Key points:

- Consolidated revenue for the Group of $544.9 million, down 4.1pc on HY17

- Net Profit after Tax (NPAT) of $24.1 million, up 15.9pc on HY17

- FY18 profit guidance (NPAT) has been upgraded to around $45 million

……………………………………………………………..

SUNRICE’s half-year consolidated revenue for the group has come in at $544.9 million, a 4.1 per cent decrease compared to the previous corresponding period ending 31 October 2016 (HY17).

Net Profit After Tax (NPAT) was $24.1 million, a 15.9pc increase compared to HY17.

The business’s financial results were driven by a combination of several factors that included: the larger Riverina rice crop of 802,000 paddy tonnes that was harvested in 2017; the gradual positive turnaround in profitability in Trukai, CopRice and Riviana; favourable FX gains; partially offset by continued challenging trading conditions in several key SunRice markets.

“SunRice has built a commercially resilient and diversified business that is able to both withstand challenging trading conditions (as demonstrated in FY17) and quickly recover when markets improve,” SunRice CEO, Rob Gordon, said.

“During HY18, the larger Riverina C17 crop of 802,000 tonnes resulted in a 21pc uplift in Rice Pool revenue and Net Profit Before Tax increased by 33pc increase compared to HY17. However, these Half Year financial results do not fully reflect the improved quality and diversity of SunRice’s earnings.

“As a consequence of SunRice’s strategy to focus on exporting Australian rice to premium markets and to secure alternative sources of rice beyond the Riverina, our international trading activity has developed into an important pillar of the business, generating increased earnings to balance other segments such as Trukai, CopRice and Riviana, which have all experienced a gradual turnaround in trading conditions during the half.

“We expect the improved quality and diversity of earnings will flow through into Full Year results, especially given current market trends. In addition, several business segments traditionally experience seasonal trading uplifts during the second half and tender markets are also anticipated to drive volume expansion during the remainder of FY18.

“Following this pleasing start to the year and the positive outlook for the second half, we have upgraded our guidance for Net Profit after Tax for FY18 to around $45 million (previously $40 million).”

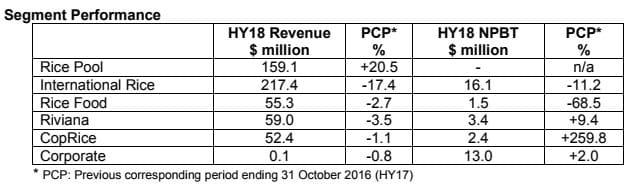

Rice Pool:

Rice Pool revenue increased by 20pc compared to HY17, driven by the larger C17 crop and the ability to once again place the Riverina crop into key premium markets where SunRice brands command strong prices. Manufacturing efficiency improvements and favourable milling yield also contributed to a positive start to the year.

International Rice:

International Rice’s net profit before tax (NPBT) declined by 11.2pc compared to HY17. Due to the larger Australian C17 crop, there was less of a requirement in HY18 to source from international supply chains.

Trukai leveraged its in-market brand strength and optimised its product mix to generate positive NPBT growth during the Half, despite weak trading conditions in Papua New Guinea impacting sales. SunFoods’ performance was impacted by lower volumes (due to the larger Australian crop) and the increasing cost of rice paddy in the California market. Participation by SunFoods in market tender processes is expected to bolster revenues for the business during the second half of FY18.

The segment was impacted by a $4.0 million gain due to hedged exposures no longer expected to occur.

Rice Food:

Sales volumes and revenues remained relatively flat compared to HY17 and NPBT declined to $1.5 million. The microwave rice category continued to grow its dominant presence in the ANZ market during the period, and now generates almost half of this segment’s sales revenue. The recent introduction of new Adult Mini Cakes is anticipated to underpin sales revenue growth in the snacking category over the remainder of FY18. The rice flour category experienced competition from Vietnamese imports during the Half.

Riviana:

Riviana NPBT increased by 9.4pc, having benefited from ownership of the Felhbergs business for a full six months (compared to the previous corresponding period). Challenging trading conditions in the foodservice sector and restructure costs also impacted on the Riviana result. A seasonal uplift is expected during the second half as Christmas and Easter festive seasons improve retail sales.

CopRice:

CopRice NPBT experienced a positive turnaround of $4.0 million during the half, having posted a loss before tax of $1.5 million in HY17. Positive pricing mix and margin growth in speciality and grocery segments drove the business’s improved performance during the Half. Dairy and sheep feed segments are expecting a seasonal uplift during the summer months, which should benefit CopRice over the remainder of FY18.

FY18 outlook

Following SunRice’s positive start to FY18, we now anticipate that NPAT for FY18 will be around $45 million (an upgrade from previous guidance of $40 million).

However, achieving guidance over the remainder of FY18 will be dependent on: macroeconomic conditions in key markets; trends in global rice markets; exchange rate movements; and several issues specific to PNG.

C17 Full Year Paddy Price

The estimated paddy price range for base grade medium grain (Reiziq) is $335-$365/tonne.

A continuation of positive price movement in international markets, coupled with SunRice’s ongoing strategy of placing Australian rice in higher returning markets and securing rice from alternative international supply chains, has supported positive revisions of the C17 paddy price range since the start of FY18. Earlier in FY18, the C17 Pool opened with a range of $300-$320/tonne.

While SunRice is hopeful positive movements in global markets will continue, any softening in markets and a further strengthening of the Australia dollar will naturally influence the final pool result.

Source: Sunrice

HAVE YOUR SAY