WESTERN Australian bulk handler and one of the world’s biggest grain exporters CBH Group has recorded a loss in its Marketing and Trading business unit of $119.3 million in the year to 30 September, 2019, which compares with the profit after tax made in FY18 of $3M.

CBH Group CEO Jimmy Wilson said some areas of the business negatively impacted the co-operative’s overall financial performance. He cited grain trading in particular, but also the markets in which some of the co-operative’s investments operate as being contributors to the losses.

“Along with other Australian grain traders, our Marketing and Trading division experienced a set of global and political circumstances during the year that significantly impacted its bottom line, resulting in a $119.3M loss,” Mr Wilson said.

Global and domestic price movements for wheat and barley both contributed to CBH Group’s trading loss.

Wheat loss explained

The ongoing drought in eastern Australia saw wheat prices and basis levels increase well above export parity during the 2018-19 harvest.

Marketing and Trading uses Chicago Board of Trade (CBOT) wheat futures as a risk management tool to hedge accumulated wheat tonnages daily, but a proportion of the price, the basis, is not able to be hedged.

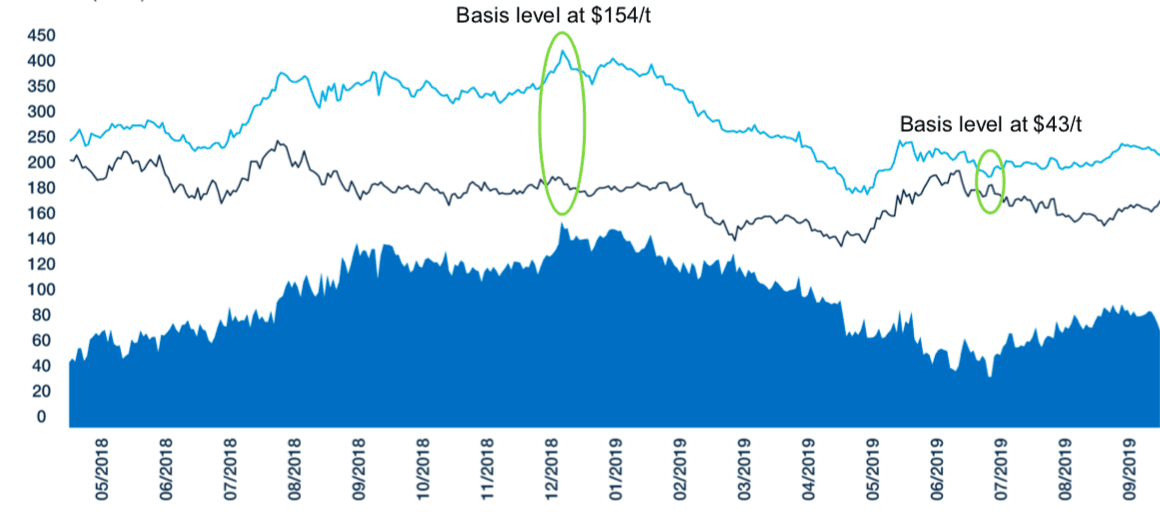

Figure 1. Wheat price A$/t May 2018 to September 2019. Blue line is APW1 Kwinana fob price. Black line is A$/t Chicago futures. The gap between the blue and black lines is the basis. The basis is also displayed in the shaded dark blue area at the bottom. The fob, futures and basis values on the price axis are not displayed at the same scale. Source: CBH

In December 2018, CBH Group said its basis levels peaked at $154/t before falling to $70/t in early May 2019 and reaching a low of $43/t in mid July.

CBH Group said this $84/t fall in the basis over CBOT futures was largely caused by a combination of the fall in Australian prices, together with a rally in CBOT wheat futures.

“The fall in the Australian price was driven by softening domestic demand exacerbated by the importation of wheat on the East Coast.

“The rally in CBOT wheat futures was driven by very heavy rains in North America leading to concerns that wet ground conditions would significantly reduce corn plantings.

“The combination of a falling domestic price, with a corresponding rally in the CBOT price was an unusual occurrence which severely impacted the profitability of Australian grain traders, including Marketing and Trading.”

“In addition, lower-priced Canadian wheat imports reduced milling-wheat demand, seeing wheat prices return to export parity from April 2019.

“Export demand was limited, as traditional markets had already migrated to buying from Black Sea or South American origins.”

Barley skew adds pain

Domestic demand then eased as the east-coast stockfeed market started substituting wheat for feed barley as the price spread widened, a direct result of lower Chinese demand following the barley anti-dumping investigation launched by the Chinese Ministry of Commerce in November 2018.

A subsequent countervailing duties investigation was announced soon after, and CBH said these investigations resulted in Australian barley values “collapsing”.

“During this time of uncertainty, Marketing and Trading moved its barley shipping program forward to minimise the impact.

“Over the year, prices continued to fall, as did the spread between malting and feed.

Prices failed to recover to the record high prices achieved during the harvest period, resulting in a negative impact to the profitability of Marketing and Trading barley book.

Operations volume, revenue up

Operations revenue increased 10pc to $4.2bn, mainly driven by higher prices for traded grains.

CBH Group’s operations unit received 16.4Mt of grain into its storage facilities during 2019, the second-biggest harvest on record, and up from 13.3Mt from the 2018/19 harvest.

Exports from the 2019/20 harvest totalled 13.8Mt, up from 12.3Mt shipped in 2018/19.

The Marketing and Trading business unit traded 8.9Mt during the year to 30 September, down from 9.6Mt in the previous financial year.

The drop has been attributed to a smaller WA canola crop as the result of dry conditions and reduced year-on-year sales from east-coast origins after drought across eastern states saw grain production fall substantially.

Net operating cash outflow for the year was $124M, compared with the FY18 inflow of $12M.

The Underlying Group Surplus before rebates was $21.8M before one-off impairments and provisions.

Impairments summary

In the year to 30 September, CBH recorded a group deficit before rebates of $13.3M, which factored in one-off impairments and provisions totalling $35.1M, including:

- $13.7M impairment of Interflour’s milling business in Turkey, with Interflour currently undergoing a strategic review of the Turkey business to de-risk its exposure in the market;

- $8.5M impairment of the Newcastle Agri Terminal which has been impacted by the ongoing drought in eastern Australia;

- $300,000 impairment in Marketing and Trading’s investment in CI Trading, Vietnam, which CBH has exited.

- $12.6M site rehabilitation provision, relating to future estimated costs relating to site retirements.

After returning $16.4M to growers through the Grower Patronage Rebate Program, CBH reported a Group net loss after tax of $29.7M.

The FHY19 Marketing and Trading loss means the unit will not be issuing a trading rebate, which compares with the FY18 result when a rebate based on $7 per tonne and totalling $48M was issued.

CBH Group financial report is available on its website. The Annual Report will be available in January prior to the AGM.

Source: CBH Group

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY