DESPITE hot, dry conditions during the first quarter of 2018, particularly in eastern Australia, the value of crop production in 2018–19 is forecast to remain unchanged at $31 billion, according to ABARES’ ‘Agricultural Commodities: June quarter 2018’ report released today.

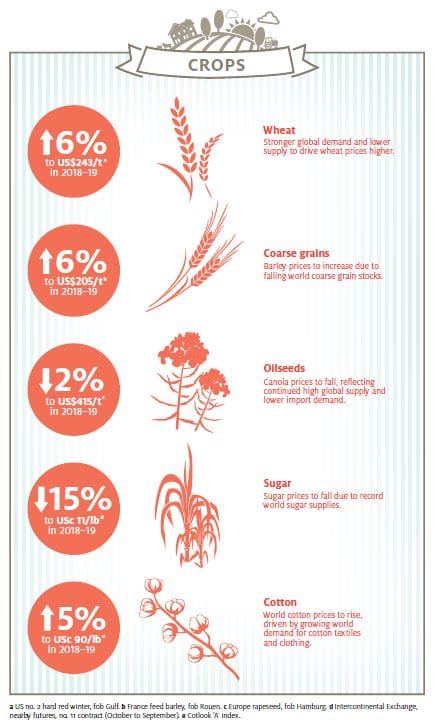

The commodity forecaster says wheat and coarse grain prices are likely to rise in 2018-19, while downward pressure is set to restrain oilseed and sugar prices.

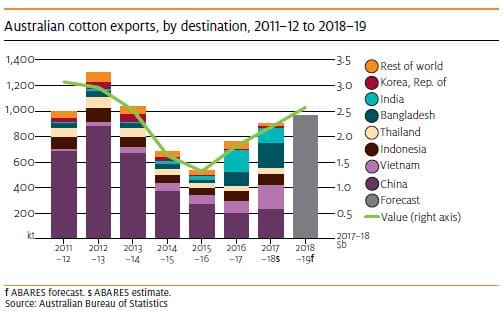

Australian cotton exports are forecast to rise in 2018–19 despite an expected decline in production.

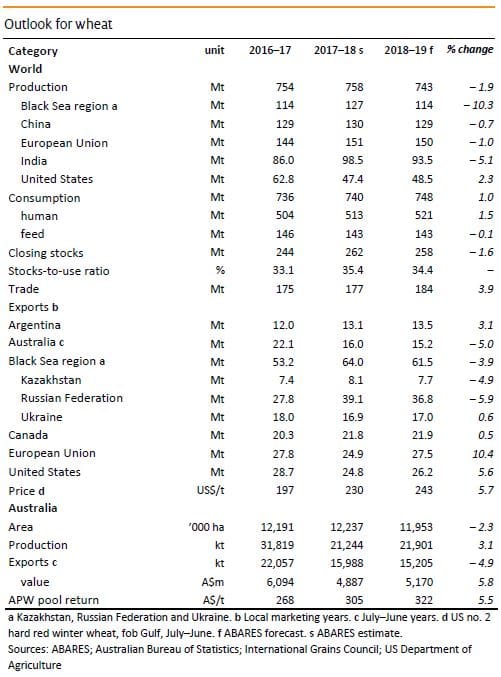

Wheat:

- In 2018–19 world wheat prices are forecast to rise in response to stronger demand for wheat for human consumption and lower production in major exporting countries.

- Despite the forecast rise, world wheat prices are expected to remain well below the 10-year average in real terms.

- Total wheat production in the major exporting nations is forecast to fall due to lower production in the Russian Federation.

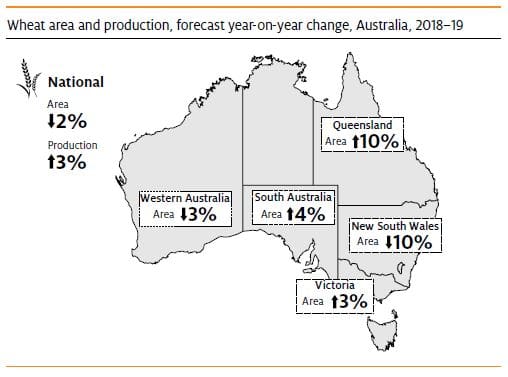

- Australian area planted to wheat is forecast to fall marginally, reflecting poor planting conditions in New South Wales.

- The value of Australian wheat exports is forecast to rise despite a lower volume of exports.

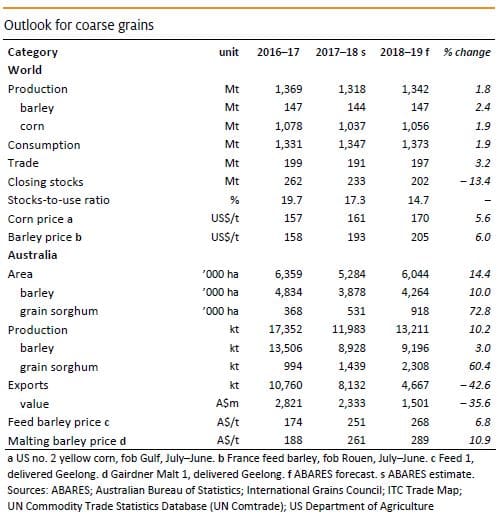

Coarse grains:

Coarse grains:

- World coarse grain indicator prices are forecast to increase in 2018–19 due to lower global supplies.

- Industrial use of corn is expected to increase, driven by greater biofuel use in China.

- Australian farmers are expected to increase the area planted to barley in response to favourable prices.

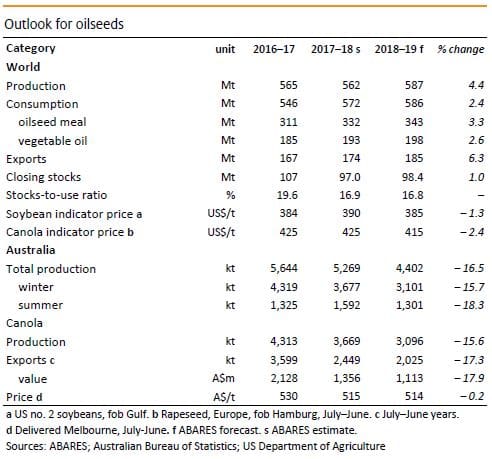

Oilseeds:

Oilseeds:

- Growth in global production and uncertainty about Chinese tariffs on US imports are forecast to place downward pressure on prices in 2018–19.

- Chinese soybean imports are forecast to surpass 100 million tonnes.

- In 2018–19 Argentine soybean production is expected to boost global supply.

- Australian canola plantings are expected to fall as farmers substitute to barley and wheat.

Cotton:

Cotton:

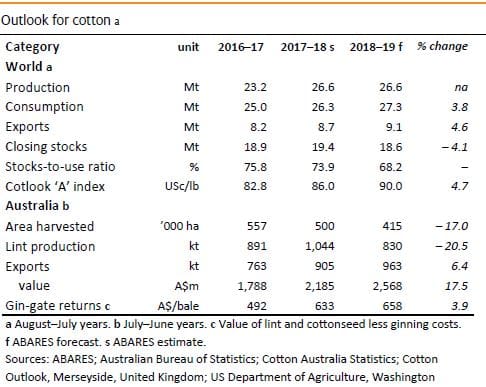

- Record world demand for cotton is expected to support prices in 2018–19.

- Australian cotton exports are forecast to rise in 2018–19 despite an expected decline in production.

- In 2018–19 returns to Australian cotton growers are expected to increase by 4 per cent to $658 per bale.

Sugar:

Sugar:

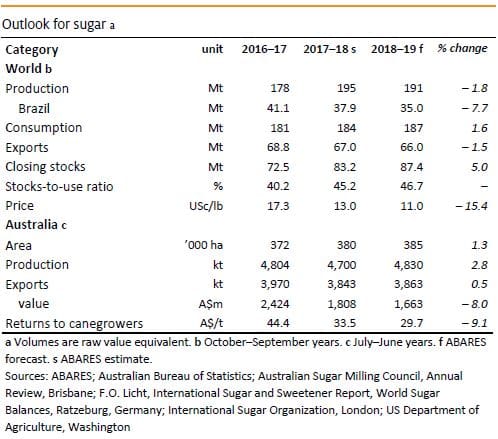

- Record world sugar supply is expected to drive prices down to a 16-year low in 2018–19.

- World sugar stocks are forecast to rise to record levels due to high carry-over stocks and world production exceeding consumption for the second year in a row.

- Returns to Australian canegrowers are forecast to fall to $30 per tonne.

Farm production value forecast to rise

Farm production value forecast to rise

The value of overall farm production in Australia is forecast to be $61 billion in 2018–19, well above the 10-year average of $55 billion in real terms.

ABARES’ executive director, Dr Steve Hatfield-Dodds said that while some sectors may see a decline in production next year as a result of the drier than average autumn conditions, the forecast rise in the overall value of farm production was good news.

“Although the first quarter of 2018 was marked by hot and dry conditions particularly in eastern Australia, the value of crop production in 2018–19 is forecast to remain unchanged at $31 billion,” Dr Hatfield-Dodds said.

“We’re also expecting the value of livestock production to rise by 3 per cent to $30 billion, contributing to growth.

“Strong demand for Australian lamb, wool and cotton exports is expected to partly offset weaker demand for Australian beef and veal, and falling crop exports.

“Despite a higher value of production, the value of exports is forecast to fall by 2 per cent to $47 billion in 2018–19, as export earnings decline for barley, canola, chickpeas and sugar.”

Export earnings for fisheries products are also forecast to increase by 1 per cent in 2018–19 to $1.6 billion, on the back of an estimated 9 per cent increase in 2017–18.

Ongoing risks to the agricultural sector include the persistence of dry conditions beyond winter in eastern Australia, and increasing competition in key export markets.

Source: ABARES

The full analysis can be found at http://www.agriculture.gov.au/ag-commodities-report

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY