AUSTRALIA’s agricultural sector is set to enjoy an overall profitable year ahead – underpinned by high commodity prices, positive seasonal conditions and low interest rates, and despite expected continuing trade tensions with China – according to a newly-released industry outlook.

In its flagship annual Agribusiness Outlook for 2021, Rabobank says a generally profitable 2020/21 season for most Australian farmers will not only kick start recovery from the recent severe east coast drought, but also put the sector in a stronger position to navigate a number of major transitions it will face in the year ahead – the pandemic recovery, reducing reliance on China and increasing sustainability.

Report lead author, Rabobank head of Food and Agribusiness Research Tim Hunt said despite the turbulent environment facing the world as 2021 gets underway, global demand for food and agribusiness products remained “surprisingly firm”, while weather patterns were also favouring Australia ahead of competitors when it comes to production.

“In a current global environment marked by the pandemic, political tensions and trade wars, demand for food and agri products has remained unexpectedly strong,” he said.

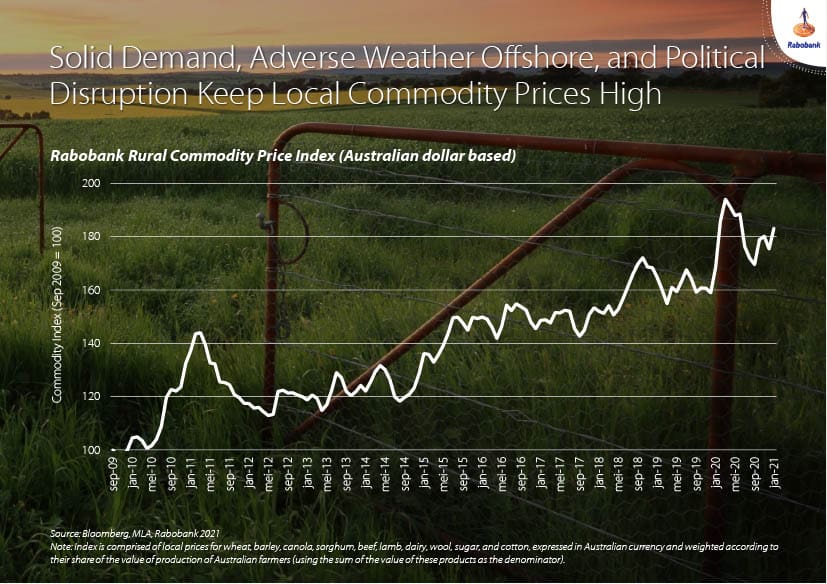

“And despite the punitive actions of China on Australian agriculture, high agricultural commodity prices, low interest rates and positive seasonal conditions are underpinning a positive outlook for most farmers in 2020/21.”

Turbulent place

The report said the world was a “turbulent place” as Australia’s agricultural sector entered 2021, impacted by factors including the continuing COVID-19 pandemic and lockdowns, the completion of Brexit and the emergence of the United States from a tumultuous presidency, as well as continuing trade wars, which were distorting the direction and price of traded goods.

“Market intervention is back in vogue, with grain-exporting countries reconsidering export quota and taxes as they fret over food security, while elsewhere port strikes have impeded trade flows.”

Demand for agricultural commodities though is being supported, with several major importing countries appearing to be stockpiling to mitigate risk of shortages and by unprecedented support from governments helping to offset the impact of the pandemic on employment and incomes, and therefore spending on food.

Mr Hunt said while foodservice channels remained compromised in many markets due to pandemic lockdowns and restrictions, the otherwise strong demand for food and agri commodities was seeing global prices supported – which was good news for Australian farmers.

Weather deals “winning hand”

The report said weather had also finally turned in the favour of Australian farmers “with mother nature dealing Australian farmers a winning hand”.

Above-average rainfall in 2020 had set up a very good winter crop along with higher-than-usual moisture to open 2021 and significantly-increased storages across the Murray Darling Basin.

“This is improving broad-acre farm incomes, boosting locally-grown feed and underpinning better water allocations for irrigators,” Mr Hunt said.

At the same time, while the La Nina weather conditions have been positive for much of Australia, they have “crimped the production prospects of competitors offshore”, with large parts of the US, Latin America and eastern Europe unusually dry.

Mr Hunt said this had helped to significantly tighten international markets and drive up global commodity prices.

China tensions

While “mother nature” is supporting Australian farmers at the moment, the report said “the Chinese government is in a less generous mood”, with tensions between the two countries showing no sign of easing.

“Australian barley, wine and timber exports into China remain effectively blocked as we enter 2021, while informal impediments appear to be constraining shipments of cotton and lobsters,” Mr Hunt said.

The loss of some of Australia’s agricultural trade with China is now evident in data, with November 2020 shipments to China falling 33 per cent below the previous year’s (albeit unusually large) value. Although, a 10pc November month-on-month fall in shipments to China is probably more representative of the impact of the geo-political tensions.

However, Mr Hunt said while the spectre of further loss of access to China hung heavily over the Australian agricultural industry, “the data to date suggests that many products are still flowing through”, with $800 million worth of food and agri products still shipped to China in November last year and preliminary data showing exceptionally strong wheat exports, at least, in December.

Major transitions ahead

Reducing the sector’s reliance on the Chinese market is one of three major transitions the report identifies that will need to be negotiated by Australian agriculture in the year ahead.

The others are recovery from the effects of the COVID-19 pandemic and adjusting to a market more focused on sustainability

“Whether China continues to reduce its purchases of Australian food and agri products in coming years – as we think likely – or not, the risks of supplying this market have definitely increased,” Mr Hunt said.

“Whether China continues to reduce its purchases of Australian food and agri products in coming years – as we think likely – or not, the risks of supplying this market have definitely increased,” Mr Hunt said.

“2021 will likely mark a watershed year, in which Australia starts to reduce its reliance on China, voluntarily or otherwise.”

Positively, prevailing global market settings – with strong demand, limited supply and high prices for agricultural commodities – make this challenge seem less daunting at the current time.

“But reorientation to reduce reliance on China is a multi-year challenge that will still be ongoing when the market cycle inevitably turns again,” Mr Hunt said.

The year ahead would also require a delicate transition as governments looked to withdraw assistance measures for consumers that had propped up end demand for food and fibre during the global pandemic.

“If this is messed up, we could easily see demand for food and agricultural products soften during this transition,” Mr Hunt said.

An increasing focus on environmental sustainability also looms large in 2021.

“COVID-19 took the headlines from climate in 2020, but it didn’t alter the commitment of key players throughout the F&A (food and agri) supply chain to mitigate climate change, prepare for its risk and find mechanisms to reduce and/or recoup the costs of adjustment,” Mr Hunt said.

“If the pandemic wanes in late 2021 as hoped, this quest will again rise to the fore, creating both opportunities and challenges. And it may prove to be the greatest of all the transitions facing the sector.”

Commodities

For specific commodities, the Rabobank’s 2021 Outlook finds:

Wheat – strong global demand set to keep prices firm through the year.

Feed grain – rising global feed grain demand and supply constraints to support prices in 2021.

Beef – a rebuild year, with favourable conditions triggering increased breeding numbers and reduced slaughter keeping cattle prices firm.

Sheepmeat – lamb prices expected to remain strong but fall short of recent record levels, given weaker demand and increasing lamb numbers.

Wool – a forecast recovery in global consumer demand set to lift prices.

Dairy – strong cause for optimism that profitable market setting will extend into the 2021/22 season.

Sugar – a balanced global 2021 supply forecast, but outlook subject to impacts of La Nina, trade flows and pandemic.

Cotton – production set for sharp recovery, as demand recovers post COVID-19.

Wine – pandemic-related disruptions to food service to continue to influence retail demand for wine, but geo-political tensions with China will put pressure on average export prices.

Horticulture – demand for quality, safe horticultural produce in key markets set to remain strong, but COVID-related labour shortages at home and China trade tensions to “take off shine”

While for agricultural land, the report says, “the big season will accelerate demand for properties and push up prices further in 2021”.

Source: Rabobank

HAVE YOUR SAY