Each year the Federal Government’s official commodity forecaster releases production and price forecasts for Australia’s key agricultural conferences.

Here’s a snapshot of what ABARES sees ahead for wheat, barley, sorghum, canola and cotton.

(If you’ve got a bit more time you can read the full comprehensive report on ABARES’s website here)

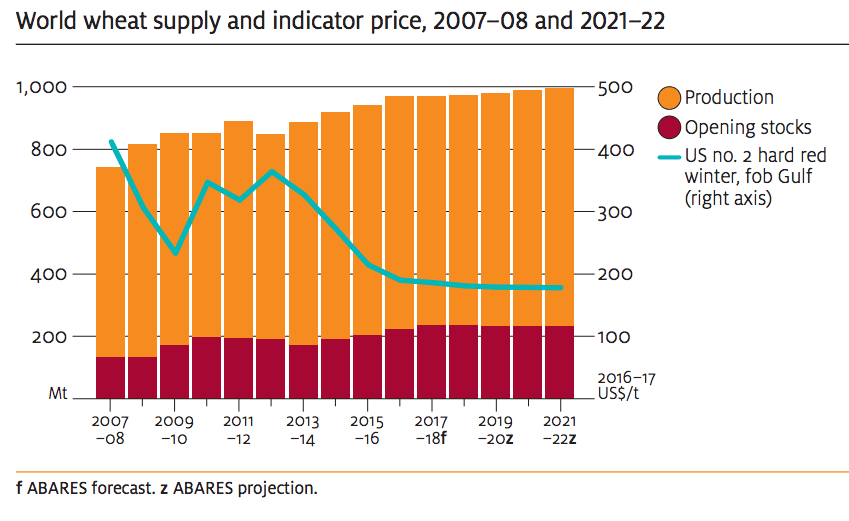

Wheat

- World wheat prices are projected to remain low in the short to medium term

- Abundant world supplies and competition from other feed grains on the global market keeping prices lower.

- World production of wheat is forecast to decline in 2017–18 but increase in the medium term as average yields return to historical trends.

- World wheat consumption is projected to grow from 735 million tonnes in 2016-17 to 762 million tonnes in 2021-22 – Driven largely by increases in Asia

- By 2021-22, China is projected to hold 45pc of world wheat stocks

- Australian wheat production to fall from 35 million tonnes in 2016-17 to 24 million tonnes in 2017-18

- In medium term, production expected to remain around 25 million tonnes in 2021-22

- Wheat export shipments in 2017-18 to fall by 8pc to 21 million tonnes (down from 23 million tonnes in 2016-17)

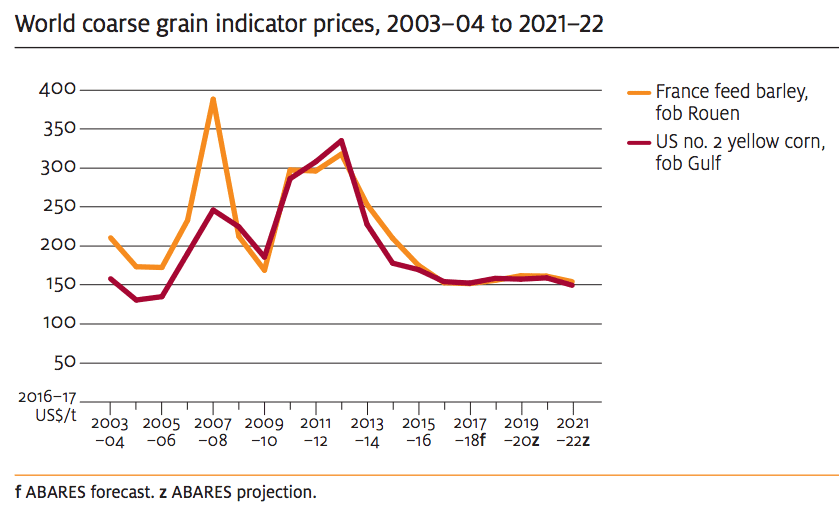

Coarse Grains

- World coarse grain indicator prices are forecast to remain historically low in 2017–18 and over the medium term, reflecting abundant world grain stocks.

- The 2017–18 world coarse grain indicator price (US no. 2 yellow corn, fob Gulf) is forecast to be US$157 a tonne, largely unchanged from the average price in 2016–17.

- The world indicator price for barley (France feed barley, fob Rouen) is forecast to average 1 per cent higher in 2017–18 at US$155 a tonne

- Consecutive years of increasing production have resulted in record world stock levels.

- Australian coarse grain production and exports are forecast to fall in 2017–18 but to increase over the medium term.

- Australian barley production in 2017-18 to fall 37pc to around 8.5 million tonnes, reflecting return to average yields

- Area planted to grain sorghum in Australia to increase from 441,000 hectares un 2016-17 to 631,000ha in 2017-18, boosted by Qld ethanol mandate introduced in Jan 2017

- World demand for coarse grains for livestock feed in developing countries expected to be main source of growth in next five years

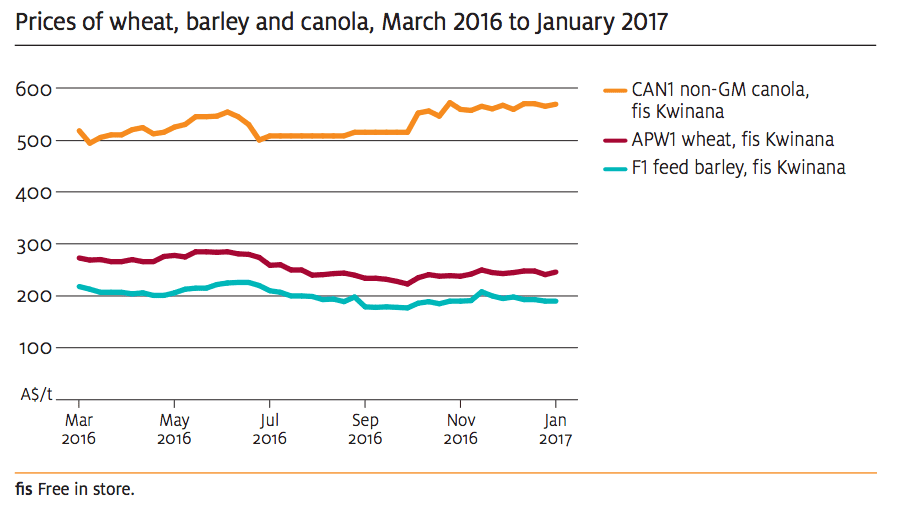

Oilseeds

- World oilseed indicator price is forecast to average lower in 2017–18, reflecting abundant stocks at the beginning of the year and another year of good harvests in major exporting countries.

- Prices to 2021–22 are projected to fall because of a continuation of strong yield gains and area expansion in South America.

- Australian canola plantings are forecast to rise in 2017–18, reflecting better returns to producers compared with other cropping alternatives.

- In contrast with wheat and barley, Australian canola prices have risen compared with March 2016

- Area planted will hinge on timing of rainfall in Autumn

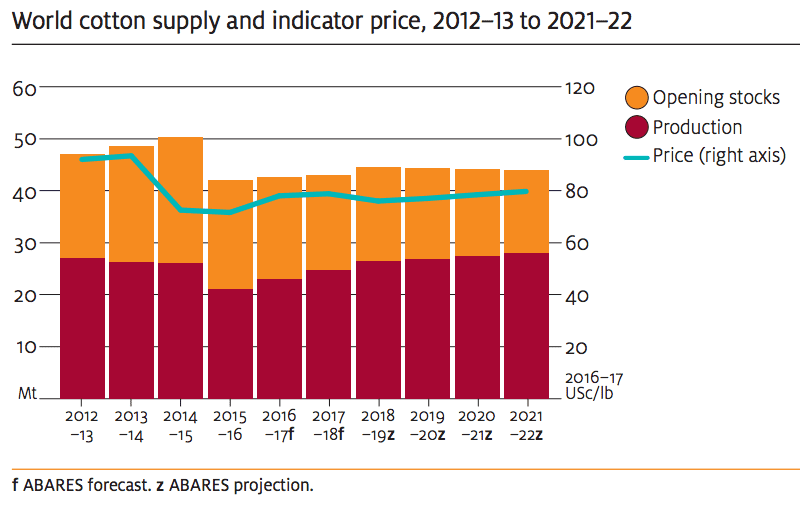

Cotton

- World cotton prices are forecast to increase over the short term as a result of world cotton consumption exceeding production.

- In 2021–22 world cotton prices are projected to average around US80 cents a pound (in 2016–17 dollars), reflecting continued growth in world consumption driven by strong demand from non-OECD apparel-producing countries.

- Returns to Australian cotton growers are projected to rise to average $592 a bale (in 2016–17 dollars) in 2021–22, reflecting higher world prices

- Cotton exports from Australia are projected to increase to around 1 million tonnes in 2021–22 from a forecast 774,000 tonnes in 2016–17.

Source: ABARES. To read full report click here

HAVE YOUR SAY