The GPC Pulses 23 faba, lupins, blackeye, and cowpeas panel: Wilson International Trade principal Peter Wilson; analyst Mahmoud Mohamed, Al Amir; California Dry Bean Advisory Board’s Nathan Sano; Agri-Oz Exports’ Francois Darcas; Malagasy business development lead Prity Malde Kara; AGT Foods Canada’s Kyle Luchia, and Coperaguas sales manager Julio Cabral Mariucci, Brazil.

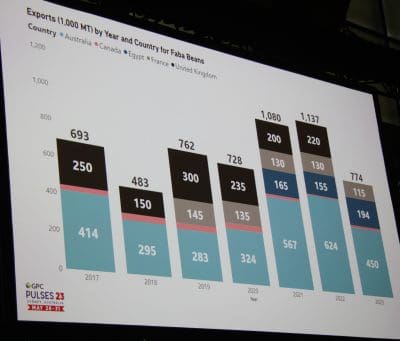

AUSTRALIA’S faba bean exports in the current marketing year are expected to dip below the record levels seen in 2021 and 2022, but will still be the third-highest on record, according to figures presented at the Global Pulse Confederation’s conference held in Sydney last week.

Presenting on the faba, lupins, blackeye, and cowpeas panel at Pulses 23 on May 30, Al Amir analyst Mahmoud Mohamed, Egypt, said despite the drop in export volume, Australia will remain the world’s largest shipper of faba beans, with Egypt its biggest market by far.

Mr Mohamed said while food inflation was an issue for the Egyptian consumer, the country’s re-exporters of processed faba beans were seeing improved margins and policy that encouraged the earning of export income.

“The companies have margin in business,” Mr Mohamed said.

Floor from local feed

In Australia, leading faba bean trader and managing director of Agri-Oz Exports, Francois Darcas, said competition from the domestic stockfeed market has absorbed tonnage from the current crop.

Egypt is the world’s largest consumer, importer and re-exporter of faba beans, and Mr Mohamed said the pulse played a crucial part in the national diet.

Ful medames, based on faba beans slow cooked for up to three hours, is the uniquely Egyptian dish that accounts for much of the country’s domestic consumption.

While faba beans from Europe cook a little faster than Australian product, Mr Mohamed said the colour of Australian varieties like Fiesta and Samira make them popular in Egypt in falafel and ful medames.

“Usually all Egyptian people eat falafel and ful in the morning.”

Faba bean exports. Source: Mahmoud Mohamed, Al Amir

Mr Mohamed said Egypt sourced some of its faba requirements from the United Kingdom and Europe’s Baltic states, with Baltic exports accounting for around 25pc of Egypt’s faba market.

He said some UK faba beans go into the European feed market, and are used in Egypt primarily for splitting for falafel.

Mr Darcas said Australia has put less product into Egypt this year compared with the two previous because of Egypt’s currency difficulties.

“In the year to date, we’ve seen a reduction in export to Egypt,” Mr Darcas said.

“Australian exports are 65pc of the past two years.”

“What we’ve seen at the same time is the Australian animal feed sector switched from peas to faba beans.

“The demand for feed beans has been very strong; it’s paying more than export.”

He said lowered demand from exporters has not been felt, but that could change based on the heavy hitter in the world feed complex.

“It’s really a function of soybean prices.”

Area weathers price moves

Although “fire sale” prices as low as $370/t have occasionally popped up when the mercurial Chinese market has closed, Mr Darcas said a minimum global price of around US$400/t c and f “seems to be the threshold” at which sales in Australia stop.

He said Australian growers will hold on to their faba beans until the market regroups, and that most are wedded to them for their benefits in the cereal rotation rather than as a cash crop.

“In my view, the area has been growing steadily over the past five to 10 years.

“It really doesn’t fluctuate on price.”

Providing the Canadian perspective on the panel was AGT Foods Kyle Luchia, who said fabas had some potential in Canada from value adding for the human-consumption market.

“The bright spot for faba beans is…it has just been introduced into dairy replacement,” Mr Luchia said

With exports running at 10-30pc of the Canadian crop, Mr Luchia said growth in Canada’s faba production could not be expected other crops offered better returns, and when Canada’s faba beans competed head to head with UK, European and Australian product.

“A high price should increase acres, and it’s not.”

“We’re not going to see growth in faba beans without some growth in export demand.”

In Australia, the Australian Pulse Protein plant at Horsham used around 8000t per annum of fabas as the only volume onshore user of the bean for the human-consumption market.

Mr Darcas said plans for fractionation plants in South Australia have been announced, but start dates were yet to be announced.

“It might be a little bit over-hyped in the media.”

According to ABARES data, Australia produced its three biggest crops ever in the current and two preceding seasons, and all from record areas of around 300,000ha.

Tonnages were 680,000t in 2020-21, 646,000t in 2021-22 and 585,000t in 2022-23.

ABARES quarterly Australian Crop Report is due out tomorrow and will reveal ABARES initial estimate for Australia’s 2023-24 production.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY