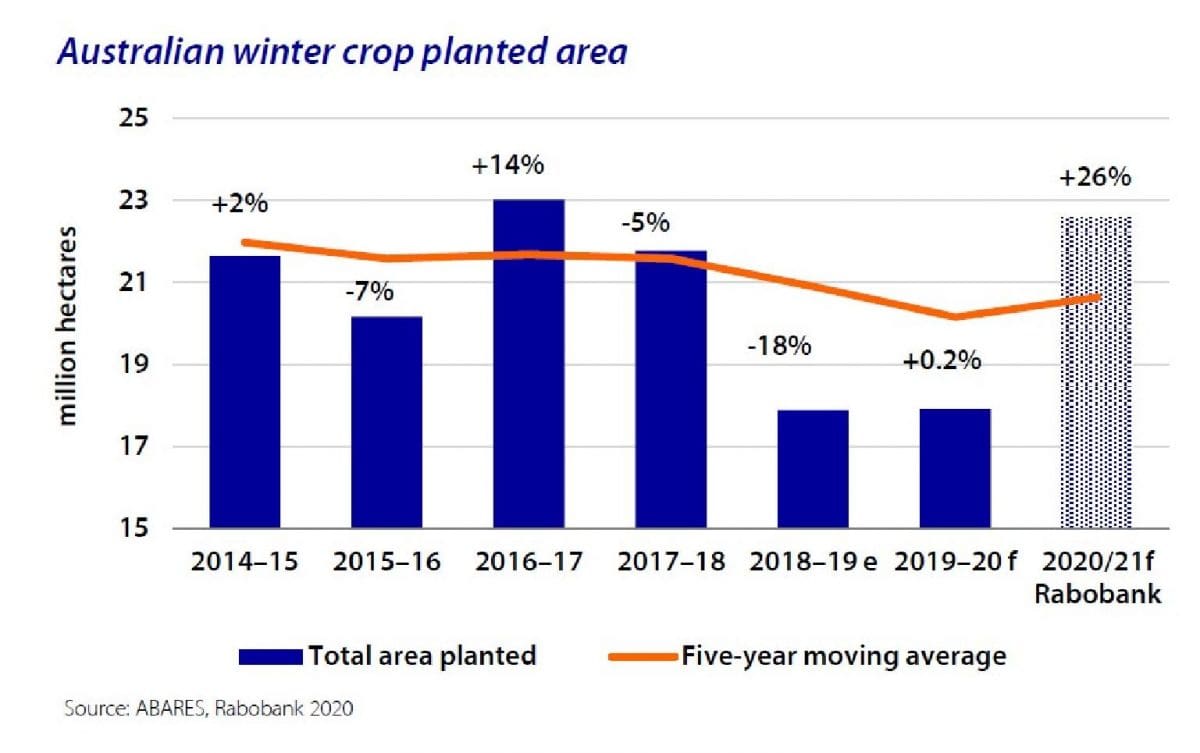

AUSTRALIA’s winter crop planting is set to climb by over 25pc this year on the back of widespread and well-timed rainfall across most of the country, according to Rabobank’s Australian 2020/21 Winter Crop Outlook released today.

After prolonged drought conditions, which have delivered three years of decline in Australia’s grain production and exports, Rabobank is forecasting the nation’s crop planting to be up by 26pc on last season to 22.5 million hectares (Mha). This is 12pc above the five-year average.

The bank predicts that, combined with forecast above-average rainfall for the critical growing season ahead, this should deliver Australia an average to above-average winter grain crop.

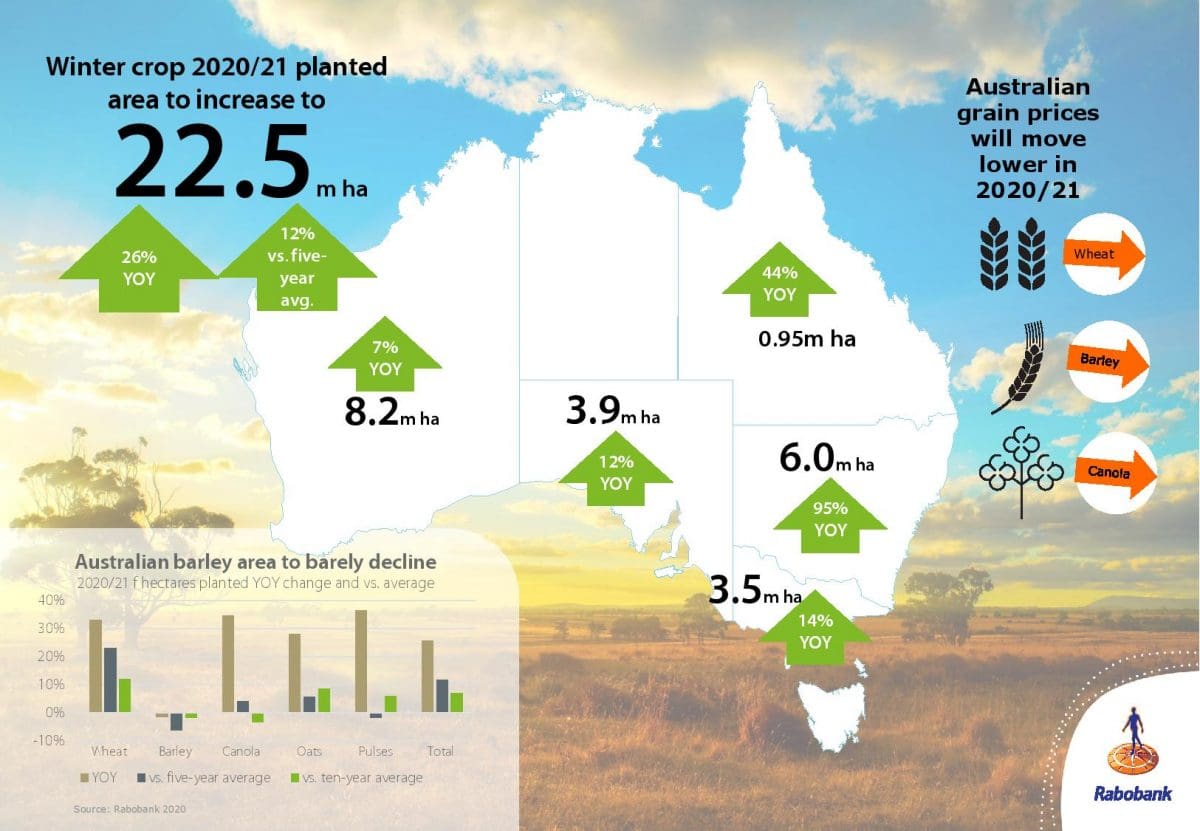

Much of this improvement will occur in the previously-droughted cropping regions of the eastern states, with New South Wales-planted area forecast to be up by a staggering 95pc and Queensland by 44pc.

For wheat, the report says a total harvest volume of 26 million tonnes (Mt) is “not unrealistic, given our expectations for hectares planted this year”.

Welcome news

Rabobank senior grains and oilseeds analyst Cheryl Kalisch Gordon said the promising crop outlook was welcome news for Australia’s agricultural sector after years of drought and the severe disruptions of summer bushfires and COVID-19 in the first half of 2020.

Cheryl Kalisch Gordon

“While it’s still around six months until the grain is in the bin, all the hallmarks of an above-average season are now falling into place,” she said.

“2020 finally saw a strong opening to the east coast winter crop planting season, with good rains and fast planting progress.

“With the Bureau of Meteorology’s forecast for above-average rainfall for all Australian cropping regions during the critical growing months of June to August, these increased hectares planted are expected to combine with at least average yields to deliver an average to above-average grain crop.”

Increased wheat plantings

Dr Kalisch Gordon said eagerness to ‘make hay’ while there was moisture around after drought – along with the high cost of the alternative of restocking livestock – had featured in farmers’ decisions to expand their planted area in 2020/21.

A more buoyant outlook for wheat than barley had prompted greater increases in wheat planted compared with last year and longer term averages.

“And the recent announcement of China’s tariffs of 80.5pc on Australian barley would also have influenced this choice for the small number who hadn’t planted by then,” Dr Kalisch Gordon said.

Rising exports

While the renewed supply of Australian grain would see prices move down from the drought-driven highs of recent years, the Rabobank report said average prices were expected to “remain in sight”, supported by an ongoing softer Australian dollar.

Export volumes – though remaining challenged by competitive global supplies along with the Chinese barley tariffs – would likely increase by as much as 70pc on last year.

This could see Australia set to export up to 17.5Mt of wheat (up 110pc on last year), 4.5Mt of barley (up 13pc) and 2.0Mt of canola (up 17pc).

State by state

Crop planting is up across all states.

Report co-author, Rabobank associate analyst Dennis Voznesenski said rainfall was received across large sections of New South Wales and Victoria during late summer and early autumn.

“Favourable soil moisture profiles in both states were then further enhanced as the months have rolled on and rainfall events continued,” he said.

“Strong early season rainfall has put New South Wales in a great position to plant a large crop of six million hectares, up a staggering 95pc from last year and 31pc above the five-year average. This planting program has been driven by the best opening rains in three years, but also the challenge of sheep and cattle restocking at high prices, which has prompted putting more country to cropping.”

Victoria’s planted crop for 2020/21 is forecast to be up 14pc to 3.5Mha.

For Queensland, however, good early rains have not been followed up in all areas, with cumulative rainfall in central Queensland now having fallen below the 10-year average.

Rabobank still sees total area planted to cropping in Queensland increasing by 44pc to 0.95Mha in the 2020/21 season.

Mr Voznesenski said South Australia had seen a fantastic start to the year, with most cropping areas enjoying above-average planting rains.

“Meanwhile, Western Australia had a promising start, but conditions became drier through March and April. However late May rain has improved prospects,” he said.

Rabobank is expecting total grain area planted in South Australia to be up 12pc on last season at 3.9Mha and Western Australia up 7pc at 8.2Mha.

Commodities outlook

Across the country overall, wheat, canola and pulses will see the largest increases in planting from last year, mainly driven by improved conditions in the eastern states.

Wheat planting is expected to be up by 33pc on last season, with canola up 35pc and area planted to pulses increased by 36pc.

Dr Kalisch Gordon said barley had seen a modest (1pc) decline in planting off the back of a pessimistic price outlook.

“Further declines were limited by the fact China’s tariff decision following the anti-dumping investigation came after the majority of barley area had been planted,” she said.

Prices moving lower

The bank forecasts Australian grain prices to move lower in 2020/21, although the “return to earth will be softened by the Australian dollar”.

“Firming global wheat production expectations and a softening in demand post the COVID-19 stockpiling means we have a neutral outlook for global wheat prices over the coming 12 months,” Dr Kalisch Gordon said.

The bank expects CBOT (Chicago Board of Trade) wheat to trade in the US525-534 cent range.

Dr Kalisch Gordon said renewed local wheat supply prospects would, however, increasingly weigh on local prices as harvest approaches, with local prices down year-on-year.

For barley, increased supply and a competitive global feed grain market (due mainly to cheaper corn prices because of a coronavirus-driven slump in ethanol demand for fuel) means global prices will be down this year.

Locally, increased barley supply and a challenging export market – particularly in light of the imposition of China’s tariffs – sees a flat price outlook, although also supported by the lower dollar.

With Australian canola, particularly the non-GM variety, enjoying stronger pricing in recent times – off the back of drought-driven low supply, increased usage in home-cooking during COVID-19 lockdowns and increased export demand – prices are expected to return lower over the course of the year.

For pulses, lower global supply should keep chickpea and lentil prices supported in 2020 –with increased demand from India and Turkey critical – although higher Australian production will hold domestic prices in check.

Exports on the rise

Increased Australian production, lower domestic premiums and a favourable Australian dollar all support an increase in Australian grain exports in 2020/21. However, finding a home for that grain will likely be challenging.

“Stagnant global demand, low shipping costs and depreciation of Black Sea region currencies will continue to challenge Australia’s competitiveness in traditional markets,” Dr Kalisch Gordon said.

Source: Rabobank

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY