DESPITE bigger grain crops worldwide this year, higher demand has left closing stocks overall unchanged from last year while corn will register its ninth year of decline, according to latest the International Grains Council Grains (IGC) Market Report.

Total grains 2021/22 production, projected at 2287 million tonnes (Mt), was 3pc higher than the 2226Mt production in 2020/21.

Closing stock, projected at 609Mt in 2021/22 for the second consecutive year, has declined by about one per cent each year since 2018/19.

Of the wheat and coarse grains monitored by IGC, it is the corn stock reduction that was most significant this year compared with last. At 264Mt 2021/22 carryout, corn stock would be 7 per cent lower than previous year and consecutively lower by 26pc, 29pc and 17pc than the three previous years. Corn stock would fall during 2021/22 to the lowest in nine years while wheat would continue to build to a record.

Relative prices led substitution

Though all prices are higher this year, strong gains in the corn price index (figure 1), up by 93pc this year, several times larger than the increase in the wheat price index, has led to wheat being substituted for corn especially in livestock feeding. Corn consumption has nonetheless increased this year mainly through greater industrial use.

Figure 1: The maize price index 2020/21 (blue line) traded beyond its five-year range (grey shaded area). Source: IGC

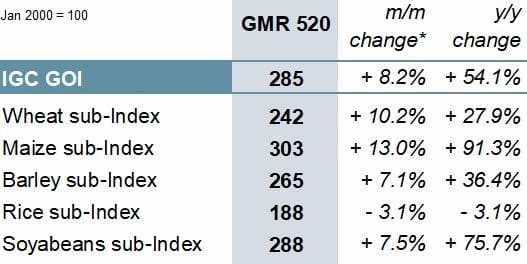

The GOI (figure 2) climbed 8pc this month to an eight-year high, as tightening supply outlooks and weather worries sparked solid gains in maize, wheat, soyabean and barley export prices.

The maize sub-index rallied 13pc this month, buoyed by concerns about worsening crop prospects in Brazil, slow US sowing pace and firm US cash markets.

The IGC wheat sub-index this month lifted 10pc, boosted by heightened uncertainty about inclement weather in parts of the northern hemisphere and strength in rowcrops.

The soyabeans sub-index rose 7pc on tightening US supplies, USDA’s smaller than expected 2021/22 plantings figure and broad-based strength across global vegetable oil markets.

Figure 2: International Grains Council, Grains and Oilseeds Price Index. Wheat, corn, barley and soybeans price indices remain firm. Asterisk represents change between Grains Market Reports 520 and 519. Source: IGC

Source: IGC

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY