saudi Arabia, the world’s major barley importers, will hold strong.

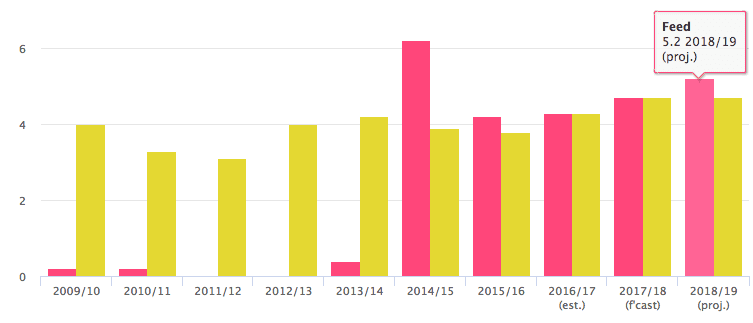

Latest data shows China’s usage over 10 years (chart 2). Feed use in 2018/19 would be at its second-highest level (5.2Mt) and industrial use at 4.7Mt would be around 500,000t greater than its five-year average.

Chart 2. Barley consumption in China. Million tonnes. Feed (red) is near record and Industrial (yellow) is equal to last year’s record. Source: IGC

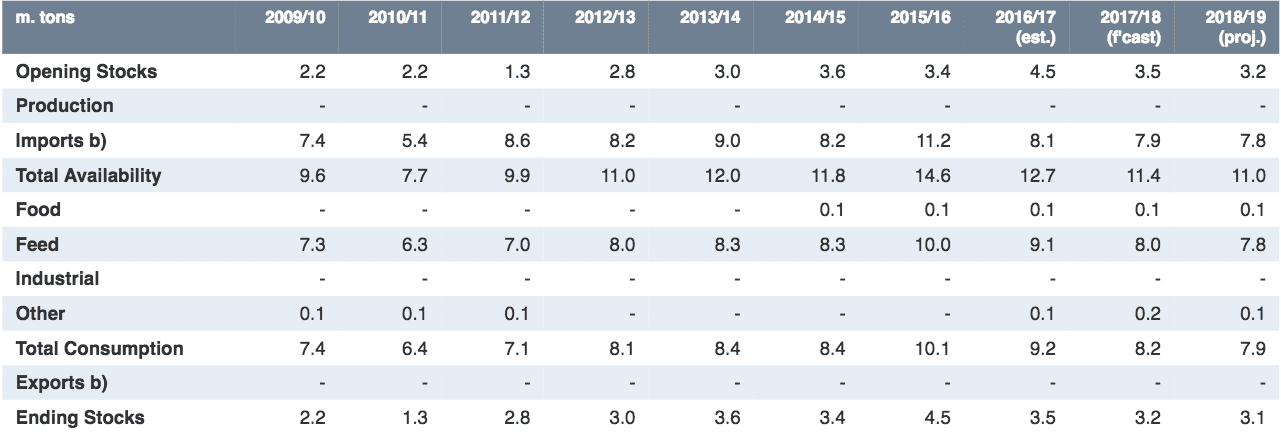

Feed barley usage in Saudi Arabia in 2018/19 is projected to be 7.9Mt, around 1Mt less than the five-year average (table 3).

Changes in wheat

Worldwide wheat production is forecast at 729Mt in 2018/19, down from 767Mt in 2017/18.

Production by the major exporters is forecast at 363Mt, down from 395 Mt last year.

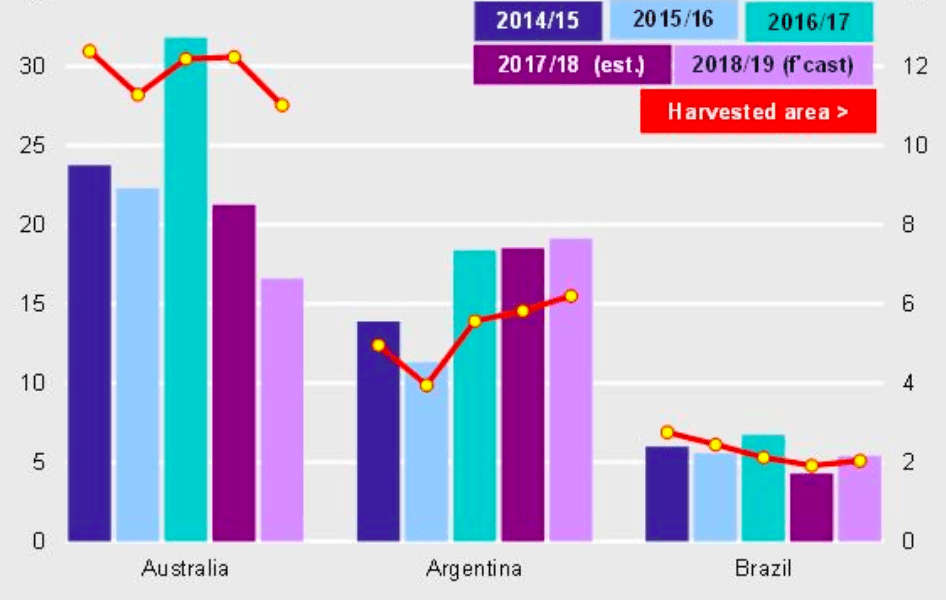

A potential export boost of 6Mt from the US, 2Mt from Canada and 1Mt from Argentina is expected, and Argentina, for the first time in many years, is forecast to export more wheat than Australia, where drought has decimated export prospects for its eastern states (chart 4).

Chart 4. Wheat production in selected countries (columns, left axis, million tonnes) and wheat harvested area (red lines, right axis, million hectares). Argentina is predicting a bumper crop while Australia knows it’s in for a shocker. Source: IGC

Harvesting of Argentina’s large crop has begun amid heavy rains, raising speculation about possible quality downgrades.

Source:IGC

The full IGC market report (as the new format GMR markets and trade plus) is available by subscription; link here

HAVE YOUR SAY