GROWING the 2019/20 crop is practically a done deal, and by most measures the numbers have been adjusted up slightly this month, according to the International Grains Council (IGC) November report released overnight.

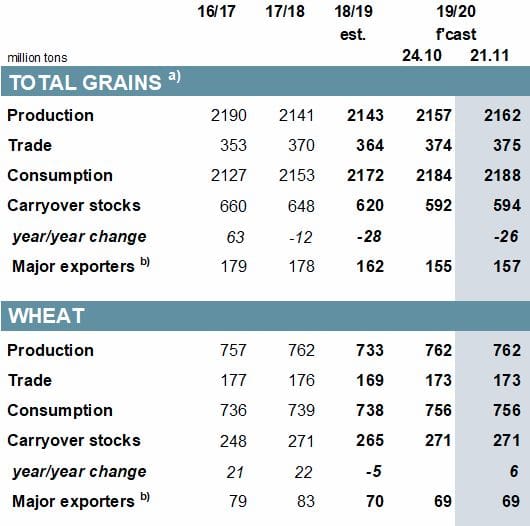

While world total wheat and coarse-grain ending stock remain lower in 2019/20 than they were in 2018/19, IGC’s November forecasts were higher than October, and higher than 2018/19 in respect of production, trade and consumption.

Figure 1. Current year total grains’ variables are improving while current year wheat, though stable, also has increased from 2018/19. (a) wheat and coarse grains. (b) Argentina, Australia, Canada, EU, Kazakhstan, Ukraine, US, Russia. Source: IGC

Eyes turn to 2020/21

World rapeseed area is seen tentatively up 3 per cent in 2020/21, including gains in the EU and the Black Sea region and world wheat area, with significant regional variation, may increase just 1pc next year.

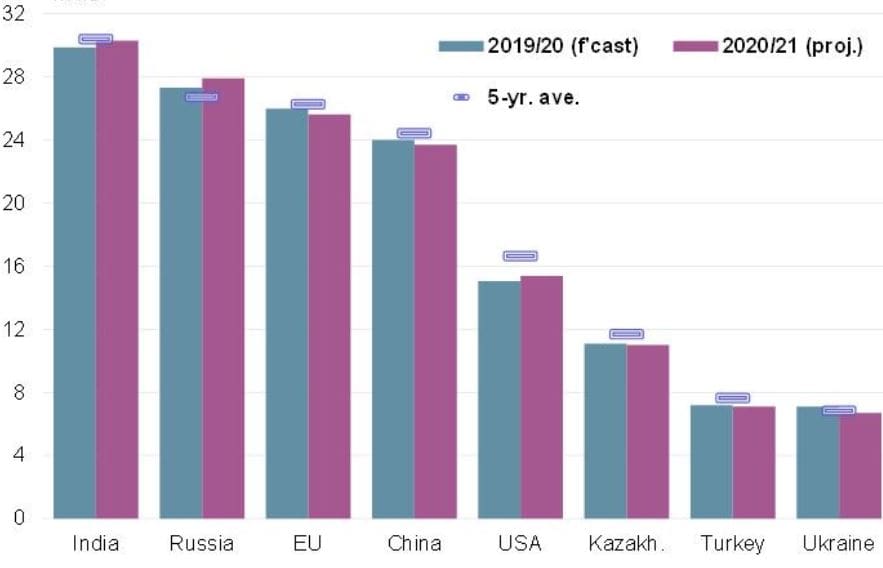

Figure 2: Wheat harvested area this year and next in selected countries is mostly below the five-year average, except in Russia. Numbers indicate million-hectare units. Source: IGC

Planting of winter wheats in most northern hemisphere countries would typically be completed by November, but this year, northern-hemisphere planting conditions are mixed. Figure 2 shows projected 2020/21 wheat areas for selected countries, most of which in the current year and the next are expected to harvest a smaller area of wheat than 5-year averages.

Russia is the exception.

IGC said a significant drop in Ukraine wheat area was reported owing to dry weather, leaving recently established crops poorly placed going into winter.

Harvested wheat area in Russia is set to expand.

US wheat planting is virtually complete, but area is expected to remain close to historic lows.

France and the United Kingdom in particular among EU countries had wet weather interrupt autumn fieldwork.

Global wheat 2019/20 consumption (table 1) has risen from 2018/19 in respect of both feed and food use.

World wheat stocks are now seen at 271 million tonnes (Mt) at the end of 2019/20, recouping the drawdowns of prior years to broadly match the stocks record set in 2017/18.

Global wheat trade is predicted to grow.

Russia in 2019/20 is forecast to be the largest exporter for the third successive season.

Big barley crop in demand

Strong demand for barley for food use could lift consumption to a record high in 2019/20, although ample availability of alternatives may cap gains.

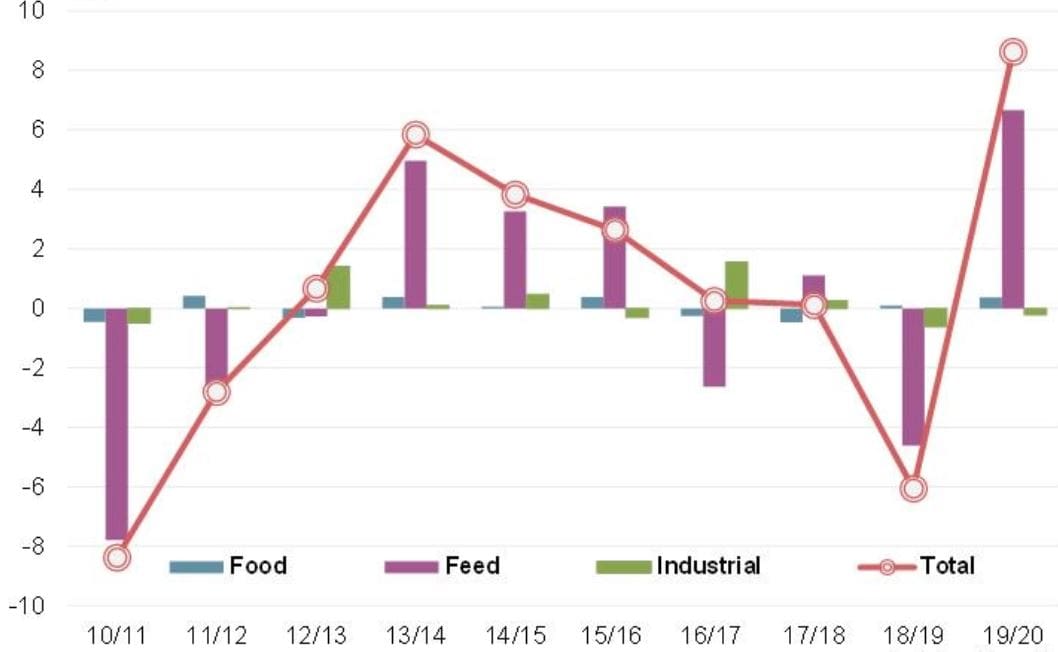

Figure 3 shows annual changes in world consumption, food, feed, industrial and total.

Global barley out-turn in 2019/20 is seen as a record, supported by strong increases in harvest in EU and Ukraine.

Figure 3. Change in world barley usage by sector. Million tonnes. 2018/19 estimated. 2019/20 forecast. Source: IGC

Source: IGC

IGC grains market report subscription is available here.

Link here to a global wheat crop calendar from FAO, agricultural market information system secretariat.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY