Louis Dreyfus Company executive vice president and Cotton Platform head, Joe Nicosia, discusses the market factors impacting cotton demand and prices at the Australian Cotton Conference last week.

WITH China’s soft ban on cotton imports no closer to ending, Louis Dreyfus Company (LDC) executive vice president Joe Nicosia said the Australian industry has to now make the most of its “window of opportunity”.

Mr Nicosia said this was primarily against its largest competitors, namely the United States and Brazil, as their stocks continue to show the impact of drought.

Based in the US, LDC is a world leader in cotton merchandising, and its Australian operations include gins at Dalby and Emerald in Queensland and Moree in New South Wales.

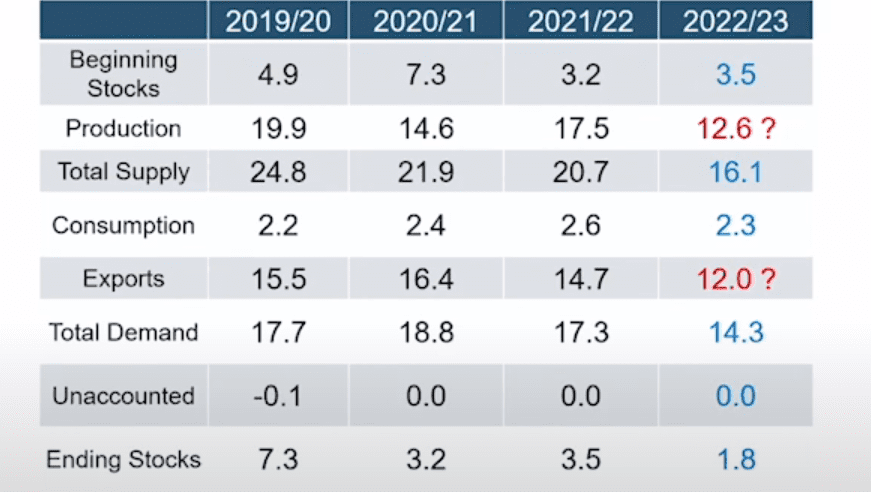

Mr Nicosia told the Australian Cotton Conference last week that USDA figures indicate that US production in 2022-23 is set to hit “a shockingly low number” of 12.6 million bales (Mb).

“It is…5Mb less than a year ago; that is almost your entire crop that we lost in this new report.”

For US exports, he said that meant a cut to around 12Mb from 15-15.5Mb on average, and that already limited stocks were committed.

“That means the United States supply for the next six months is pretty much gone”.

The Us cotton balance sheet comparing seasons from 2018 Source: USDA, LDC

USDA is forecasting Australia’s current production at 5.5Mb, and ginning is now drawing to a close.

He said it is estimated that Australia, the US and Brazil will together produce about 31Mb in 2022-23, down about 4Mb on last season.

He said this deficit, alongside an increase in exports and demand for high-quality “contamination-free” cotton, means there will be high demand for Australian cotton in the near future.

Mr Nicosia said this global stock issue has been compounded by new demand from China, which has turned away from Australia exports.

He said this demand has largely been filled by the US and Brazil, increasing the opportunity for Australia to “steal” their traditional customers in markets such as Vietnam, Pakistan and Bangladesh.

Mr Nicosia was very clear in his message to Australian merchants.

“Your job in the marketplace today is to displace the traditional consumers’ preferences that they used to take with the West Africans, Brazilians and the US”.

Finding the ‘window’

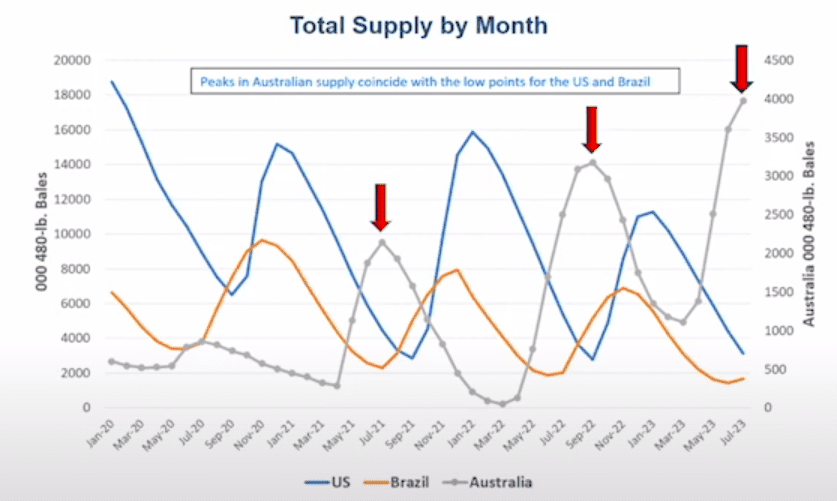

Mr Nicosia said thankfully for Australian growers, local production usually rises as US and Brazil stocks reduce due to opposing harvest periods.

He said this, alongside a reduction in available northern stocks, has created the perfect “window of opportunity” for Australian cotton.

“The United States stocks are going to be extremely tight, and extremely tight for a long time and that is going to be to [Australia’s] benefit for this year easily.

“As supplies get tight, [Australia] has a window of opportunity…when no one else can take care of.”

Total supply by month comparing United States, Brazil and Australian production. The scale for Australian production has been altered to highlight peak differences. Source: LDC

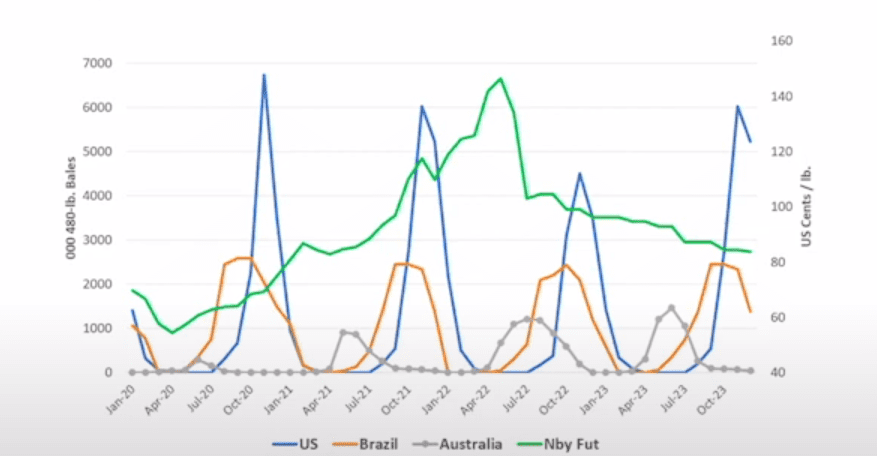

Although Australia can meet some of this demand challenge, Mr Nicosia urged Australian merchants not to forget the price drops that occur near the end of Australia’s production peak.

Using the New York Cotton Exchange, Mr Nicosia said Australians needed to be wary of the price reductions toward the end of the year as US and Brazil stocks rebuild.

“The July price reflects the tightness of the US market and somewhat of the world at that low trough point in time, but as we move into December, the Brazilian and US supplies move way back up, and as the new supplies come, the price is usually cheaper.

“The July price as it moves into December goes through a drastic change and a reduction in value.

“This… is telling you that time is against you and your cotton.”

He also warned against the inverse in the market that occurs between May and November

“It is a decaying asset and the values of Australian cotton versus the world are somewhat melting away, but [Australia] has a great window of opportunity.

“[I]t is not a question of price but of when and the time that you have to do this.”

US, Brazil and Australia production by month compared to New York Cotton Futures prices. Source: LDC

Considering consumption

Mr Nicosia said the Australian cotton industry also needed to pay attention to consumption levels with economic conditions and COVID-19 hitting global demand for textiles.

“The money flow of the world greatly influences the price of cotton.”

He said the fears of recession due to rising inflation and interest rates, as well as China’s “COVID-zero” ambitions, have combined to cut consumption from a recent high of 124.5Mb in March 2022 to 119.1Mb in August 2022.

Mr Nicosia said he believes “consumption is going to take a large uptick” but not until both issues are neutralised.

He said world markets and cotton stocks were in a state of “extreme volatility”, which may benefit Australian growers and the wider cotton industry if merchants can take advantage of the tight selling window.

The biennial Australian Cotton Conference was held at the Gold Coast from August 16-18.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY