ANZAC Day is approaching. For many farmers nationwide, this day represents a traditional date to ideally follow a dawn service and quick game of two-up with another gamble: starting the sowing campaign. Like this time last year, many regions are looking like there is not nearly enough moisture to support a wide-scale plant.

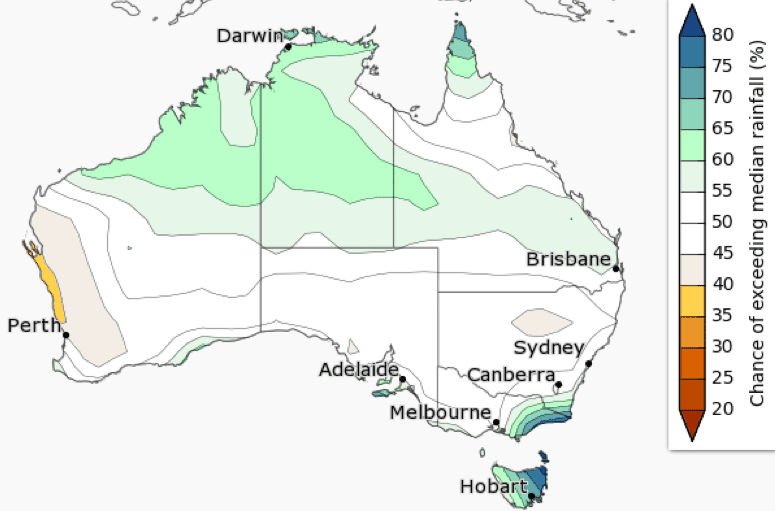

This week the Bureau of Meteorology (BOM) released its most recent forecasts for the coming months, with climate outlooks predicting most cropping regions will have a 50% chance of above median rain from May to July (Chart 1).

Chart 1: Chance of exceeding median rainfall May-July 2018. Source: BOM

The major climatic influence on this outlook comes from the likelihood of a developing Indian Ocean Dipole (IOD) negative through our winter.

A negative IOD should be favourable to those looking for rain, as the relatively warm waters off our north-western coast create stronger westerly winds and more cloudy conditions, feeding moisture to the mainland.

This outlook is much more optimistic than 12 months earlier, when forecasts of a positive IOD loomed as the significant threat for a dry winter.

The IOD is usually less of a headline-grabber than the El Nino/La Nina phenomenon that features in many reports and news articles. However, if last year is anything to go by, the IOD will have a significant influence on our rainfall during our winter months.

In 2017, a weak La Nina condition persisted for most farmers across the nation, but they didn’t entirely benefit from the bountiful rains we usually associate with La Nina because the positive IOD countered it.

Currently, most forecasters are tipping neutral conditions in the Pacific Ocean this year, and believe it is unlikely that sea-surface temperatures will reach the thresholds of an El Nino or La Nina event.

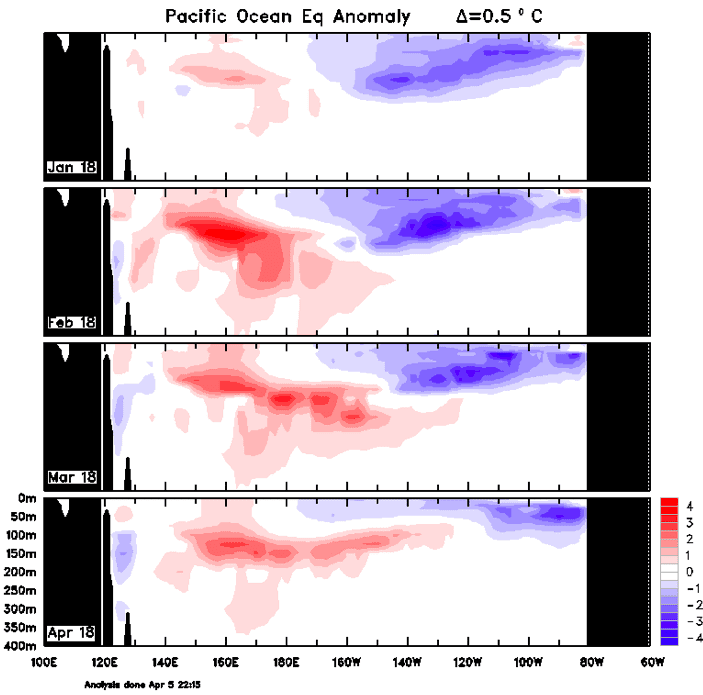

The forecasts have been heavily influenced by a warm body of water under the sub-surface (Chart 2), which has undergone a steady rise to the surface in recent months.

Chart 2: Pacific Ocean temperature anomaly January, February, March and April (red indicates warmer and blue cooler). Analysis date April 5, 2018. Source: BOM

This warm body of water makes it more likely that warming will continue through our winter months.

There are a couple more factors at hand:

- In the past month, it has shrunk in size and doesn’t appear substantial enough to create warming to El Nino levels without a correlation of the atmospheric conditions, such as weakening of the trade winds.

- Forecasters do roll out a disclaimer during this time of year that forecasting is more difficult than usual. Referred to as the Boreal Spring Predictability Barrier, the next few months will prove to be the hardest time to predict the sea-surface temperatures for the coming months accurately.

Political uncertainty affects prices and trade

For the demand side, rising trade tensions between the US and China have been the big shock to global markets this week. On April 4, China’s Ministry of Commerce announced its plan to impose 25-per-cent duties on several US products including wheat, corn, sorghum and soybeans in retaliation to a similar proposal by the US on many Chinese products.

The announcement has created incredibly volatile markets globally. This is particularly so for soybeans, as more than half of last year’s US soybean exports were shipped to China.

However, material impact on our market is less likely. Australia will still need to price competitively versus the other approved origins to pick up any of the 1-million-tonne (Mt) demand that it has been doing each year. As for sorghum and barley, any additional demand should have already been penciled in since anti-dumping investigations effectively stopped the US sorghum flow earlier this year.

Australian wheat targets unlikely

The Australian wheat export pace has recently looked sluggish, and it now seems near impossible to hit ABARES export forecast of 16.8Mt. A 7pc tax advantage over our competitors has assisted recent feed-wheat sales to The Philippines for May-to-July shipments at values of US$245-250 per tonne c and f. However, from August forward, the Black Sea new-crop pricing in the low $220s c and f appears too sharp for Australia to be connecting on these positions, despite the tax duty. Other crucial export destinations such as Indonesia and Vietnam have already fallen behind targets because of the same challenges, and it will only become more challenging in the second half of this year.

All this makes the next few weeks harder to predict. If the widespread rain doesn’t eventuate, the slow export pace will quickly be forgotten. Domestic calculations will take priority, to the contrary and our pencils will need to be sharpened to compete in the second half of our year.

Source: The article from COFCO this week was written by Tim Murray.

HAVE YOUR SAY