POOR weather conditions hit wheat crops particularly hard this season in several key producing countries, such as Canada (minus 38 per cent below last season’s output), the Russian Federation (minus 13pc); and the United States (minus 7pc. Not surprisingly, therefore, global wheat inventories could fall below opening levels in the 2021/22 marketing season.

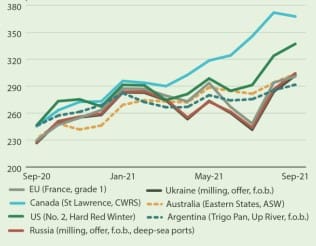

With most of the drawdowns concentrated in major exporting countries, the wheat stocks-to-disappearance ratio could fall to the lowest level in over two decades, which is a worrying sign of supply tightness in world markets, raising the possibility of even further gains in wheat prices this season (Figure 1).

On the demand side, wheat food consumption continues to rise at almost the same pace as population growth while feed use of wheat has intensified markedly since the previous season, largely on the back of tight supplies and high prices of more typical feed grains.

Concerning trade, apart from quantity consideration, also the quality of this year’s wheat crop will play an important role in determining how trade flows will unfold in the 2021/22 marketing season.

In the European Union, where exports are forecast to rebound, significant quality downgrades, particularly in France, could deter potential buyers, as evidenced by the recent cancelation of a purchase by China.

Conversely, Russia seems to be benefiting from better quality wheat this season, increasing its attractiveness for international buyers. In fact, with strong global demand for high-quality Russian wheat and overall lower Russian supplies that could result in more restrictive trade measures, pressure on markets can be expected to mount even further.

The current supply tightness in global wheat markets must also be assessed in light of important and fast changing developments in energy markets and supply chain logistics.

Easing COVID-19 restrictions are likely to sustain economic recovery, boosting prices of oil, gas, and, as a result, fertilizer.

In addition, port congestions, such as those witnessed recently in China and the US, are also a concern, contributing to supply chain disruptions which, along with elevated freight rates, might add more volatility to wheat prices and increase import costs. This would be a particular burden for the poorest countries in the world.

Source: Agricultural Market Information System

HAVE YOUR SAY