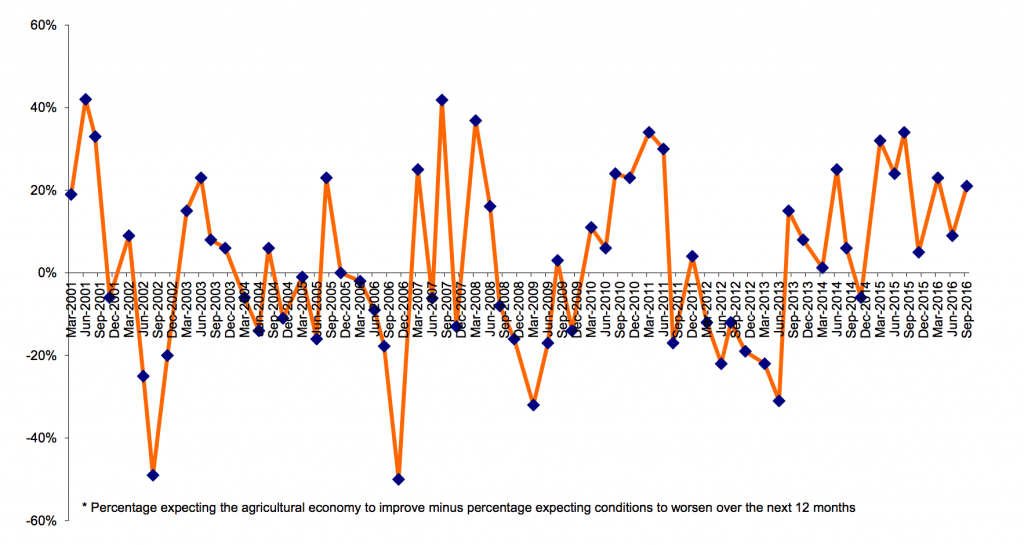

Percentage of survey respondents expecting the agricultural economy to improve minus percentage expecting conditions to worsen over the next 12 month. Source: Rabobank

Widespread winter rainfall has buoyed the spirits of Australia’s farmers, with confidence in the agri sector rebounding to early-year highs, Rabobank’s latest quarterly Rural Confidence Survey has found.

Beef and sheep producers remained upbeat about their prospects, while sentiment lifted in grains, cotton and sugar.

In contrast, confidence in the dairy sector slumped to one of its lowest levels in 15 years, as low farmgate prices continued to hang over the 12-month outlook.

Queensland rural confidence has also staged a turnaround, off the back of widespread rainfall, with that state’s farmers now reporting the highest levels of optimism in the nation. However, follow-up rainfall will be needed to sustain confidence levels into the future.

The latest survey, completed last month, saw the net national Rural Confidence index (the percentage of farmers expecting conditions to improve less the percentage expecting conditions to worsen) more than double to 21 per cent, up from just nine per cent in the previous survey.

Overall, 37 per cent of the nation’s farmers expect conditions in the agricultural economy to improve over the coming 12 months (up from 28 per cent in the previous survey), while 16 per cent expect conditions to worsen (down from 19 per cent). The majority have a stable outlook – 46 per cent expecting similar conditions to the previous 12 months.

Rabobank national manager Country Banking Australia Todd Charteris said widespread and significant rainfall events in June and July had alleviated dry conditions across much of the country, underpinning strong production prospects for the season ahead.

“The grains sector has significantly benefited from the timely rain, with a bumper crop on the cards, particularly in Western Australia,” he said.

“Good yields will be critical this season, as grain prices remain weighed down by burgeoning global stocks of wheat, corn and soybeans.”

Mr Charteris said beef and sheep producers were also upbeat about the outlook, with both weather conditions and markets “going in their favour”.

“While many graziers are coming out of a tough winter period, the good winter rainfall has set them up for fantastic pasture growth in coming weeks,” he said.

“Conditions have turned around in many parts of Queensland, with large swathes of the state recording significant rainfall in early July particularly.

“While it is a ‘God- send’, and has boosted the spirits of many of the state’s dryland farmers and graziers as well as irrigators, much of the state remains drought declared and follow-up rainfall will be critical to sustaining confidence.”

Seasonal conditions emerged as the biggest driver of farmers’ confidence this quarter, with 62 per cent of those with a positive outlook citing the season as cause for their optimism, up from 49 per cent.

Commodity prices also underpinned overall confidence levels, reported as a positive driver of confidence by 58 per cent of respondents, down marginally from 62 per cent.

Sugar producers were the most upbeat about their market prospects, with 77 per cent citing commodity prices as the reason for their optimism, while beef and sheep graziers were also buoyed by strong market fundamentals.

Conversely, commodity prices were, not surprisingly, a driver of a negative outlook among dairy and grain producers – cited by 94 per cent of dairy farmers and 93 per cent of grain growers expecting the agricultural economy to worsen as reason for their pessimism.

“The 2016/17 season will remain challenging for those in the dairy sector, with milk prices below the cost of production for many producers,” Mr Charteris said.

“In light of this profound pressure on profit margins, thankfully there has been some cost reprieve with lower prices for fertiliser, temporary water and supplementary fodder.”

Mr Charteris said while there was not much upside for farmgate milk prices in the current season, there were “signs of light at the end of the tunnel, with the taps of supply starting to turn off around the world, which should see global prices start to rise modestly in the first-half of 2017.”

Investment intentions

The latest survey saw continuing strong investment appetite in the agri sector, with 90 per cent of the nation’s farmers looking to increase or maintain their level of farm business investment over the coming 12 months – up slightly from 87 per cent in the previous survey.

Of the 25 per cent looking to increase investment, 49 per cent were prioritising on- farm infrastructure such as fences, yards and silos, while 35 per cent were planning to increase livestock numbers – with restocker demand particularly strong in Queensland.

New plant and machinery were also high on the agenda (for 26 per cent of those intending to increase their investment) while 26 per cent were hoping to expand their farming operation via property purchase.

Farm income

In line with overall confidence levels, farmers’ income expectations for the next 12 months increased – albeit the net result was weighted by significantly lower expectations in the dairy sector.

Overall, 36 per cent of Australian farmers were expecting higher gross farm incomes in 2016/17 than in the previous financial year, while a further 43 per cent expected a similar financial result.

Those anticipating their farm income to decline stood at 20 per cent.

These income projections came off the back of a strong result in the last financial year, with 51 per cent of Australian farmers reporting higher gross farm incomes in 2015/16 than in 2014/15.

States

Across the country, confidence increased or remained at stable levels in all states, except Western Australia (where it moderated but remained positive) and Tasmania, which bucked the national trend and dipped to a three-year low on the back of extensive flood damage and ongoing challenges in the dairy sector.

The most significant upswing in sentiment was reported in Queensland, with “what, for many, would be considered the best rainfall in several years” driving net confidence to its highest level in the 15-year history of the survey.

Good winter rainfall was also behind the lift in New South Wales confidence, while Victorian farmers were also buoyed by seasonal prospects, Mr Charteris said.

“That said, overall sentiment in Victoria remained muted, as the positivity prevailing in the grains and livestock sectors was unable to outweigh the subdued sentiment in the dairy sector,” he said.

In the major grain-producing states of Western Australia and South Australia, Mr Charteris said, growers were buoyed by harvest prospects but this was overhung by pricing concerns.

Sectors

Confidence lifted strongly across all commodities, except dairy, which retracted further into negative territory to its lowest level in four years.

The biggest increase in confidence was reported in the cotton sector, while sugar producers also posted a surge in confidence.

Driven largely by improved market dynamics, Mr Charteris said, local physical cotton prices were trading above the “magic” $500 per bale, while sugar remained well – supported above $550/tonne – up around 75 per cent on this time last year.

Sentiment was also up in the grains sector, however this was largely driven by the expectation of average to above-average yields, with domestic wheat prices at a four-year low.

“Our latest production forecast has pegged a 26.7 million tonne wheat crop, with further upside if the season remains favourable,” he said.

“Good winter rainfall has also lifted prospects for the summer crop, with many key water storages now at levels to fulfil strong planting intentions.”

In the livestock sector, confidence lifted in both the beef and sheep sectors, with graziers reporting strong sentiment for the past two years.

“The planets have really aligned for beef and sheep producers,” Mr Charteris said, “with the Eastern Young Cattle Indicator trading at record levels above $7 per kilogram and lamb and wool prices also strong.

The season is also shaping up well, with a flush of feed expected in coming weeks and on-farm water storages at, or near, capacity.”

Mr Charteris said the buoyant cattle market was making it difficult for producers to rebuild their herds, particularly in Queensland.

Source: Rabobank. The Rabobank Rural Confidence Survey questions an average of 1000 primary producers across a wide range of commodities and geographical areas throughout Australia on a quarterly basis. The next results are scheduled for release in December 2016.

HAVE YOUR SAY