RALLIES in futures markets, led by spring wheat woes in June and July, subsided last week.

However more uncertainty awaits as pricing of the world’s 2017 wheat crops is dictated by investors’ sentiment, actual crop outcomes through the Northern Hemisphere summer and Australia’s own cereals harvest in the last quarter of calendar 2017.

Futures markets trade long

“The long structure in traders’ positions in wheat futures is not compelling for further upside,” Lachstock analyst Lachlan Hume said.

“This could still play out if further production concerns arose in Canada and China, but time is on our side.”

He said that while spring wheat had grabbed the headlines, the real story behind the rally was concerns for the available supplies of wheat in the major eight exporting nations.

Market Check strategy and managed programs manager Nick Crundall said there had been a decent correction of approximately 60c/bushel since the recent highs, as the market realised the rally had knocked the US out of export competitiveness.

“The selloff was further encouraged by funds finding themselves long CBOT for the first time in a couple of years, in a fundamentally bearish market, a position they were quick to exit,” he said.

“That being said, there is enough risk to the corn and spring wheat crops, along with the Australian crop, to warrant a higher trading range than we have seen in past 12 months.”

“This means there will be an increase in the stocks-to-use ration for the Hard Red Winter (HRW) and Soft Red Winter (SRW) wheat balance sheets.”

Plenty of world wheat stock, but major exporters’ stocks are tightening

The conundrum is that while high world wheat stocks over several years had dragged market sentiment lower, the spring wheat crisis this month acted as catalyst for review.

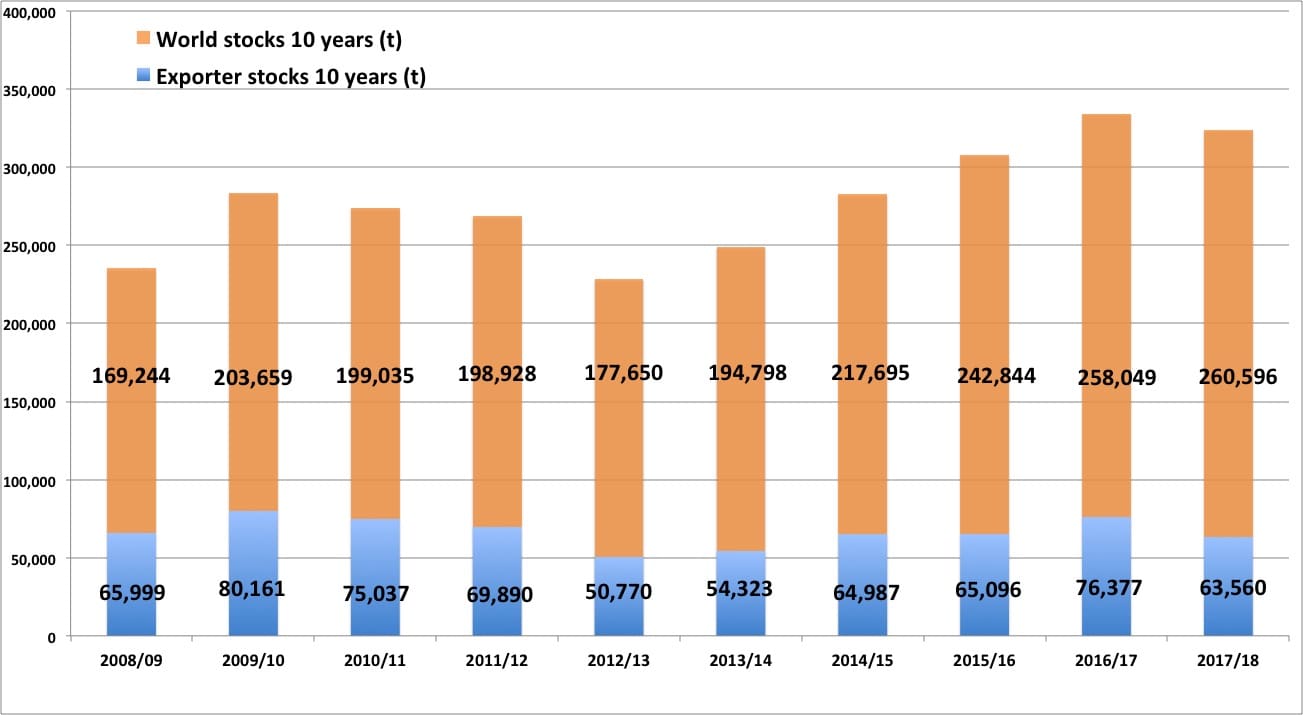

World wheat stock 10 years, ‘000 tonnes, 2008/09 to 2017/18. Source: USDA. Click on chart to enlarge

It turned out that stock among exporters, available for trade into international markets, had been creeping lower and could be cause for concern.

Spikes create opportunities

The present value of grain stocks has obviously increased, and sellers traded judiciously into stronger 2017 markets.

However, such market-moving rallies have also thrown opportunity to growers whose businesses are positioned to capture profitability one or two years forward.

Forward prices were up to 90 percentile levels for 2018/19, and came very close to those levels for 2019/20 also, according to Ten Tigers managing director Chris Tonkin.

“We have set people up nicely with a good base price for a percentage of their grain for the new season for 2018/19,” he told Grain Central.

“We are active in helping people make good business decisions early, at a time when they are not emotionally too involved or stressed.”

“You have to be organised and have things in place to know what a good price is.”

Eight of the major wheat exporters are Russia, USA, Canada, Australia, Argentina, Kazakhstan, Ukraine and EU.

HAVE YOUR SAY