The Red Sea port of Jeddah is one of the key points for barley entering Saudi Arabia.

SAUDI Arabia’s Grains Organization (SAGO) bought 725,000 tonnes of optional-origin barley overnight for arrival in October and first-half November, made up of nine cargoes bound for Red Sea ports, and three for Dammam in the Persian Gulf.

Sellers are entitled to ship from Australia, EU, the Black Sea, and South and North America excluding Canada.

Trade sources reported Glencore submitted winning tenders for six of the nine cargoes destined for Red Sea ports, and Agrorodeo, Bunge and Louis Dreyfus each booked one.

Red Sea destination values were reported as generally cheaper in the earlier slots and more expensive in the later period, at between about $US 208/t and $212/t cost and freight (c and f).

Barley destined for Gulf ports traded at a premium of about $6/t to recognise the much higher cost of shipping the longer distance, and other factors including marine protection and indemnity (PandI) premiums that are much higher for vessels entering Gulf waters.

Trade sources reported COFCO successfully tendered the three Gulf ports cargoes.

Australian origin has a relative freight advantage over competitors into Gulf ports, but a disadvantage into Red Sea ports, where Russia, Ukraine and EU have much shorter voyage times and can invariably execute more cheaply than Australia.

SAGO’s previous tender purchased 1.08 million tonnes (Mt) of barley for August and September arrival at an average price $198.81/t c and f.

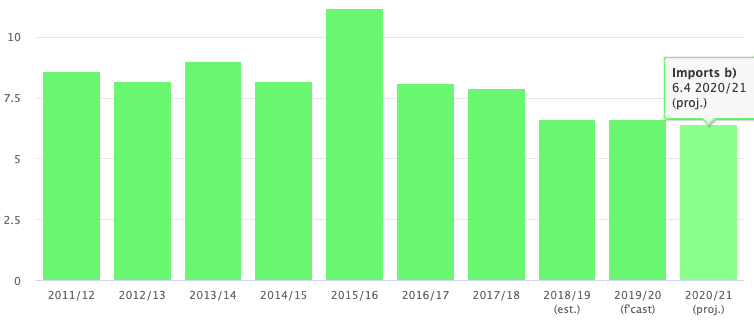

Import quantities appear to have settled for a third year under 7Mt.

Feedgrain demand in Saudi Arabia is rising but barley usage is not growing.

The growth in the market for imports is occurring in other feed ingredients including corn and soybean meal.

This year, Australia may export more than the odd cargo, especially if prices are higher than in recent years from EU, Russia and Ukraine as typically competitive suppliers.

Prices encouraging

Market Check head of strategy Nick Crundall said the tender results were encouraging for both global and Australian barley prices, with booked values up more than US$11/t since the last tender to follow some of the rise in pricing seen recently in wheat.

“The good news domestically is if you convert the sale price for the Gulf shipments, it’s around replacement values, showing that we are competitive for new-crop at current prices,” he said.

“Whether we actually deliver on these sales is yet to be seen, given it’s optional origin and we still need to see how our spring period goes.

“Although the overall tonnage was big, the delivery window is a bit early to execute new crop, and most of it is going into Red Sea Ports, so it’s unlikely we’ll do any of that.

“For the one consignment that’s first-half November into the Gulf, the seller might chose to execute Aussie if it equates, and risk incurring the late fee if they miss the delivery window.”

Saudi Arabia’s July-June barley imports sat at 6.6Mt in 2018-19 and 2019-20. Source IGC

HAVE YOUR SAY