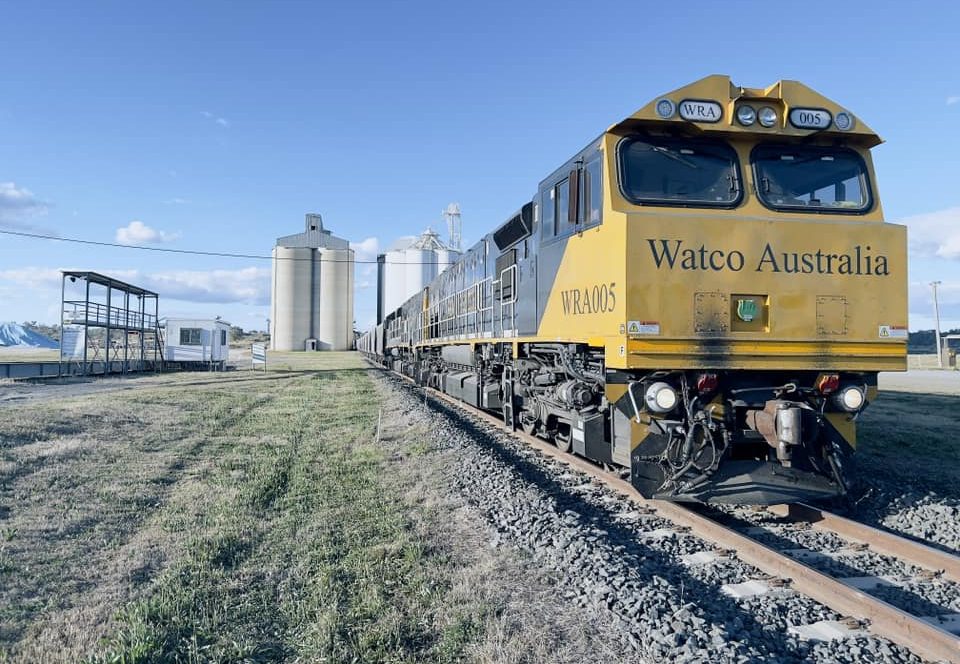

A train loads with sorghum at Malu on the Darling Downs bound for export via GrainCorp’s Fisherman Islands terminal in Brisbane. Photo: Rob Fry

AUSTRALIA exported 381,997 tonnes of barley and 283,917t of sorghum in July, according to the latest export data from the Australian Bureau of Statistics.

The barley figure comprises 305,269t of feed, down 27 percent from the 417,575t shipped in June, while malting at 76,728t is up 60pc from the 47,807t exported in June.

July sorghum exports at 283,917t fell 27pc from the June total of 386,965t, with China continuing its run as the biggest customer by far.

Japan on 61,085t was the only other sizeable bulk sorghum customer for July.

On feed barley exports, Thailand was for the first time the largest-volume market with 210,782t, followed by Qatar on 52,263t, and New Zealand on 17,043t.

Mexico on 30,502t, Japan on 19,570t and Peru on 14,185t were the top three destinations for malting barley shipped in July.

Flexi Grain pool manager Sam Roache said low feed barley stocks in South Australia and dry conditions biting in Queensland and northern New South Wales were major drivers of the slide in volume exported seen in July.

Also, a lack of selling into export channels has affected volume.

“Both the trade and growers have been holding stocks back in anticipation of a positive China announcement, and correctly so,” Mr Roache said.

“Export business has exploded, with significant bulk and container sales to China for the October-January period estimated to be well north of one million tonnes.

“Today we see a lack of available offers for the Oct-Nov period, with stocks and slots quickly exhausted by the notably strong China demand.

“We have seen the first bulk shipment leave WA and significant container volumes have also been packed, without any execution issues.

“Our expectation is for the program to continue to build without undue execution issue or interruption.

Mr Roache said strong demand from China was expected to continue, where relative price of barley is attractive for feed, and recent import pace suggests demand is higher than USDA and analysts have suggested.

“Argentina, Canada and Ukraine are all suffering from below-average production and reduced exports, leaving France and Australia to service the bulk of China demand.

“We also note locally that barley remains relatively cheap versus wheat in the south and Wagyu rations plus a lack of available fibre will keep demand well supported in the northern domestic feed market.

“A combination of Canada’s production losses, China’s re-entry, and quality issues in Europe are also continuing to force malt premiums higher, with some very high numbers in the market today.”

Sorghum exports continued their slide, with stocks running very low as dry conditions prevail in Australia’s sorghum-growing regions.

“We expect the program to continue to slow down in the coming months, even with current values doing their best to pull everything out of the balance sheet.

“US sorghum prices have been moving higher with China demand continuing.

“This is pushing demand pressure on to Australia when the market here has limited appetite to sell.

“I think we have seen the highs for sorghum export volumes for quite some time.”

| FEED | May | June | July | Tonnes |

| Hong Kong | 12 | 0 | 12 | 24 |

| Japan | 105203 | 155090 | 0 | 260293 |

| Jordan | 62073 | 0 | 0 | 62073 |

| Malaysia | 165 | 0 | 171 | 336 |

| New Caledonia | 0 | 213 | 154 | 366 |

| New Zealand | 0 | 0 | 17043 | 17043 |

| Papua New Guinea | 0 | 25 | 25 | 50 |

| Philippines | 1754 | 1645 | 2764 | 6163 |

| Qatar | 52500 | 22000 | 52263 | 126763 |

| Saudi Arabia | 126325 | 184000 | 0 | 310325 |

| Singapore | 1 | 4 | 0 | 5 |

| South Korea | 2032 | 661 | 1408 | 4101 |

| Taiwan | 924 | 1537 | 2174 | 4636 |

| Thailand | 67323 | 32571 | 210782 | 310675 |

| UAE | 27000 | 6000 | 14850 | 47850 |

| Vietnam | 89249 | 13829 | 3623 | 106701 |

| TOTAL | 534560 | 417575 | 305269 | 1257404 |

Table 1: Australian feed barley exports for May, June and July 2023. Source: ABS

| MALTING | May | June | July | Tonnes |

| Ecuador | 5000 | 0 | 7330 | 12330 |

| Japan | 0 | 0 | 19570 | 19570 |

| Mexico | 0 | 33000 | 30502 | 63502 |

| Pakistan | 0 | 595 | 398 | 993 |

| Peru | 17941 | 0 | 14185 | 32126 |

| Philippines | 1727 | 605 | 271 | 2604 |

| Singapore | 4116 | 2527 | 3233 | 9875 |

| South Korea | 0 | 9000 | 0 | 9000 |

| Taiwan | 0 | 0 | 498 | 498 |

| Thailand | 1078 | 960 | 487 | 2525 |

| Vietnam | 33863 | 1120 | 254 | 35237 |

| TOTAL | 63725 | 47807 | 76728 | 188259 |

Table 2: Australian malting barley exports for May, June and July 2023. Source: ABS

| SORGHUM | May | June | July | Tonnes |

| China | 434271 | 267405 | 218590 | 920266 |

| Japan | 0 | 26400 | 61085 | 87485 |

| Kenya | 0 | 60000 | 0 | 60000 |

| New Zealand | 0 | 12 | 0 | 12 |

| Philippines | 1585 | 771 | 993 | 3349 |

| Sudan | 0 | 30000 | 0 | 30000 |

| Taiwan | 4864 | 2302 | 3149 | 10316 |

| Vietnam | 176 | 75 | 100 | 351 |

| TOTAL | 440896 | 386965 | 283917 | 1111778 |

Table 3: Australian sorghum exports for May, June and July 2023. Source: ABS

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY