AUSTRALIAN agriculture is risky and farmers have to constantly adapt to changing conditions, yet insurance and other risk management tools available overseas are currently unavailable in Australia.

It’s a topic University of Queensland senior research fellow, Dr Mal Wegener, is addressing at the 62nd annual conference of the Australasian Agricultural and Resource Economics Society (AARES) underway in Adelaide this week.

“Australian farmers operate in one of the most risk-prone farming environments in the world but, unlike their counterparts in North America and Europe, there’s not easy access to income protection insurance,” Dr Wegener said.

“While Australian home owners are required to take out mortgage insurance on their home loans, farmers are not provided with the same protection as other Australians on the banks foreclosing on their properties – which are in fact their livelihoods.

“If farmers had the opportunity to take out reasonably priced income protection insurance, it would provide them with a similar safeguard if they can’t maintain their mortgage repayments due to farm conditions or something as ‘out of their hands’ as poor seasonal conditions, low export market prices, or adverse exchange rates.”

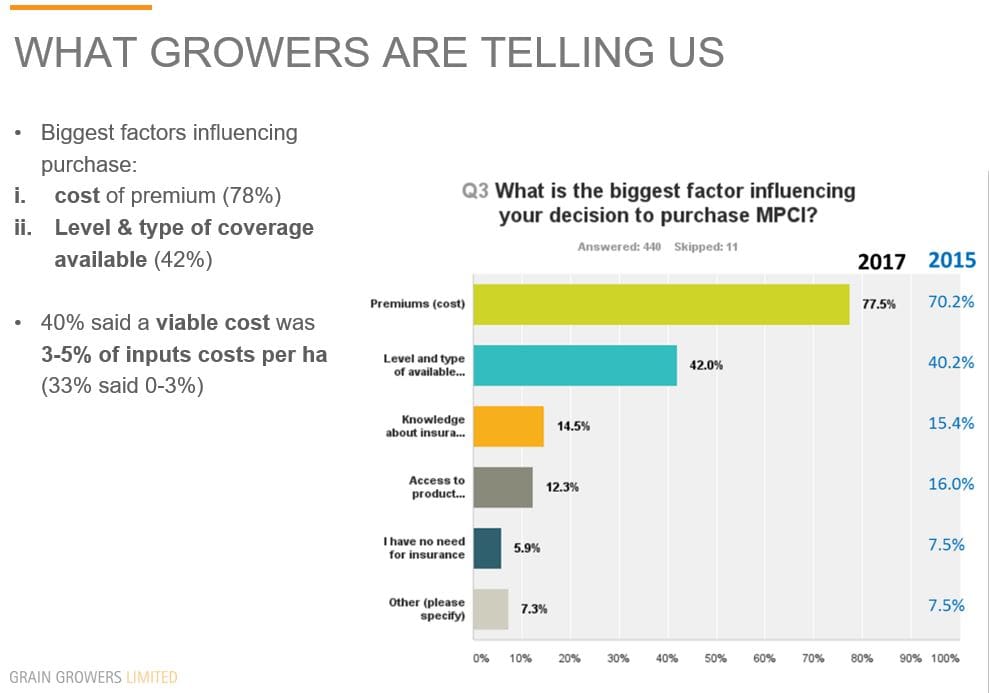

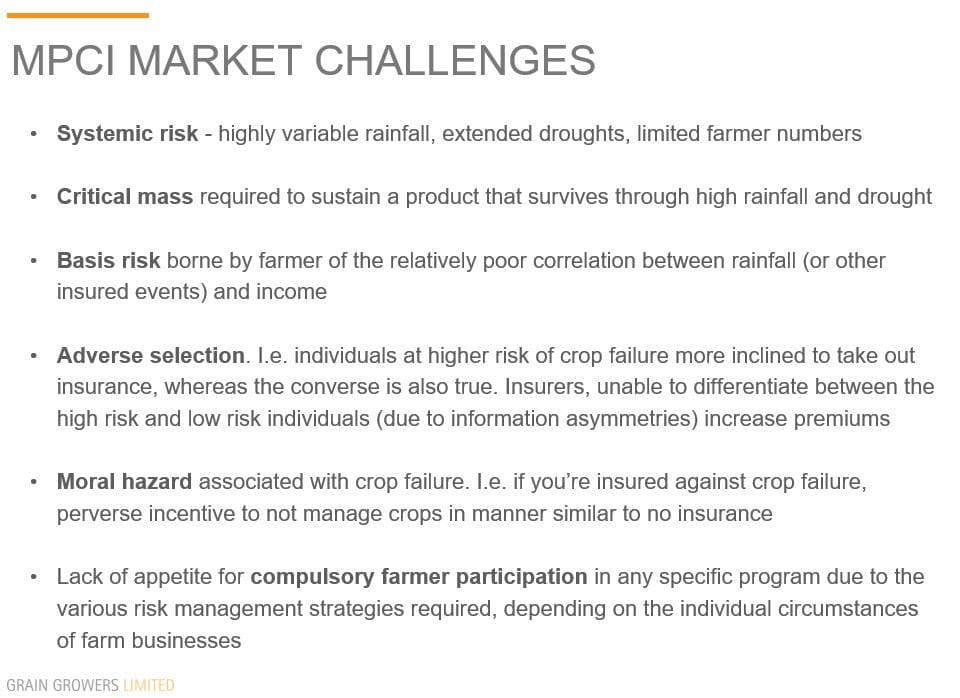

Dr Wegener said some of the major concerns with insurance had been the cost of premiums, the potential for farmers to influence loss levels through management decisions, and a tendency for insurance schemes to attract farmers with high risk levels.

Moreover, major risks in Australian agriculture, such as drought, often affected many farmers at the same time, thus reducing the ability of insurers to spread the risks.

“As long ago as the 1970s, the Industries Assistance Commission called for an investigation of forms of insurance for farmers which may be cost effective, for instance rainfall insurance,” he said.

“Australian governments appear to lack the enthusiasm needed to enable the development of insurance for farmers to reduce the impact of drought and other adverse seasonal conditions.”

“Meanwhile, North American and European farm insurance schemes are supported by government which either meet administration costs or subsidise premiums to make the cost of buying income protection insurance more manageable.”

Also addressing the subject of insurance at the conference, GrainGrowers CEO, David McKeon, said the Australian multi-peril crop insurance market was evolving over time.

“There is now a range of products on the market ranging from income protection models, yield-based models and weather-derivative models. So, there is plenty of choice for farmers,” he said.

However, Mr McKeon said insurance providers were constantly faced with developing viable products in a relatively small marketplace.

“Through product design they are able to meet some of the challenges such as moral hazard and basis risk. However, the challenge of critical mass in the Australian market remains a challenge with just over 20,000 grain farmers in Australia,” he said.

“Interestingly, in countries like Canada, there are government-supported models, but at the same time we are seeing growth in private crop insurance models that aren’t subsidised by the government. That is an interesting dynamic to follow.”

GrainGrowers conducted surveys of its members in 2015 and 2017 to gauge their views on multi-peril crop insurance (MCPI) (see following charts).

…………………..

The AARES conference theme is ‘Abundance in an Era of Scarcity? Challenges and Opportunities for Australasian Agriculture, Environment, Food, Resources and Agribusiness’, and it aims to progress key issues for the agricultural, environmental, food and resource sectors.

Other speakers at the conference and their issues include:

- Prof Ross Garnaut, Professorial Research Fellow in Economics, University of Melbourne on making Australia the energy superpower of the low carbon world economy.

- Prof Quentin Grafton, AARES President and UNESCO Chair in Water Economics and Transboundary Water Governance on the Murray Darling Basin Plan and water policy.

- Prof Edward McLaughlin, Director of the Food Industry Management Program, Cornell University on the global rise of retail discounters and implications for the Australian retail sector, farmers and consumers.

- Prof Peter Cramton, Professor of Economics at the University of Maryland on the challenges of electricity market design as we transition to 100% renewable energy.

- Prof Lin Crase, Head of Commerce School, University of SA on Renewables, affordability and reliability: What is the future of energy in Australia?

- Prof Phil Pardey, Director, University of Minnesota’s College of Food, Agricultural & Natural Resource Sciences on implications for Australian farm policy with the resurrected TPP, renegotiated NAFTA and Brexit.

- Prof Dawn Thilmany McFadden, Agribusiness Extension Specialist, Colorado State University on lessons and opportunities for Australia in food and agriculture tourism.

Farming issues in the developing world will also be covered at the conference, including case studies on Vietnam, Tanzania, China, India, Indonesia, South Africa, Niger, Pakistan, Peru, Timor-Lest, Bangladesh, Brazil, Vanuatu, Nigeria, Colombia, Ghana, Ethiopia and the Philippines.

………………………………

Further reading: GrainGrowers’ report, ‘Managing risk using Multi-Peril Crop Insurance – 2017‘.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

At Stable we’re working on an index based income insurance product that was designed and built by UK farmers. We hoping to bring it to Australia and NZ later this year. It can enable a simple hedge for arable, dairy and livestock farmers. More at www. Stableprice.com

There are some very exciting options very near by, and by the way the Federal Govt via Barney Joyce have a 50% rebate on the cost of applications, while some states have a stamp duty exemption and there is rising pressure in NSW to have a short term subsidy in place to assist uptake so to deveop a deeper market…its on the move but slow for all us who want it yesterday!!