Harvesting wheat last week at Cascade near Esperance in WA. Photo: Paul Carmody

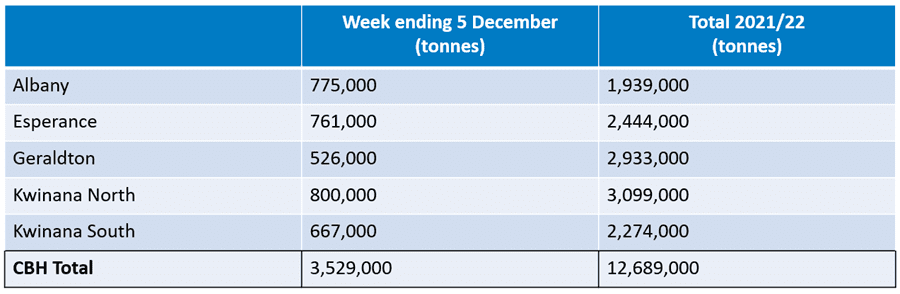

FINE weather in Western Australia in the week to Sunday has allowed growers to deliver 3.5 million tonnes (Mt) of grain into the CBH Group system to bring the total intake for the current harvest to 12.7Mt.

CBH Group chief operations officer Mick Daw said excellent harvesting conditions over the past week along with higher-than-expected yields have seen multiple grain-receival records and the November state shipping record broken.

“In the last week, we have received over 500,000 tonnes per day for six days, bringing our total tonnes received to date to nearly 13Mt,” Mr Daw said.

Last Wednesday, CBH set a new single-day receival record of 586,000t, breaking the previous record of 569,000t which was set two days prior.

“In addition to this, we have also surpassed our previous state shipping record of 1.11Mt for November with 1.17Mt shipped, including an all-time record month for Geraldton, shipping 422,000t of grain.”

Mr Daw acknowledged this unprecedented volume had placed significant pressure on everyone involved with harvest including growers, their families, employees, transporters and CBH staff.

“CBH is actively working to ensure we can maintain services for growers. This may not be your closest site, but we will ensure major sites can continue to take grain.”

“We ask that all CBH staff, growers and transporters be patient, respectful and work together to get through this record-breaking harvest.”

Wheat

The wheat market continues to hold firm at A$435 per tonne free in store Kwinana for APW grades or higher, with end users still trying to digest the rain impact on quality in eastern Australia.

Australia is forecast to produce 34.5 million tonnes of wheat this season with the trade estimating up to a third of this will be feed quality.

The APW-to-ASW spread in WA continued to be well over A$100/t as the market look to cover its APW requirements.

“However, we are predicting this spread to narrow as the market covers their higher-protein requirements,” CBH said.

The international market continues to watch the Russian export tax situation with this expected to climb to US$85/t by mid-December on stronger export prices.

Russian wheat prices are being driven by expectations that the Russian Government will implement an export quota of 5Mt for shipping between March and June 2022.

In addition to this, Statistics Canada forecast wheat production is at 21.7Mt, 38 per cent lower than last season.

“This should also keep Australian prices firm in the short term.

“Growers are continuing to selectively sell wheat as they look to wait until they have finished harvest to optimise their grades.

Barley prices soften

Feed barley markets have drifted slightly lower during the week with prices in the A$270s/t FIS Kwinana on relatively quiet demand from key Middle Eastern markets.

However, interest from China for Black Sea barley for mid-2022 shipment should provide a base for the market and limit the drifting of prices lower.

Canola

The canola market remains tight despite a record crop of 5.7Mt forecast for Australia.

Canada’s canola crop is the lowest in 14 years at 12.6Mt, which has once again provided a base on prices with non-GM canola priced at $900/t FIS Kwinana.

Grower selling is slowing as a large percentage of the crop is harvested and growers are sufficiently sold for the near term.

Albany Zone

With some warmer weather last week, receivals increased significantly across the zone, with canola, barley and oats still making up the bulk of receivals, although wheat deliveries have increased.

Grain quality is generally good, despite recent rain, and most barley received is being graded as feed.

Esperance Zone

Harvest is progressing well in the Esperance zone, and another week of fine weather should see similar tonnages across the zone to last week, and some growers will finish harvest.

Wheat is the major grain being received in the zone, with most growers almost having completed or a reasonable way through their barley and canola crops.

Quality remains good given the amount of rain that has fallen during the harvest period.

All sites still remain open and the average cycle time for the zone is reasonable.

As storages fill, cycle times will become longer due to the availability of the grids on sites.

Cycle times are variable between sites depending on location in the zone and the requirement for the grain to be accumulated for vessels at the port.

Geraldton Zone

Morawa and Canna both broke their all-time site receival records last week, and more grain is expected to come into both.

Wheat made up the bulk of receivals across the Geraldton Zone, with only small amounts of the other commodities being delivered.

Some growers have now finished harvest, and grain quality continues to be excellent overall, with late crops being monitored closely for any potential issues.

Site cycle times remain consistent with previous weeks.

As services at sites such as Mullewa, Northampton and Yuna fill and close, queues at alternative services may increase and potentially impact cycle times.

Kwinana North Zone

Very good harvesting conditions across the zone last week saw wheat making up most of the deliveries, and yields above expectations.

Only small amounts of canola and barley are still to come in, and all sites in the zone remain open for receivals and the average cycle time has improved.

Kwinana South Zone

The Kwinana South Zone also had very good harvesting conditions in the week to Sunday, and with no rain predicted for this week, another bumper week of receivals is expected.

Barley receivals have started to slow in the north of the zone as growers move into their wheat programs, and wheat deliveries in the past week were double that of the previous, with yields still above expectations.

All sites are open for receivals except for Tammin, which is open for remote sampling but not for receivals due to services filling and rail being allocated to sites with rapid-rail outloading capabilities.

The average cycle time has again improved as more growers have started harvesting wheat.

Source: CBH Group

HAVE YOUR SAY