NEITHER lower wheat production in the European Union, Kazakhstan and Turkey nor the increase in Russia’s wheat production estimate this year were fresh news to wheat-watchers in the USDA World Agricultural Supply and Demand Estimates (WASDE) August report released overnight.

The projection of Australia’s wheat crop now in the ground was unchanged from last month’s WASDE at 26 million tonnes (Mt), which is up 71 per cent from the drought-reduced 15.2Mt produced in 2019-20.

Growers in Australia looking to price grain from the upcoming winter-crop harvest, and traders looking to export, cannot take this month’s WASDE as any indication of firmer prices ahead for wheat.

In a report analysing the USDA’s latest figures, Rabobank said Russian export pace and lower global demand would limit EU and US price upside, despite year-on-year lower US ending stocks and EU production.

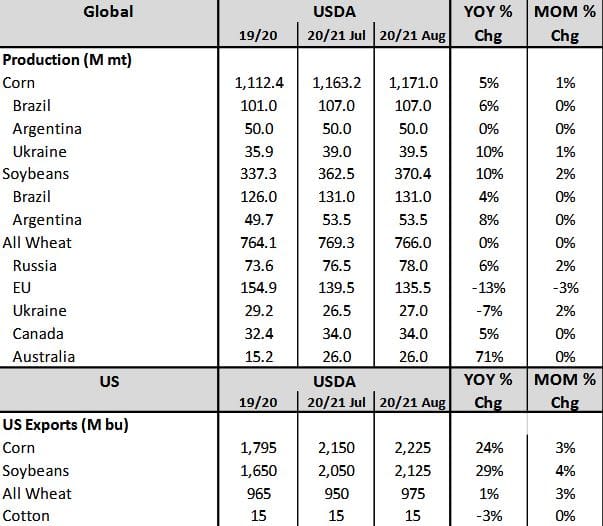

It said the 2020-21 global wheat balance sheet decrease of 3.3Mt in production was led by an expected 4Mt drop in Europe to 135.5Mt, and a 1Mt reduction in Kazakhstan and Turkey (Table 1).

Table 1: The August USDA report substantially lifted world production estimates of corn and soybeans. Wheat changes, on a global scale, were small. Rabobank 2020 citing sources USDA and Rabobank 2020

These changes were partially offset by an anticipated 1.5Mt increase in Russian production, to 78Mt.

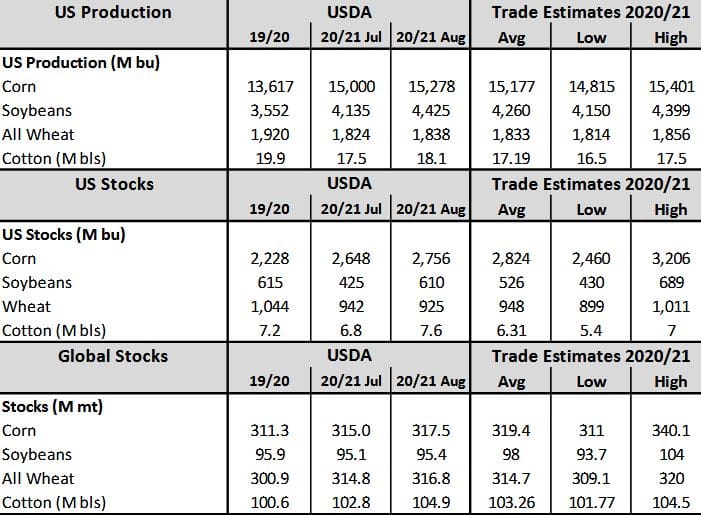

This, in combination with higher beginning stocks and lower domestic demand, results in ending stocks being 2Mt higher, at 316.8Mt, near the higher end of analysts’ estimates (Table 2).

Table 2: Record yields pushed USDA’s projections of US cotton, corn and soybean crop production to the high end, or above, the range of trade prior estimates. Projected world ending stocks were driven higher for wheat and the row-crops. Rabobank 2020 citing sources USDA and Rabobank 2020

Stock figures hard to predict

USDA jumped its yield estimates of US row-crops, corn, soybeans and cotton, all of them records. It made significant upward adjustments to ending stock forecasts for the three commodities and to very much increased exports of corn and soybeans. But in Rabobank’s view the exports and stock projections one year out contain greater uncertainty than the estimates of production, which at this moment is relatively close to harvest.

Read the full Rabobank report.

Source: Rabobank, USDA

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY