VISIBLE trade in grains has slowed this week in the lead-up to the Christmas holiday.

However the markets and supply/demand conditions are setting the pace for January activities across the grain belt from the western Eyre Peninsula in South Australia through the 2000-kilometre arc beyond the Murray Darling Basin watershed into Central Queensland’s summer crop zone.

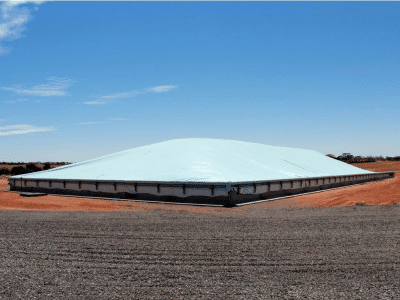

Bunkers were filled and storage bins sealed as hot, dry weather saw the southern harvest advance rapidly.

Harvest pace in Victoria finally surged last week as headers got back on the job, delivering 0.8 million tonnes (Mt) into GrainCorp’s Victorian depots. In South Australia Viterra had its biggest week this year, taking in 1.2Mt.

Threats of severe damage to ripe crops from early December downpours mostly were averted.

Link Brokering’s Dion Costigan, Bendigo, Victoria, said weather damage had not been as severe or as widespread as feared when rain in the middle of harvest hit early this month.

“The downgrading isn’t as bad as it looked like it would be,” Mr Costigan said.

The better outcome has likely allowed enough nearby trade to satisfy demand and clear short-term supply, allowing merchants time to sort their way through medium-term commitments for consumer and shipper into January, and perhaps leave their end-January and February slots till after the holiday break.

Hard wheat comes off earlier high

Mr Costigan said the wheat indicative delivered Melbourne price prompt sat at around A$268/t for APW wheat.

“Hard wheat, AH2 and AH1, has come off its highs of around three weeks ago by $25-$30/t,” he said.

“There’s a great heap of H1 and H2 in the Mallee but there are only a few reluctant sellers.”

AH2 earlier this week was around A290/t delivered Melbourne and AH1 $317/t.

Southern stability helps trade flow north

Traders say heavy continuing demand out of the south and into northern New South Wales and southern Queensland holds the prospect for further coastal voyage movements to satisfy the top-price Brisbane consumer, while road movements up the Newell Highway supplying wheat for Darling Downs feeders will continue through 2018.

The wheat market delivered to feedlots on Queensland’s Darling Downs, at around $325/t January/February compares with sorghum around $50/t cheaper in its March/April harvest delivery period.

Price gap between wheat and sorghum narrows

ABARES in early December predicted a much-improved sorghum plant this year for harvest early 2018 and sorghum prices were discounted more heavily compared with wheat.

Since that time the sorghum-growing region has been hotter and drier than the southern region, and the price gap has narrowed.

Left Field Solutions’ principal Pete Johnson, Toowoomba, Queensland, said the high point for that gap was a bit wider than $65/t.

“Over the past 10 days the sorghum price has rallied as confidence in the size of the sorghum crop has decreased,” he said.

“The differential on Tuesday was in to about $48/t for February/March delivered Darling Downs,

“Around a 15 per cent discount to wheat is probably fair value for sorghum.

“Sorghum crops on the Darling Downs were looking good up to the start of this week.”

China export engagement

The price of barley has held strong. Talk abounds of ongoing demand for this year’s smaller crop of Australian barley.

No doubt China buyers have stepped up barley purchases in eastern Australia for both brewing and stock feed, amid mixed harvest conditions in the big export barley states of Western Australia and South Australia.

Sorghum sales to China first half 2018 would hang in the balance depending on final planting conditions in January and particularly in the Central Queensland regions inland from the bulk shipping ports of Gladstone and Mackay.

Trade chatter of substantial sales of US sorghum and corn to China suggests Australia’s new season sorghum is too expensive, but that it just a soaking Queensland rain away from serious engagement with China.

HAVE YOUR SAY