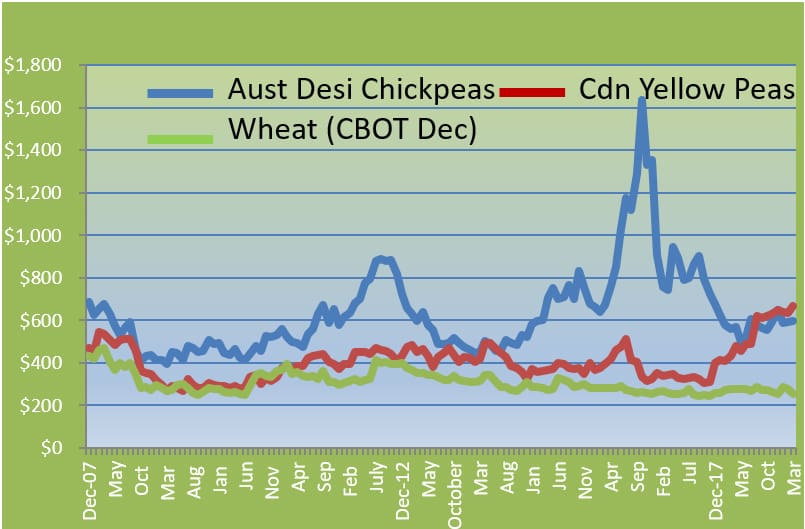

DESI chickpea prices are likely to continue to erode towards historical levels, assuming Australia receives enough rain in key areas to have the crop seeded, according to Pulse Australia’s latest Pulse Guidance Notes issued this week.

While Australia is unlikely to see 2016-type outcomes in terms of area and yield, desi chickpeas are favoured in the rotation and, assuming an export surplus from eastern states, Pulse Australia sees no real encouragement in the international wheat market to shift area to wheat and away from desi chickpeas.

“With nearly 40 per cent stocks-to-use, there seems to be no medium-term bullish prospects on wheat. We have a wheat problem in the world, which is manifesting itself in larger pulse crops and thus lower prices,” the report said.

“Wheat is continuing to drag on pea and chickpea prices.

“While India is still the basis, even though it’s out of the market for desi chickpeas, it’s interesting to note that desi chickpeas in India are similar to, or below, pea prices, which is most unusual, but probably due to large government-held stocks of desi chickpeas, and smaller availability of yellow peas due to import tariffs etc.

“The pea price also needs to be taken with a grain of salt, given the lack of liquidity in local supply.”

Lentils flatline, fabas to ease

Pulse Australia said lentils were in a similar situation, and while Australia had a smaller crop last year, local carryover stocks, on top of stocks in the other major exporting countries of Canada and places such as Kazakhstan, are weighing on values.

“Lentils remain flatlined, wedged between the reality of comfortable stocks and the resistance of farmers to accept much lower prices and the customers not being prepared to pay more.

“This highly illiquid low-volatility environment we expect will continue to persist well into 2020.

While faba beans were an attractive, albeit drought-affected, crop in Australia due to poor competitors’ crops, Pulse Australia expects faba beans to head back to more traditional pricing levels as supply comes back on stream.

Egyptian faba-bean demand demonstrated much greater inelasticity than most expected, with scarce and expensive faba beans being preferred in falafel production over plentiful and cheap kabuli chickpeas. Greater supply will see prices erode as we head towards harvest time.

Back to normal

This year is seen by Pulse Australia as more than likely to be one of resetting towards the norm following extremes we have seen in pulse markets over the past three years.

“The macro fundamentals around wheat and soybean pricing have some way to run before we see supply come back closer to demand.”

Closer to home, Pulse Australia said feed shortages were supporting some eastern cereal and pulse prices, while seasonal uncertainty was bringing lower-risk cropping options to the fore.

“With the expectation that India will be open for business by this time next year, and hopefully earlier, the 2020 Australian winter rotations should be much closer to the norm, as we, and markets globally, reset towards the norm.”

Source: Pulse Guidance Notes prepared by Pulse Australia and the Grains Industry Market Access Forum with the support of the Australia-India Council

HAVE YOUR SAY