AUSTRALIA’S tough start to winter cropping this year comes at a time when offshore developments continue to push world market prices up amid mixed news of Northern Hemisphere crops.

Underpinning the upside for world wheat prices was the latest International Grains Council (IGC) outlook which saw global grain production as shrinking, consumption remaining high, and the possible contraction of global stocks for the first time in five years.

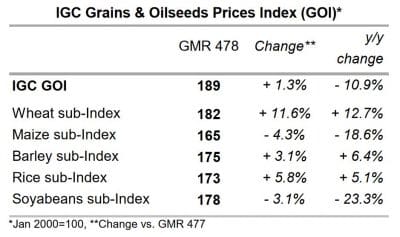

source IGC, global market report, nr. 478, June 2017 compare previous month and year ago

The IGC wheat prices index rallied almost 12 per cent in a month, being 13pc higher than a year ago, and was at its highest level since July 2015.

IGC linked the increase almost entirely to heightened concern about dry weather limiting production in European and North American wheat crops which compounded concern for the Australian winter crop.

North America lower hectares, swing to oilseeds

Canadian wheat growers, along with their US wheat-growing counterparts just south of the border in states including the Dakotas and Minnesota, have been forced by the weather into planting less wheat area than initially intended.

Along with an unattractive wheat price when compared with the oilseed complex, soggy spring planting conditions delayed wheat seeding and sealed Canada’s million hectares increase in canola planting.

According to Statistics Canada (Statscan), which released its 2017 crops seeded area report last week, Canada achieved a first in the country’s plantings: a greater area of canola than wheat.

Prices kick

Australia’s ASX (WM) eastern wheat futures price had already added A$12/tonne on Friday.

US wheat futures market price rises were further fuelled during the US Friday trading session by the United States Department of Agriculture (USDA) release of its monthly estimate of US crops area planted, which forecast a 9pc reduction in total US wheat plantings, the lowest since records began in 1919.

While this wasn’t exactly fresh news, the timing and significance of lower spring wheat plantings spilled into other wheat markets which traded substantially higher during Friday.

CME Chicago Soft Red Winter wheat futures and Kansas City Hard Red Winter wheat futures settled the week up US61 cents per bushel and US58.5c/bu respectively, compared with their Monday closes, having both traded their daily US30c/bu limit on Friday.

European harvest

Acceleration of harvest pace in EU confirmed some yields compromised by dry weather, particularly in France and Spain, which lead the European Commission last week to revise downward its cereals supply and demand balance sheet for the next, 2017/18, marketing year.

While it decreased common wheat ending stock by 341,000t (10.8Mt), increased barley stock by 421,000t (6.4Mt) and decreased durum wheat stock by 382,000t (2.1Mt), the majority impact of lower maize, triticale, rye and other cereals would leave the EU total cereals stock 3.9Mt smaller (34.9Mt) at 30 June 2018 compared with 1 July 2017.

HAVE YOUR SAY