THE INTERNATIONAL Grains Council’s (IGC) first formal projection for 2018/19 heralds a 46 million tonnes (Mt) drawdown of world grain stocks, following a smaller stock reduction in 2017/18, the first since stock had progressively built after 2012/13.

The world grain body said this would indicate a stocks-to-use ratio being the lowest in five years.

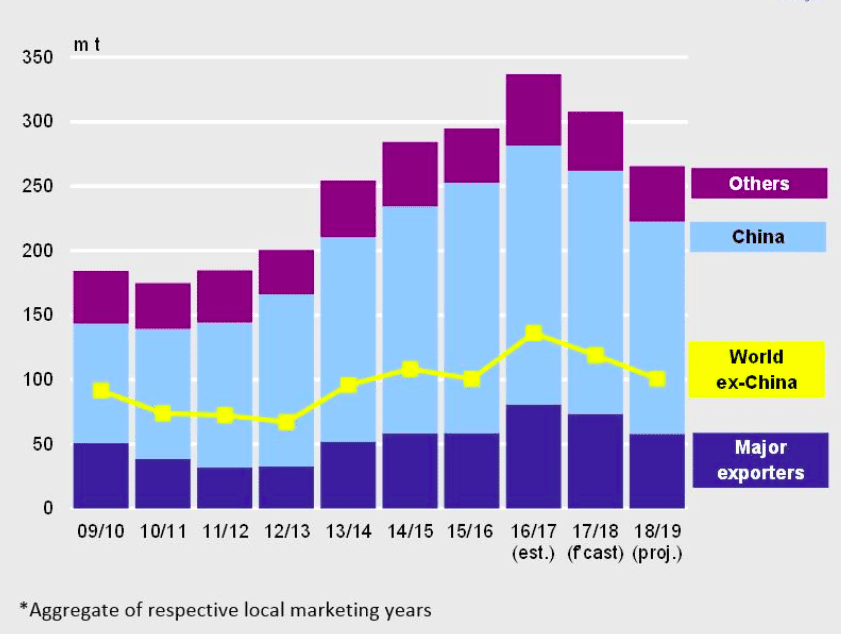

Chart 1. World carryover stock* of corn (maize), million tonnes.(Source: IGC) (Click on image to expand)

The contraction of grain stocks over the current year was mainly linked to maize (chart 1), though barley and sorghum stocks were also lower. Wheat stocks were projected a little higher.

The effect of world stock on perceptions in grain markets perhaps would have exacerbated the futures price rises which occurred in February and early March. Major wheat and coarse grains exporters’ 2018/19 stock levels look likely to settle below those of 2015/16.

IGC projected grain stocks would drop 17 per cent over the 2018/19 crop year, as higher consumption had driven increased volumes of shipped grain.

The all-time high IGC 368Mt projection of 2018/19 wheat and coarse grains trade would be trade records for both wheat and maize, maize trade having risen for 10 consecutive years.

Index rises

IGC said strength in grains and oilseeds export quotations had lifted its grains and oilseeds prices index (GOI) to a 20-month high in the first half of March.

While prices have since dipped, resulting in only a net 2pc gain in March, it was the almost-8pc rise in the maize sub-index which contributed most to the GOI gain.

Estimates for 2018/19 grain production and trade are highly speculative at this time of year, with southern-hemisphere crops not yet planted, the northern hemisphere’s winter crop coming out of dormancy, and spring-crop seeding still under way.

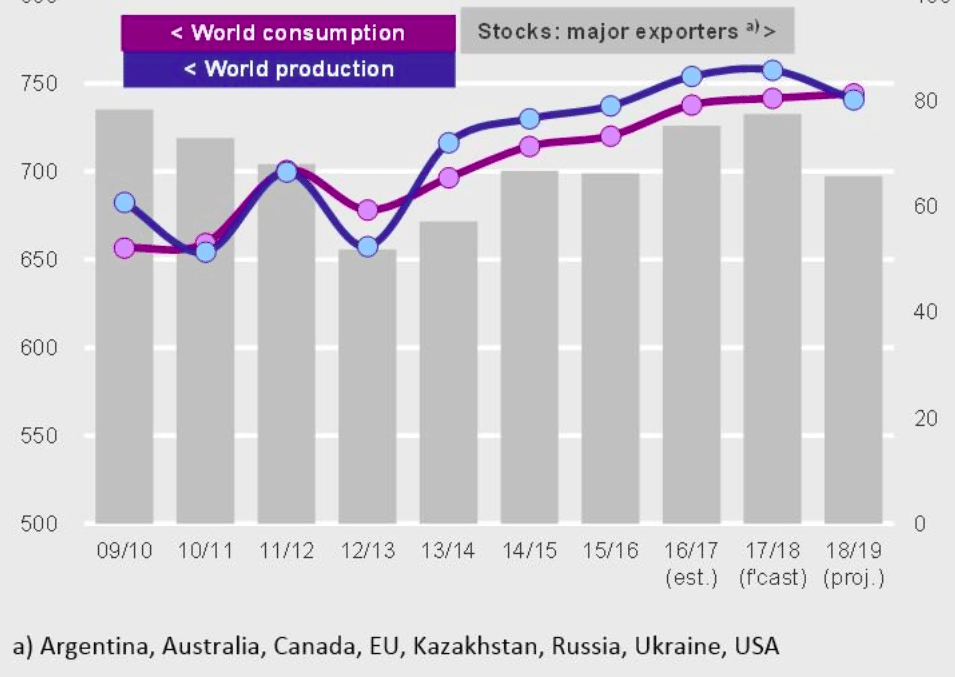

IGC’s preliminary 2018/19 world wheat production forecast is 17 million tonnes (Mt) below 2017/18, and consumption is seen as up a little (chart 2).

This would be good news for wheat traded volume, projected to rise 3pc in 2018/19 to 179Mt.

It would result in a clip to world wheat stocks and would lead to stocks held by major exporters Argentina, Australia, Canada, EU, Kazakhstan, Ukraine, US, and Russia, dipping from current year 78Mt to 66Mt, the same level of wheat stock held by exporters in 2015/16.

Chart 2. Source:IGC, million tonnes, left axis world wheat consumption (purple line) and production (blue line). Right axis: (grey columns) major exporters stock (a). (Click on image to expand)

Current-crop revised

Worsening weather prospects for the 2018/19 crop led to revisions for the current season, particularly in respect of higher current-year consumption, higher trade and lower ending stocks.

The 2017/18 year generated record total available supply, made up of opening stock plus production, of wheat and coarse grains at 2175Mt.

Accelerating consumption, particularly of industrial and feed maize, saw recent month-by-month upward revisions to this year’s annual trade figure, and a reduction to corresponding end-year stock.

Soybean impact

IGC soybean projections are experiencing changes which are linked closely to the IGC grains projections. Soybean, as the world’s major oilseed, is experiencing growth in production, trade and consumption.

A steep fall in soybean production in Argentina has captured news recently, but the 2017/18 world crop would still be about 10pc above the prior five-year average and would affect closing stock with only a small decline.

NOTE: The 2018/19 wheat marketing year starts in different countries according to their crop cycle. It is staggered by months between June and August for the major northern hemisphere exporters. In the southern hemisphere, Australia’s wheat marketing year begins in October and Argentina’s starts in December. Crop years for importers China and India start in July and April respectively.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY