Panel chair LDC’s Tony Geitz with presenters Rabobank’s Michael Every, Logic Letter’s Ron Lawson and LDC executive vice president Joe Nicosia.

THE AUSTRALIAN cotton industry is well placed to hold its ground amid geopolitical uncertainty thanks to its high yields, supporting supply chain, and sustainability credentials.

However, it cannot escape the pressure of flat global demand as China moves into higher-value manufacturing, and synthetics crib market share.

Speaking at the Australian Cotton Conference today, LDC Joe Nicosia said cotton’s share of the world fibre market had hit an “all-time low”, but the cotton industry could gain some ground by promoting itself to environmentally conscious consumers as being free from microplastics.

“This is a long-term possibility for US and Australian cotton and other cotton going forward,” Mr Nicosia said.

“It is estimated that we eat a credit card worth of microplastics s a year.”

“We’re losing the war against polyester, against manmade fibre, but we’re starting to see at least awareness about what’s taking place,” Mr Nicosia said.

Global cotton consumption has been trending down for 20 years, and the flat price outlook means Mr Nicosia can see government stocks building in China and India to buffer producers against lacklustre demand.

Also speaking in the session on world markets, SFO Commodities principal and LOGIC Letter author Ron Lawson referenced the groundbreaking book Silent Spring by Rachel Carson, which linked thin avian eggshells to the DDT pesticide.

“For millennials, microplastics are what us baby boomers had for DDT,” Mr Lawson said.

“It brought on a movement globally that pushed DDT out.

“In the social media space, how good we can be at showing a biodegradable product is that doesn’t get into the oceans, the better off we are.

“Polyester is the devil, but it holds colour nice and you don’t have to iron it.”

Mr Nicosia said the European Union has recently named polyester as the preferred sustainable fibre, a decision that perhaps points to a missed opportunity for cotton as producing not just lint but seed as a valued source of feed for livestock including dairy cows.

“We need to do a better job of talking about the plant, not just the fibre.”

“We know France loves their cheese; we help them make it.”

Gold to Australia, silver to Brazil

Making an Olympic Games analogy, Mr Nicosia ranked the world’s four biggest cotton exporters on the podium, and awarded gold to Australia, silver to Brazil, bronze to the US, and a participation award to West Africa.

He put Australia first on quality, bale condition, and interior logistics, and the US first for availability and export logistics.

Mr Nicosia gave fulsome praise to the Australian cotton industry and its product.

“You guys have wonderful yields here in Australia.

“It’s amazing how you work together as an industry; in the US, we’re defined as seven segments, not one industry.”

He also acknowledged the difficulty of Australia’s recent marketing years without China in the picture, which he said “made lemonade out of lemons” by broadening the customer base.

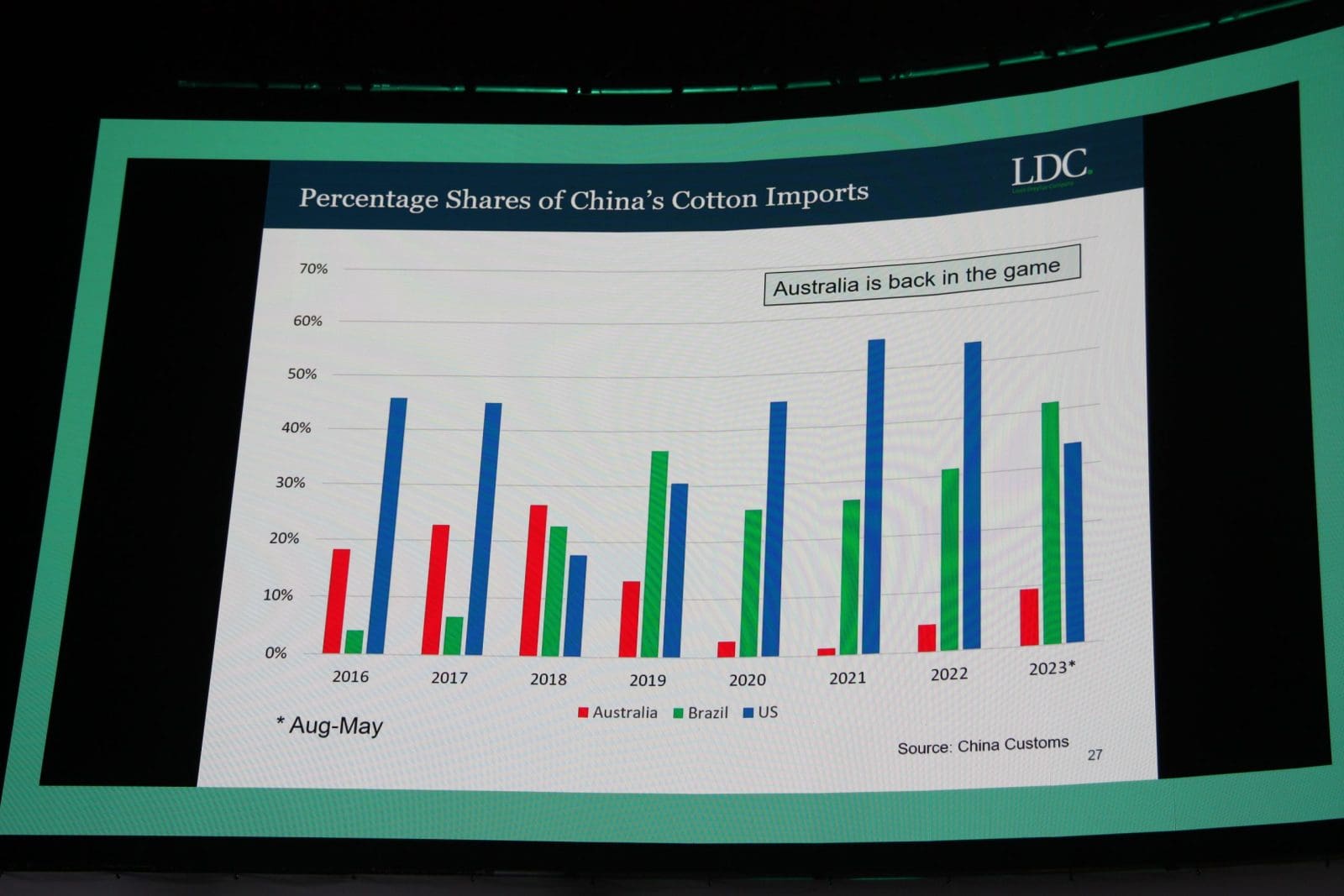

This LDC graph shows the rebuilding of Australian cotton exports to China now that tariffs imposed in 2020 have been removed.

In his rankings, Mr Nicosia gave Brazil top honours for marketing, price attractiveness, production reliability, resilience to weather impacts, and warehousing.

“I’m going to give it to Brazil, and they don’t even have that many warehouses.”

Mr Nicosia said the rise in Brazilian production was biting into Australia’s low-competition months when its new-crop bales hit the market.

“By the time you get to July or August, here comes hundreds of thousands of bales.”

He said the low Australian dollar and Brazilian real have helped to make both origins competitive, and more production could be expected from Brazil.

“Australia and Brazil are being saved today by the value of your currency.”

Mr Nicosia said Brazil’s real has continued to stay weak and promote increased production.

“Cotton is a safrinha crop; it’s only taking one fifth of the safrinha area, as they expand…we’re going to continue to see growth.”

Mr Lawson said US and Brazil were currently “neck and neck” on cotton production, and new regulations from the EU restricting its purchase of crops grown on land deforested after 1 December 2020 could further increase Brazil’s already considerable cotton area.

The seven commodities listed by the EU are: wood; rubber; beef; cocoa; coffee; palm oil, and soy.

“It’s not what it wants to grow, it’s what it’s allowed to grow.”

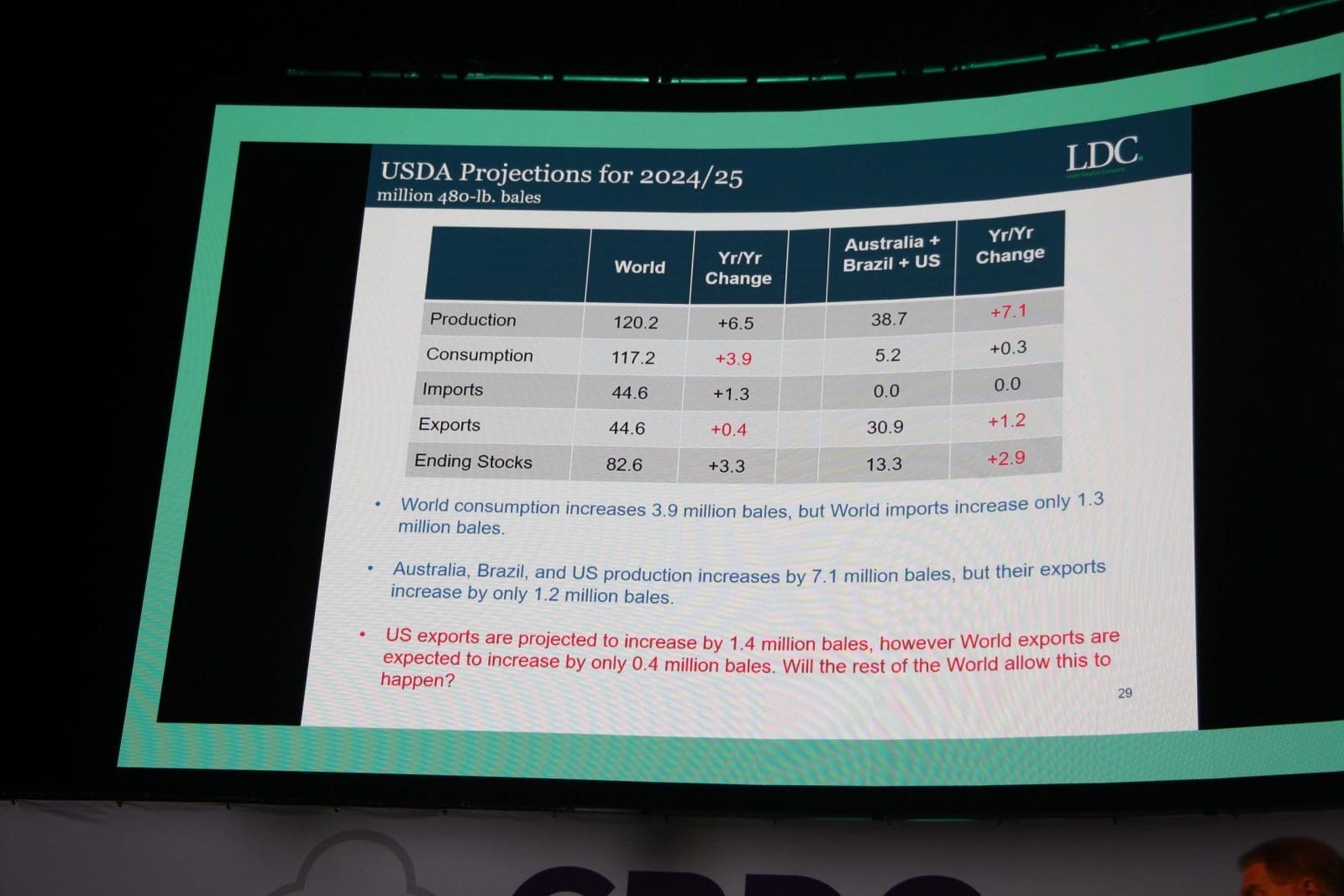

As he stepped through global supply and demand, Mr Nicosia said Australia and Brazil combined produced 10 million bales of cotton in 2016-17 against 17Mb for the US alone.

In 2024-25, US production is forecast to come in at 12Mb, compared with 18Mb for Australia and Brazil combined.

“In history, the US is the largest exporter of cotton in the world; period,” Mr Nicosia said.

“The US has now lost that honour to Brazil.”

This LDC slide paints a bearish picture for the global cotton market in the near term.

Mr Nicosia said the US cotton industry said was already under pressure from its inability to expand area, and its high cost of production.

“Either the world has to increase consumption, or someone in the world has to quit growing cotton; my guess is the United States.”

RMB on rise

Rabobank global strategist Michael Every said cotton was trading in a world where the liberal international order seen in recent decades was “slowly coming apart”, with the departure of Bangladesh’s Prime Minister from the country the latest development.

“We are at the tail end of a world system which we tried to build after the Cold War,” Mr Every said.

Rabobank global strategist Michael Every presents at the Australian Cotton Conference.

He said with the US in its current state pre-election, “there is no adult in the room” when it comes to the geopolitical environment, and that three trade blocs were developing, one based on the US dollar, one neutral, and one based on China’s currency, the renminbi (RMB).

“The big emerging change we are seeing is a big shift in financing…from the US dollar to the renminbi.

“It will change global trade flows because not everyone will want to join in.”

Mr Every said China was already using the RMB more than the USD, and that trend will increase if Donald Trump wins the US election in November.

He said growth in China’s textile trade was not as fast as that being seen in other sectors, as China tries to “move up the value chain” by manufacturing goods like electric vehicles, and already had strong support to build a bloc based on the RMB.

“China is doing around half its textile exports with countries we think will be in its zone of influence.

If Donald Trump returns to the White House, Mr Every said a tariff of 60pc or more can be expected on Chinese imports, and estimates are that such a move would cost China 28 million jobs.

“Were Donald Trump to win the election…he’s promising to turn international trade absolutely on its head.

“If America doesn’t buy from everybody, nobody earns US dollars.”

Mr Every said some countries want to hedge their bets and stay neutral.

“Big economies like Türkiye and India clearly don’t want to be in either camp.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY