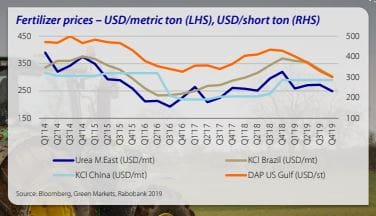

GLOBAL phosphate prices are at their lowest level in more than 10 years, with a significant drop-off in demand and additional supplies expected to continue to keep a lid on prices into 2020, according to the latest Rabobank Global Fertiliser Outlook.

In response to lower demand, driven by weather issues in the United States and India during last year’s planting season, some phosphate producers cut production temporarily, although the report says a resumption in production is expected in 2020.

In response to lower demand, driven by weather issues in the United States and India during last year’s planting season, some phosphate producers cut production temporarily, although the report says a resumption in production is expected in 2020.

This is likely to keep prices below the 2019 average during the first half of this year.

Looking further forward, however, a firmer recovery during 2H 2020 will depend on whether crop commodity prices rise, lifting demand for fertiliser.

In nitrogen markets, the report says prices have been supported by increased import demand from India, with the global urea price expected to increase further in the first half of 2020 due to an improvement in US demand and ongoing Indian import demand.

That said, “given recent increases in capacity and China’s continued presence in the international market”, the report says the current level of production is likely to limit prices below last year’s average.

For Australia, the report says below-average local demand is set to keep prices in line with global values.

Agricultural analyst Wes Lefroy said Australia was heavily reliant on imports of fertiliser, ensuring local prices were dictated by global price movements.

“While global benchmarks are the key driver of farm-gate fertiliser prices, currency movements – as well as ocean and road freight costs – also play a key role,” he said.

Mr Lefroy said in 2020 Australian farmers were likely to be more conservative with their fertiliser programs, which would also keep a lid on any demand-driven local price rises – especially for nitrogen.

“If healthy rainfall arrives prior to the upcoming winter crop planting season, we expect farmers will take a conservative strategy towards their nutrient application, as many recover from drought or a below-average crop,” he said.

During the 2018/19 season, despite tough seasonal conditions, demand for phosphate was in line with previous years, with sales (according to Fertiliser Australia) up slightly by 0.3 per cent (year-on-year), an increase of 1.2pc on the five-year average.

“Demand for phosphate is determined by the area planted to crop, whereas nitrogen application rates fluctuate according to how the season is playing out,” he said.

“And we saw this last season, with Fertiliser Australia reporting a 5.3pc drop in nitrogen sales year-on-year.”

Mr Lefroy said once the season turned, local urea (nitrogen) stocks were well supplied and this would help mitigate any localised shortages witnessed during the 2019 winter.

“As of September 2019, year-to-date urea imports are well ahead of imports for the same period from 2017 and 2018,” he said.

Source: Rabobank

HAVE YOUR SAY