A barley crop in Montana shows the effect of a hot and dry growing season. Photo: Welker Farms

A CUT to forecast US wheat production has helped to generate some bullish numbers in the USDA’s July World Agricultural and Supply Demand Estimates (WASDE) released overnight.

“USDA took the axe to the US wheat numbers more than expected, but corn and beans didn’t have too many surprises,” Lachstock Consulting said in its summary.

Global wheat ending stocks for 2021-22 were cut 5Mt to 292Mt, 3Mt below market expectations.

The big contributor to that was the US, down 4Mt to 47.5Mt based on numbers also released overnight in USDA’s Crop Production report, which includes initial survey-based production forecasts for all US wheat classes.

Figure 1: USDA price estimates for Australian, Canadian and US export wheat. Source: USDA

“These production forecasts for durum and other spring wheat indicated a significant decline compared to last year for these two classes due to the severe drought conditions affecting the Northern Plains,” USDA said.

“Partially offsetting this decrease is higher winter wheat production, both on increased harvested acreage and a higher yield.”

In the WASDE, Australia’s kind growing season to date has lifted the 2021-22 production estimate for wheat to 28.5Mt, 1.5Mt up from the June number.

Upward revisions have also been seen for the EU, up 700,000t to 138.2Mt, and Ukraine, up 500,000t to 30Mt.

In addition to the US, cuts have been made for Russia, down 1Mt to 85Mt, and Canada, down 500,000t to 31.5Mt.

Global wheat production in 2021-22 is now seen at 792.4Mt, 2Mt below the June figure.

Increased Australian exports seen

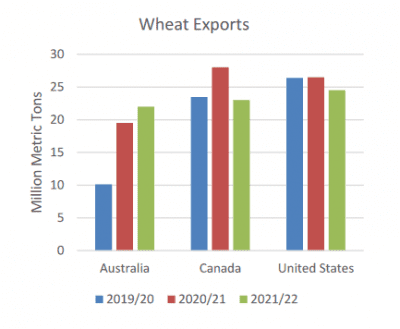

In its accompanying Grain: World Markets and Trade report, USDA said Canada’s wheat exports are expected to plummet 18 per cent from the record 2020-21 figure of 23Mt, and US 2021-22 wheat exports are expect to fall 8pc to 24.5Mt,

Figure 2: Australia’s 2021-22 wheat exports are expected to rise while shipments from Canada and the US are forecast to decrease. Source: USDA

“While Canada and the United States will likely continue to dominate in the Western Hemisphere, Australia has the potential to both solidify and grow market share in Asia, especially in white wheat markets,” the report said.

“The tightening supply situation for Canada and the US contrasts with the more ample supply situation for Australia, a close competitor in Asian markets.”

USDA forecasts Australian wheat exports at 22Mt, up 13pc from 2020-21.

Canada’s supply situation is seeing as being constrained by carry-in stocks forecast as the smallest in decades, drawn down in part by large exports to China throughout 2020-21.

US carry-in is expected to be the smallest since 2014-15.

“Production in Canada is forecast lower as a shift toward barley and oilseeds led to reduced wheat plantings.

“In addition, yields are forecast lower amid unfavourable weather conditions.

“Current high prices in Canada reflect the tight carry-in and the lower expected production.

“The smaller exportable supplies of durum and spring wheat from Canada and the US are likely to underpin high prices this marketing year.”

Increases have also been seen in USDA estimates for Australian current-crop and new-crop barley exports.

USDA increased its projection of current crop Australian barley exports by 700,000t to 6.7Mt based on strong shipments through May, while it lifted the 2021-22 estimate by 500,000t based on a bigger crop now expected.

In his commentary of the USDA figures, Commonwealth Bank Agri Commodities strategist Tobin Gorey said they show a “materially tighter” end point for season 2020 for the US and the world.

However, he said gains in US mid‑protein prices were not replicated elsewhere.

“Paris futures did make sharpish gains, but spot prices in Europe and the Black Sea are yet to have made any gains,” Mr Gorey said.

“The high‑protein wheat price story though continues as an unalloyed positive.

“The USDA took the razor to spring wheat production forecasts for the US, Russian and Kazakhstan because of the hot and dry conditions in those growing regions.

“The USDA only took just a little off their Canada wheat crop estimate but many, ourselves included, suspect that estimate will drop substantially further. Weekend weather underscores the reasons for that suspicion. The US Northern Plains and Canada’s Prairies got very little rain over the weekend, and temperatures across those regions were high or worse.”

Corn, soybeans flat

The estimate for Brazil’s 2020-21 corn crop at 93Mt is down 6.5Mt from the June figure, but is 800,000t above market expectations, and the estimate for Brazil’s export surplus has been cut 5Mt to 28Mt.

USDA has left its area and yield estimates unchanged for the US corn crop now in the ground.

A 1Mt cut to 102Mt for forecast 2021-22 soybean imports was the only major change for China seen in the July WASDE.

“The report is bullish wheat…, neutral-to-bearish for corn, and neutral beans,” Lachstock said.

“The market is still all about weather for beans and corn forecasts, whilst the dry weather is clearly taking its toll on the USA wheat crops still.

Source: USDA, Lachstock, Commonwealth Bank

HAVE YOUR SAY