Delivering grain last week at CBH Group’s Miling site in the Kwinana North zone.

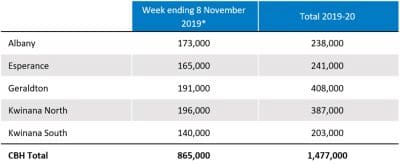

DELIVERIES to CBH Group hit 1.48 million tonnes from the Western Australian 2019/20 harvest to 8 November, following the biggest receival week for all four of its zones which took in 865,000t in total.

It looks to be a short season in the north with some growers in the Geraldton zone likely to wrap up their harvest program within the next week.

“It’s been a tough year for a lot of our growers but, despite the dry season, we are seeing some really positive quality and yield results which is testament to how agronomy and cropping practices have advanced and enabled the industry to build this resilience,” CBH general manager Ben Macnamara said.

Around the zones

Geraldton

Rain early in the receival week delayed harvest for some growers.

Wheat has made up around two-thirds of the zone’s receivals, with barley making up much of the remainder.

Kwinana North

The zone received 5-25 millimetres on 31 October and 1 November, which held up harvest for some growers.

Most deliveries to 8 November have been barley, with growers now moving on to harvesting wheat and canola.

All sites scheduled to open this harvest are now operating.

Quality has been variable in wheat deliveries so far, with loads ranging from H1 to ASW1.

Some sites have introduced AUW1 and AUH2 segregations.

Kwinana South zone

The zone was slow to get after rain early in the receival week, but activity ramped up considerably after the rain stopped.

Three quarters of the grain received to date has been barley, with wheat and canola now also coming in.

A high percentage of barley is going feed compared to previous years, with a Malt 2 segregation being offered at a couple of sites.

Albany zone

Rain at the end of the previous delivery week slowed harvesting and deliveries, but dry weather towards the end of the week has allowed harvesting to resume at a solid rate.

Most sites scheduled to open this harvest will be operating this week.

Barley receivals increased in the week to 8 November, with sites along the south coast roughly even for barley and canola receivals, and the north-eastern areas seeing strong barley inflows.

A high percentage of barley is going feed compared with previous years, with a Malt 2 segregation being offered at a couple of sites.

Esperance

All sites in the Esperance zone are now open, and despite rain over last weekend, harvest was most growers were able to resume harvest on 4 November.

Receivals to date have been mostly canola and barley, and wheat deliveries have started.

Quality has been good, although high moisture has been a problem for some growers.

Market update

Wheat

Wheat prices remained at around $325 per tonne free in store (FIS) Kwinana throughout the week, with limited grower selling.

Growers are focused on harvesting their barley first, and the variable yields and quality has meant they are waiting to harvest their wheat before selling it.

Some demand from South-East Asia and the Middle East is being seen, with Australian prices now calculating into key markets, although for limited volumes.

The initial wheat harvest quality results show a larger percentage of higher-protein wheat, a stark contrast to last year, when a large majority was low-protein ASW.

Barley

Harvest of barley is in full swing, with prices to growers generally easing $3-5/t over last week, putting feed prices at $263/t FIS Kwinana and Spartacus malt barley at $278/t FIS Kwinana.

The dry finish and frost in southern areas has seen malt selection rates coming in well below average.

This is anticipated to improve as harvest moves into the areas of the state not as heavily impacted by the season.

Internationally, demand for feed barley has remained quiet, but some interest is being seen from Asia, although for small quantities.

The market is awaiting a decision on the China barley anti-dumping investigation and this will be an important signal for the direction of this market.

Canola

Canola prices continue to remain historically high at $614/t FIS Kwinana, but grower selling remains slow.

Oil contents are slightly lower than last season, with reports of 44 per cent compared with 46-48pc in the previous year.

On exports, Europe has been in the market, and despite this year’s WA canola crop being smaller than last year’s, CBH expects most of its production will be shipped to key European crushers.

Source: CBH Group

HAVE YOUR SAY