GLOBAL values for wheat are seen as steady to firm in the short term based on a strengthening trade as markets react to the ongoing impacts of the COVID-19 pandemic, according to Agricultural Market Information Systems’ (AMIS) OECD-FAO Agricultural Outlook 2020-29 and its latest Market Outlook.

AMIS provides outlooks for global maize, rice and soybeans as well as wheat, and said markets for all four commodities were expected to remain generally well balanced in 2020-21 (July-June).

This is despite health and economic consequences of COVID-19 coupled with intensifying trade uncertainties having jeopardised food-market stability.

It said forces at play had made predicting markets in coming months “most challenging”, and the need for international collaboration to help reassure the orderly flow of food products had never been greater.

AMIS said a favourable medium-term diagnosis of global agricultural markets was juxtaposed against the “unprecedented disruption of global economic activity” caused by COVID-19, and shutdown measures to contain it.

Out to 2029, AMIS has forecast supply growth would outpace demand growth, causing real prices of most commodities to remain at or below their current levels.

Moreover, productivity growth was going to drive the projected increase in output, easing pressure on land and resource use.

An expanding global population was expected to remain the main driver of demand growth.

COVID weakens food demand

The report assumes a significant macro-economic contraction in 2020 and a mild recovery in 2021, and global food demand weakening due to the widespread loss of disposable income.

This is expected to far outweigh the disruptions to food supply, and thus depress agricultural commodity prices.

Price declines are expected to compensate for the loss in purchasing power for most consumers, keeping global food consumption almost unchanged; however, food security for vulnerable populations, in particular in least-developed countries, will be at risk.

The scenario also points to uncertainties surrounding the impact of the pandemic on agriculture in the medium term, when impacts on prices will depend on the timing and scale of supply disruptions and the path of economic recovery.

If bottlenecks in processing activity or the availability of intermediate products severely disrupt agricultural supply and it lags behind the overall economic recovery, prices will rise.

Alternatively, if agricultural production capacity bounces back from disruptions and the economic slowdown continues, prices will decline.

Global production ratchets down

Wheat production forecast for 2020 points to a slight decline year on year following this month’s downward revision, with improved prospects in Brazil, Canada, the Russian Federation, and Ukraine being insufficient to counter cuts for the European Union, and to a lesser extent the United States and Argentina.

In Argentina, conditions are mixed with favourable conditions in the provinces of Buenos Aires, Entre Ríos, and some parts of Santa Fe, but persistent dryness and frosts have lowered prospects in the rest of the country.

In Australia, conditions are generally favourable except for Queensland, where conditions remain dry; by contrast, New South Wales has had exceptional good conditions and an expansion of sown area.

Global wheat utilisation in 2020-21 is expected to exceed that of 2019-20, driven because of increased food use, while feed demand is projected to drop from last year, and industrial use is seen as steady.

Projections for wheat trade in the year to June 2021 have scaled up amid more robust global import demand and expectation of large export supplies.

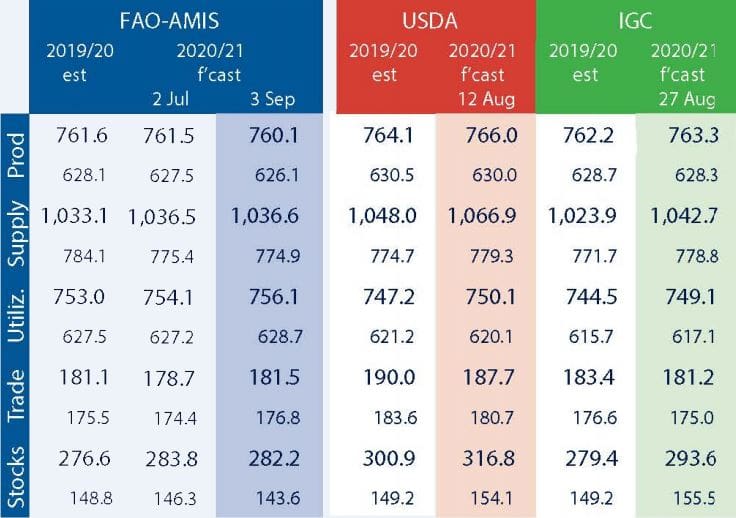

Table 1: FAO-AMIS, USDA and International Grains Council’s estimates for major components of world wheat trade. Source: AMIS

Ending stocks for 2021 have been trimmed since July, but are seen as rising by 2 per cent from the opening figure to the second highest level on record; China accounts for most of the anticipated year-on-year build-up.

On 9 July, Saudi Arabia announced the completion of the first phase of privatisation of the state-owned wheat-milling sector, opening the way for wheat to be directly purchased from the global market.

The final stage of the privatisation of Saudi’s milling sector was launched 14 July.

On 18 August, the Ministry of Economy in Ukraine set the wheat export cap at 17.5 million tonnes during 2020-21 (July-June), 3Mt below the amount exported in 2019-20.

Wheat prices firm

Export prices strengthened by 1pc during August.

Some support came from confirmation of disappointing harvests in parts of Europe and concerns about the production outlook in Argentina.

However, yield results improved in the Russian Federation as harvest advanced, and production expectations edged back towards 80 million tonnes or more.

Price sentiment was also contained by generally beneficial weather in Australia, and expectations strengthened for possibly one of its largest crops on record.

With increasing confidence that global production would be close to record levels, market participants have awaited a clearer picture of demand, with COVID-19 still clouding the outlook and dampening any upward price momentum.

Northern conditions mixed

In the Northern Hemisphere, spring wheat conditions were generally favourable, while conditions remained mixed for winter wheat, particularly in parts of Europe, Ukraine, and the southern Russian Federation as the season drew to a close.

In the European Union, harvest was wrapping up under mixed conditions.

Yields in northern France and Romania have suffered due to hot and dry conditions earlier in the season.

In the United Kingdom, harvesting was wrapping up under poor conditions after a season of variable weather.

In Ukraine, the winter wheat harvest was ending under favourable conditions across most of the country apart from the south, where dryness earlier in the season resulted in below-average yields.

The Russian Federation’s winter wheat harvest was concluding among exceptional conditions in the Central and Volga districts, while earlier in-season dryness had reduced yields in southern regions.

Spring wheat is under generally favourable conditions, with some slightly drier-than-normal conditions developing.

In China, harvesting of spring wheat was ongoing amid favourable conditions.

In the United States, conditions were favourable as the winter-wheat harvest wrapped up in the northern states and spring wheat harvest began.

Canada’s winter-wheat harvest was wrapping up under favourable conditions, and spring wheat was growing in generally favourable conditions, but some dryness in Saskatchewan has caused premature ripening.

Source: AMIS

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY