THE OCTOBER World Agricultural Supply and Demand Estimates (WASDE) from the United States Department of Agriculture (USDA) lifted world wheat ending stock by three per cent; record stock forecast for the end of the 2017/18 marketing year is forecast at 268.1 million tonnes (Mt).

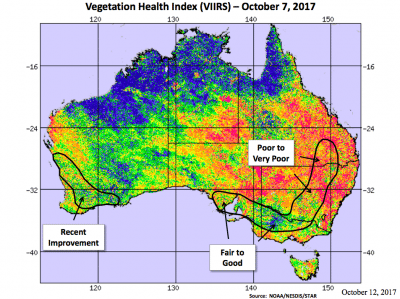

Vegetation index mapping shows the now-all-too-familiar picture of Australia’s winners and losers in the 2017 crop cycle; image USDA

Global 2017/18 wheat supplies were increased, primarily on higher production forecasts for Russia, European Union, and India more than offsetting a decline in Australia.

Based mainly on harvest results to date, Russia’s 2017/18 wheat production was increased 1.0Mt to a new record of 82Mt. This was well above last year’s previous record of 72.5 Mt.

EU wheat production was raised 2.2Mt to 151Mt, largely on higher production in France.

Australia’s wheat production is reduced 1.0Mt to 21.5Mt on persistent dry conditions in most of eastern Australia. This would be Australia’s lowest wheat output since the 2008/09 crop year.

World wheat consumption and trade also higher

Foreign 2017/18 trade is fractionally higher this month as reduced exports by Australia are offset by increased exports from Canada.

Projected imports are lowered for India and Turkey as increased 2017/18 production for both countries is expected to reduce import needs.

Total world consumption is projected higher, primarily on greater usage by India, EU, and Russia on their increased supplies.

Coarse grains and oilseeds minor global influences

Global coarse grain production for 2017/18 was forecast up 2pc to 1,319.4Mt. The USDA forecast higher world coarse grains consumption, and reduced stocks relative to last month. Amongst the coarse grains included in these data are corn, sorghum, barley, oats, rye and millet. Coarse grains closing stock were forecast to be 229Mt, of which corn represented 201Mt, down 1pc.

Projected corn use in China was raised 1pc to 240Mt, based on recent trade data indicating a higher-than-expected level of corn product exports.

World oilseed production was projected at 577Mt down 0.3pc as reductions for soybeans, rapeseed in Australia, and sunflowerseed were partly offset by increases for cottonseed and peanuts.

Rapeseed production was lowered for Australia where yields are impacted by below-normal rainfall.

World oilseed exports for 2017/18 were down 0.2pc to 173.9Mt on lower soybean and sunflowerseed exports.

World oilseed ending stocks were projected down 2pc from last month to 108Mt mainly reflecting back-year adjustments that reduced soybean carry-in for Brazil and the United States.

Source USDA.

HAVE YOUR SAY