THE Federal Government’s Wheat Port Code of Conduct (WPC) is set to extend to cover all bulk grains, and companies not complying with the code will be subject to penalties, according to the latest review of legislation covering Australian grain exports.

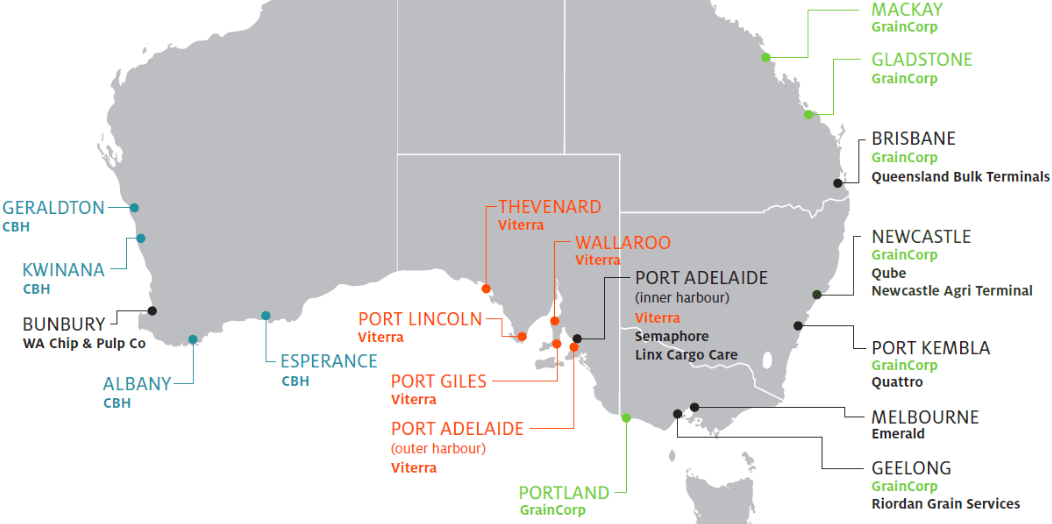

Bulk grain export facilities. Colour coding CBH in blue, Viterra orange, GrainCorp green. Other operators’ names are printed in black. Source: ACCC. Click image to enlarge.

Released this week, the review by the Department of Agriculture and Water Resources Task Force has surprised some in the grains industry by recommending that port terminal service providers (PTSPs) no longer be required to publish stocks information.

The WPC is mandatory. It balances the interests of port terminal owners who own export trading businesses and the interests of other exporters.

Since its introduction in 2014, its aim has been to cut red tape, increase transparency and safeguard the export supply chain.

Minister for Agriculture, David Littleproud, said the review made only technical recommendations to improve the operation of the WPC.

“The review made 12 recommendations to clarify and strengthen some parts of the code, including extending it to cover other grains,” Mr Littleproud said.

“We listened to farmers, bulk handlers, exporters and experts to make sure the code is giving exporters fair and transparent access to port terminals.”

The taskforce behind the review met with more than 30 stakeholders, including government agencies, grower and industry-representative bodies, exporters and port terminal operators, and received submissions from 15 organisations.

“It makes sense to review codes to make sure they are doing what they’re supposed to do.”

The amendments largely stem from the Australian Competition and Consumer Commission’s (ACCC) practical experience in monitoring the code’s operation over its first three years of operation.

Recommendation 3 of the review gives the WPC some teeth by saying appropriate remedies, including civil pecuniary penalties and infringement notices, be considered for “serious and egregious breaches” to encourage PTSPs to take actions within specific periods as required by the code.

These could relate to:

- Publication obligations, including continuous disclosure rules;

- Non-discrimination, no hindering and dispute resolution provisions;

- Certain aspects of the capacity allocation and protocol obligations;

- Publication obligations, including regarding capacity and performance indicators; and,

- Record-keeping obligations.

The review’s other recommendations include:

- Amendment of the code so that all accepted bookings be reported no later than three months before the shipping slot opens, or within two working days of a booking being accepted within this period;

- PTSPs be required to provide the ACCC with retrospective port-loading statements setting out the bookings for each calendar month (whether executed or not) within one month of the conclusion of the calendar month;

- That Grain Trade Australia take the lead in engaging with open-access up-country storage operators and third-party exporters to establish and/or confirm industry standards and expectations in relation to the reconciliation of freight differentials and other costs arising from site swaps;

- If, despite action by industry, new evidence emerges of a non-exempt PTSP using its market power to intentionally and unreasonably restrict fair and transparent access to grain for export through operation of its up-country storage and handling network, the need for intervention, including regulation, should be considered.

The review recommends the code next be reviewed in 2022.

“I will consult with stakeholders as I consider the report ahead of releasing a government response to the review in coming months,” Mr Littleproud said.

Under the terms of the Australian Consumer and Competition Act 2010, Australian wheat exporters active as of 2016-17 as listed in the review were:

- ADM Trading Australia Pty Ltd

- Agrigrain (major shareholder Plum Grove)

- Arrow Commodities Pty Ltd

- Australian Grain Export Pty Ltd

- Bunge Agribusiness Australia Pty Ltd *

- Cargill Australia Limited *

- CBH Limited *

- CHS Broadbent Pty Ltd

- COFCO International Australia Pty Ltd *

- Emerald Grain Pty Ltd (wholly owned by Sumitomo) *

- Glencore Agriculture Pty Ltd (Viterra is a Glencore company) *

- GrainCorp Operations Ltd *

- GrainTrend Pty Ltd

- JK International Pty Ltd

- Louis Dreyfus Company Australia Pty Ltd

- Origin Grain Pty Ltd

- Plum Grove Pty Ltd (shareholders include Mitsui, Salim Group and Seaboard Corporation)

- Riordan Group Pty Ltd *

- Riverina (Australia) Pty Ltd *

- Wilmar Gavilon Pty Ltd (a joint venture between Wilmar International Limited and the Marubeni Corporation)*

Asterisk indicates that an exporter operates, has an interest in, or has a relationship with an Australian port-terminal facility as of 2016-17.

Source: DAWR

The full report is available at the Review of the Code of Conduct tab on the DAWR website

HAVE YOUR SAY