AUSTRALIA’s grain industry needs to spread its export risk through greater market diversification, particularly in light of recent trade tariff issues that have highlighted vulnerabilities in Australia’s grain trade, according to representative body, GrainGrowers.

Appearing at the Parliamentary Inquiry into Diversifying Australia’s Trade and Investment Profile this week, GrainGrowers chief executive officer, David McKeon, and chair, Brett Hosking, put the case for the grain industry to pursue greater export market diversification.

“What the last few years have shown, particularly with decisions by the Indian government to put tariffs on chickpeas and lentils, and more recently decisions by the Chinese government to put tariffs on barley, is that when we have significant market concentration Australian farmers wear the brunt of that risk,” Mr McKeon said.

“It shows that while there are advantages in having big markets where we can service customers well and meet their needs, it comes with downside risk as well.

“So, while there is a need to service customers there is also a need to make sure we have a good spread of markets and opportunities to make sure we are resilient against international government policy decisions.”

Exports account for about 70 per cent of Australia’s total annual grain production with, on average, 29 million tonnes of grain exported each year to a value of more than $11 billion.

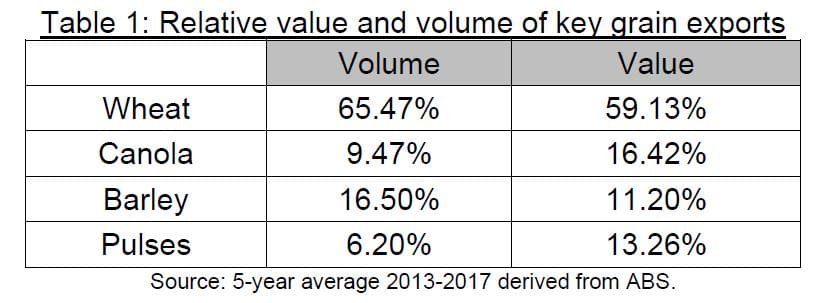

Wheat is Australia’s major grain export with canola, barley and pulses other major exports.

While barley exports are almost three times the volume of pulses, the value of pulse exports is greater.

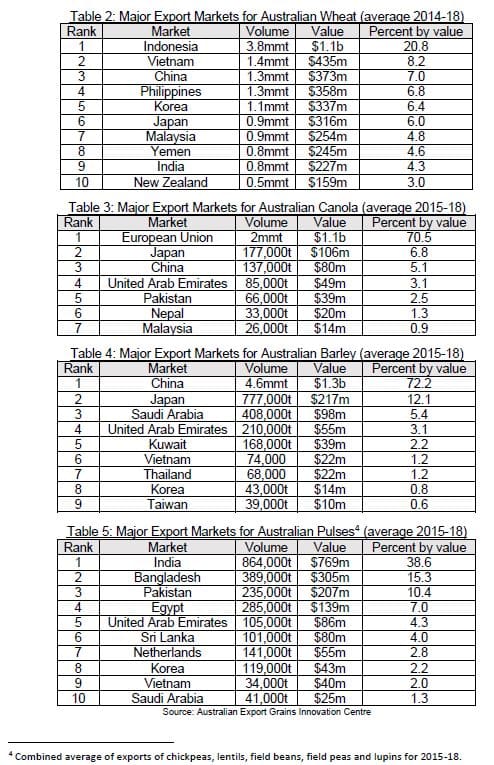

Mr McKeon said while discussion had focused on whether Australia was over-reliant on China with over 70pc of Australian barley, until recently, going to China, he said the key export markets for other grains were spread across a range of nations.

Between 2014/5 and 2018, one market dominated the exports of each of Australia’s four major grains commodities.

These were Indonesia for wheat (21pc of all wheat exports), European Union for canola (71pc), China for barley (72pc) and India for pulses (38pc).

In all instances the next largest single destination was less than half of these four largest markets by both volume and value.

Between 2018 and 2020, the industry saw a significant shift away from key markets for wheat, barley and pulses due to a range of market shocks, major changes in trade conditions, and drought.

Proactive plan

In GrainGrowers’ submission to the inquiry, Mr McKeon said it was critical Australian industry and government had a proactive plan in place to help ensure exporters had viable market options to help manage the changes.

“This plan is particularly critical for managing rapid and unexpected market changes that have immediate and significant impacts on Australian growers, exporters and supply chain services providers.”

Role for government

Mr McKeon said GrainGrowers considered there was a role for government, working closely with industry, to be more proactive in identifying new market opportunities and establishing new commercial relationships.

“We have been engaging with this parliamentary inquiry and government on these issues for a few years now,” he said.

“We really do need to see the rubber hitting the road as far as some of the policy changes that are required.

“Developing new markets isn’t something that happens overnight. It does take many years of market scoping and market development work before there are large, commercially-meaningful outcomes.”

David McKeon

Mr McKeon said there was also a key role for government in removing the trade-distorting barriers into some markets.

“While industry can provide technical support and knowledge to help overcome some of the technical market challenges, ultimately many negotiations are government to government,” he said.

“So, the Australian government really needs to boost its resourcing and enhance its focus on things like non-tariff measures that are impeding the ability of grain to get into key markets.

“A key example is malt barley into India. There is potentially a half-million-tonne market there, but there is still an impediment with some of their thresholds for a number of weed seeds. That technical trade barrier effectively means it is not commercially-viable for Australian exporters to sell malt barley into India yet.”

Mr McKeon said another market that presented opportunities was Indonesia under the Indonesia-Australia Comprehensive Economic Partnership Agreement that came into effect on July 5.

“With Indonesia, in 2019 there was high demand across our east coast for Australian grain, so we saw a lot of Western Australian grain that would otherwise have gone to Indonesia cross to the east coast. We expect this year that particularly a lot of that milling wheat will go into the Indonesian market,” he said.

“But, what the Indonesian trade agreement provides is for us to gain quota access for feed grain into the Indonesian market. That could be a combination of wheat, barley and sorghum, depending on the relative pricing.”

Support for initiative

Mr McKeon said for Australia to diversify its market access, adequate resourcing and R&D funds needed to be put into the back-end of market development.

He said the newly-established body – Grains Australia Ltd – would help harness industry focus and efforts to enhance trade outcomes for the Australian grains industry.

“As an industry, we have recently established Grains Australia to take the lead role for the industry in this area,” he said.

“Grains Australia will be the focal point for trade market access, market information education and classification.

“We need to make sure it is resourced well. It will play a key role in helping realise international market opportunities.”

Grain Central: Get our free daily cropping news straight to your inbox – Click here

Commodities will always flow to the highest bidder. Iron ore, international students, wool and look the list is endless in highlighting that trade with China has been mishandled by the Government and the grain industry representatives. We barley growers are victims of incompetent leaders and a Defence propaganda machine in Canberra. There is a solution but it cannot be resolved with the same people who helped destroy our market.