Harvesting carinata in Georgia in the US. Photo: Nuseed

AUSTRALIAN-based global crop protection and seed technology company Nufarm has posted a statutory net profit after tax for the six months to March 31 of $49 million.

This is down sharply from the corresponding HY23 period, which recorded Nufarm’s statutory NPAT at $149M.

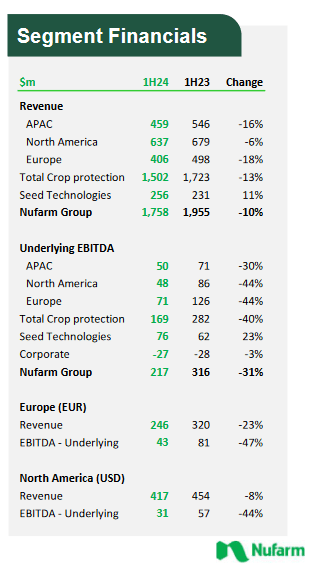

Nufarm reported HY24 underlying earnings before interest, taxation, depreciation and amortisation of $217M, down from $316M in HY23.

“Despite challenging conditions, Nufarm delivered a solid result for the first half of fiscal 24,” Nufarm managing director and chief executive officer Greg Hunt said, adding that EBITDA for the full year to September 30 is expected to total $350M-$390M.

“Our balance sheet position is strong. “

Challenges in Crop Protection

In releasing its HY24 results, Nufarm said revenue and margin in its Crop Protection business were impacted by challenging industry-wide conditions, but a solid result and some important strategic milestones were nonetheless achieved.

“The industry has moved from a period of tight supply to more normal supply, which has resulted in a reduction in on-farm and distributor inventory,” Nufarm said in its presentation to shareholders.

“The destocking had a negative impact on product prices and margin.

“Despite these challenging conditions, we grew volume year on year in crop protection, and we maintained a strong focus on reducing inventory.

In the Asia Pacific region, Nufarm reported revenue of $459M and underlying EBITDA of $50M.

In the Asia Pacific region, Nufarm reported revenue of $459M and underlying EBITDA of $50M.

“Favourable seasonal conditions on the east coast of Australia and growth in Asia resulted in strong demand and a normalisation of inventory levels.

“Declining global prices for key products resulted in a year-on-year reduction in net sales and margins with historically low 2,4-D prices the main contributor to reduced earnings.”

Nufarm said its 2,4-D plant in Laverton, Victoria, was being brought back on-line following works to upgrade and expand manufacturing capacity.

“Final works as part of this upgrade are expected to be undertaken in the second half of the year.”

Nufarm’s North American segment reported revenue of $637M and underlying EBITDA of $48M, and achieved strong volume growth.

“Sales and margin were mainly impacted by lower prices for non-selective herbicides.”

As of 31 March 2024, North American inventory was 20pc lower than at 31 March 2023.

In Europe, Nufarm reported revenue of $406M and underlying EBITDA of $71M.

“Sales and margin were negatively impacted by lower volume and price largely due to unfavourable weather and distributor destocking.

Nufarm’s Wyke facility in Yorkshire in the UK was negatively impacted by lower volume of sales to industrial customers which were affected by destocking in the agricultural segment and a prolonged downturn in the China property market.

“Whilst we made progress in reliability and asset integrity initiatives at Wyke, these efforts were more than offset by lower volumes.”

Earnings up in Seed Technologies

Revenue for the Seed Technologies segment was $256M for HY24, and underlying EBITDA was $76M, both up from the HY23 results of $231M and $62M.

Base seeds were driven primarily by year-over-year growth in Australia and South America.

North America sunflower and Brazil sorghum revenue fell due to the impact of lower crop prices on plantings.

Revenue from seed treatment fell year on year due to customer destocking.

During HY24, Nufarm increased its sales of omega-3 products in the Americas markets including Chile, the US, and Canada.

Following the approval of Aquaterra for use in Norway, Nufarm has advanced commercial negotiations for entry into Norway’s aquafeed market.

“We also continued to progress discussions with potential partners for distribution and marketing within certain nutritional segments in the USA for expansion of our Nutriterra products.

“Grower acceptance of omega-3 canola continues to build.

“During the period we expanded commercial contracts with growers to support expected sales growth in 2025.”

Promising signs for carinata

Nufarm said it concluded the 2023 crop year with multiple audited and verified proof-of- sustainability certifications for carinata which can be applied to sustainable aviation fuel (SAF), renewable diesel, and sustainable maritime fuel.

“The 2023 Argentina crop harvest was successfully shipped to Europe and is in the process of crush and sales with our partners.”

Nufarm also referenced a large event it held in March with BP to showcase the 2024 growing crop in Florida, with major airlines, mining companies, transport companies, policymakers, and supply chain partners in attendance.

“Supply expansion activities for the 2024 carinata crop are in progress with an expansion of farm contracts already in hand in Argentina and Uruguay.

“Our first year of farm contracting and geographic expansion in the Brazil market is also well advanced with confirmed contracts with farmers in hand.

“Initial launch activities have been conducted in Spain and France for small commercial scale planting in 2024.”

Nufarm also reference the European Union further advancing its biofuel implementation policy, where ReFuel EU will implement a 2pc SAF inclusion mandate in airline fuels starting in 2025.

“In addition, a significant advancement was made with the inclusion of cover crops into the Annex IX A category of the Renewable Energy Directive (RED II).

“This is a very significant signal toward the future value and demand for carinata within EU SAF markets.

Nufarm also outlined advances in commercial development activities in Energy Cane, with additional agreements signed with commercial mills and the launch of hybrid products with increased biomass and sugar per hectare for resulting ethanol conversion.

“Despite near term challenges, we believe that the industry has positive long-term fundamentals.”

Outlook

In Crop Protection, Nufarm is expecting prices to remain subdued in the near term due to inventory imbalances at an industry level, primarily in Brazil and parts of Europe.

“We expect those imbalances to be resolved through the course of the second half and to deliver year on year earnings growth over this period.

“For Seed Technologies, seed treatment and licensing revenues in FY24 are, at this stage, expected to be lower than the prior year, likely leading to a small year on year reduction in EBITDA.

“We have a strong growth outlook for our base seeds, omega-3 and biofuels platforms.

“We are reaffirming our omega-3 guidance for revenue of $50M-$70M in FY24 and plantings of omega-3 canola in 2024 support our ambition to more than double revenue from omega-3 products in FY25.

Source: Nufarm

HAVE YOUR SAY