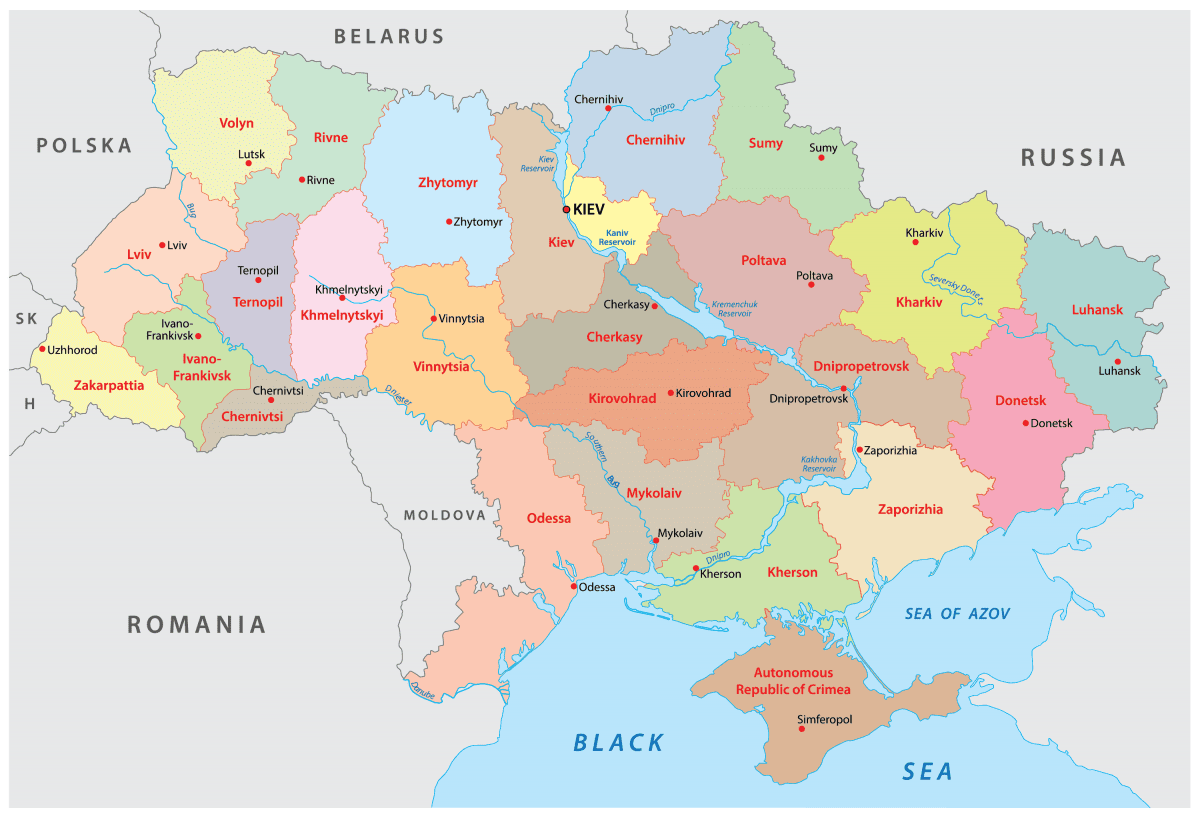

Crops in some Ukraine provinces have had excessive rain in the growing season, which has caused lodging and reduced protein. Source: World Atlas

THE winter harvesting campaign is in full swing across Ukraine, one of the most important producers and exporters of agricultural produce in Europe. Expectations are high for record production this season, but adverse weather conditions in the first half of July threaten to take the gloss off crop quality and final yields. As of July 23, Ukrainian farmers had reaped 14.1 million tonnes (Mt) of winter crop grains off an area of 3.4 million hectares (Mha), putting the harvest progress at around 22 per cent of the planted area. This is up from 5.5Mt of harvested grain off 9pc of the planted area a week earlier.

Winter wheat made up the majority of the output, with 8.86Mt in the bin off 2.68Mha. That is an average yield of 3.31t/ha, and constitutes 30pc of the forecast wheat area. The winter barley harvest is the most advanced, with 1.9Mha already completed, 48pc of the total planted area. Output to last Friday was 5Mt, giving an average yield thus far of 2.63t/ha. The pea harvest is 47pc completed, with 240,000t reaped off 110,000ha for an average yield of 2.18t/ha.

The bulk of harvest thus far has been confined to the south of the country, with the oblasts of Kherson, Mykolayiv and Odessa on the Black Sea 69pc, 60pc and 29pc completed respectively. Further east, harvest in the war-torn provinces of Luhansk and Donetsk is 44pc and 39pc completed respectively.

Estimates vary

The Ministry of Agrarian Policy and Food predicts the harvest of grain and legume crops in the 2021-22 marketing year will increase by 17pc compared to last season to a record 75.8Mt. The forecast was made up of 37.1Mt of corn, 28.5Mt of wheat, 8.3Mt of barley, 600,000t of peas and 500,000t of oats. The International Grains Council (IGC) released its latest global crop update earlier in the month, and pegged total Ukrainian grains production slightly lower at 74.2Mt. It called the wheat crop 27.2Mt, corn 37.3Mt, barley 8.1Mt, and canola 2.5Mt. The USDA upped its Ukraine estimates earlier this month on the back of favourable June weather to 30Mt for wheat, 37.5Mt for corn and 9.2Mt for barley.

A rebound in winter-crop production will mean higher exports in the 2021-22 marketing year, particularly over the next six months. The ministry of agriculture data released last week called total grain exports 56Mt, including 20.7Mt of wheat, 30.7Mt of corn and 4.1Mt of barley.

The IGC was a little more conservative, forecasting total exports at 53.1Mt, made up of 19Mt of wheat, 29.6Mt of corn, 4.3Mt of barley and 2Mt of canola. The USDA has wheat, corn and barley exports higher at 21Mt, 30.5Mt and 5.2Mt respectively, on the back of higher production expectations.

The latest official statistics put Ukraine wheat stocks at 1.74Mt as of July 1, 4pc higher than a year earlier, and corn stocks have increased 13pc to 2.29Mt. Farmers hold 1.18Mt, or almost 68pc of the wheat volume and 1.56Mt, or just over 68pc, of corn stocks, to open the 2021-22 marketing year.

On the other hand, barley stocks fell compared to the previous year to 1.07Mt due to sustained export activity. Exports of Ukraine barley to China increased significantly in the 2020-21 marketing year, with the Asian nation becoming the largest importer of Ukrainian barley. This ended the long-standing dominance of Saudi Arabia as an export destination for Ukraine’s barley, with the Middle Eastern country shifting to purchases of Australian and Russian supplies in the 2020-21 season.

Ukraine exported 4.15Mt of barley in the 12 months to June 30 with 70.3pc, or 2.92Mt, going to China. Saudi Arabia was the second-biggest importer at 320,000t, just 7.7pc of total exports. The North African nation of Libya was just behind at 280,000t, or 6.6pc of total barley exports.

Export activity in the first three weeks of the 2021-22 marketing year has been quite buoyant, with over 1.66Mt sailing from Ukraine ports. Corn has been the flag bearer at 824,000t followed by wheat at 399,000t and barley at 426,000t. How wonderful it is to see such data released to the market so quickly and such a pity it takes five weeks from month end to see the same export statistics released here in Australia.

Wheat spread widens in wet

The premium for Ukraine milling wheat over feed wheat continues to widen and is approaching a three-year high amid weather-induced concerns over new-crop quality. The premium started to widen in mid-June after rain and above-average temperatures at the beginning of the month boosted the spread of plant diseases. Combined with strong winds, wide-scale lodging became apparent in some areas, which generally reduces protein content.

Torrential rain in the Odessa, Mykolayiv, Kherson, Zaporizhshya, Dnipropetrovsk and Donetsk regions in the first week of July led to localised flooding events, slowing harvest and exacerbating the lodging problem. The severe thunderstorm activity has continued over the past couple of weeks, with the rising water levels temporarily impacting some port facilities, but not drastically affecting export shipment operations.

According to media reports, around 3.2Mha of wheat and 1.4Mha of barley are affected by the wet start to harvest, 46pc and 57pc of the total area sown to these crops in Ukraine this year. Early new-crop wheat samples suggest that feed wheat’s share of this year’s wheat harvest will most likely be higher than the 30pc seen in the 2020 harvest. This is already making it difficult for exporters to accumulate sufficient volumes of milling wheat to cover their export commitments, pushing export prices for 12.5pc and 11.5pc protein wheat higher. The spread between 11.5pc protein wheat and feed wheat in the spot export market has widened to around US$12/t after touching $14.50/t on July 16, the highest since August 2018. The widening of protein premiums is not restricted to Ukraine.

The severe drought conditions in Canada are having a drastic impact on global production of high-protein wheat. There are issues in the United States as well. This is already influencing grade spreads here in Australia. The flush season to date is not conducive to a high-protein harvest, so the recent trend could easily continue into the Aussie harvest if the seasonal conditions remain favourable.

HAVE YOUR SAY