INCREASING wheat yields in Ukraine and Russia and improved logistics through Black Sea ports are putting pressure on the volume of wheat exports into Asia from Australia, where a focus on consumer-focused quality is required to stave off further losses.

The good news is that Australia can work to counter increased Black Sea wheat exports to Asia by actively promoting Asian bakers’ nuances of quality preferred by those eating the product.

That’s the opinion of Professor Ross Kingwell, co-author of the report entitled Ukraine: an emerging challenge for Australian wheat exports, published by the Australian Grains Export Innovation Centre (AEGIC).

“Ukraine’s competitiveness in the international wheat export market is underpinned by greater rates of yield advancement and greater cost efficiencies in its grain supply chains. During the next decade these advantages are likely to undermine Australia price competitiveness,” Professor Kingwell said in his address to the AEGIC conference in Melbourne last month.

Professor Kingwell said Ukraine’s top 15 export grain destinations in the five years to 2014 included many Asian markets, and Russia was also “very seriously targeting markets in parts of Asia”.

“The reach of Russian grain into export markets between the first decade of the 21st century and the second has shifted from a focus on North Africa and the Middle East (MENA) to now making its way into Southeast Asian markets,” he said.

“Their grain logistics networks are modernising, their wheat is gaining acceptance by flour mills in Australia’s key markets and Black Sea wheat is displacing Australian wheat in price-sensitive markets.”

Professor Kingwell said he believed a focus on Australian wheat quality would stand it in good stead to weather the modest threat Ukraine wheat posed to Australia in its key wheat markets.

“The potential threat is large though not certain. Australia does have time to counter this competitive threat as long at Australia’s wheat producers act strategically.”

“We must understand the opportunity, to know that our future for the next decade or more is in the Asian region, to get closer to our customers and understand the segments of those markets that have a preference for Australian wheat and understand truly what it is about Australian wheat that is a best fit for their needs.”

“We need to communicate that advantage back to our wheat breeders so they develop varieties that are not only attractive to growers but are especially attractive to our potential end-users.”

“We must continue to monitor this region (Asia) which is becoming responsible for 30 per cent of the global wheat trade. Whatever change is experienced in that region — be it climate, politics, technology or policy — we need to quickly understand what that is and what the ramifications will be for our export sector.

“The upside of all this is that the growth in Asian markets creates capacity for these destinations to take more Black Sea grains and more Australian grain, even though our market share could decline.”

Competitor analysis essential

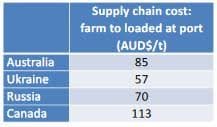

Source Kingwell, AGIC 2016

Professor Kingwell said it was important to undertake competitor analysis on exports from Russia and Ukraine as well as Canada and Argentina at a time when the cost of getting Australian wheat from farm to port sat somewhere between Canadian wheat at the high-cost end, and Russian or Ukrainian where farm to port costs are relatively low.

Ukraine’s strengths

Dr Kingwell described Ukraine as a low-cost provider of wheat with a large area of fertile soil, and a low-cost supply chain relative to Australia or Canada.

He said crops in Ukraine and Russia were on a higher yield trajectory than Australia, and that Ukraine’s portfolio of crops created a greater biological and commercial resilience compared to the cereal-dominant farming system of Australia.

“Ukraine and Russia are looking at upside in both technology and climate. It is important that Australia be aware of developments in that region.”

Black Sea producer nations also have a significant nearby demand pull in the MENA region and are looking forward to a huge demand pull in coming decades emanating out of Africa.

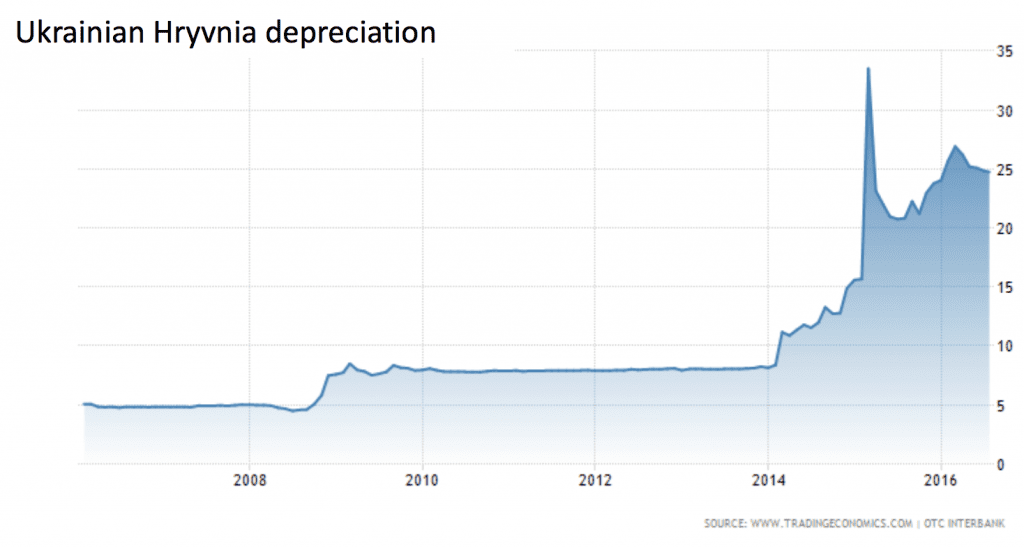

Professor Kingwell also said a “massive depreciation” of the Russian Rouble and the Ukrainian Hryvnia against the US dollar since 2014 further added to the attractiveness of Black Sea wheat exports. “The Australian dollar’s also depreciated by about 30 per cent, compared with the Rouble and the Hryvnia about 40 to 60 per cent.”

He said this had helped to underpin a competitive advantage for Black Sea exports, and helped to set the global wheat price, as well as having huge implications for the profitability of grain production in Ukraine and Russia.

“There is a substantial gross margin available in Ukraine and Russia for wheat production. Even at current low wheat prices, there are farm businesses generating substantial profits.”

Link to the AEGIC Ukraine summary fact sheet here (approx 1 megabyte download) and full report here (approx 15 mB download), Ukraine: an emerging challenge for Australian wheat exports. AEGIC is soon to release a report on Russia.

Background

Wheat is Australia’s largest broadacre crop by volume and value. The Australian Bureau of Agricultural and Resource Economics and Sciences estimates gross value of wheat production in 2015-16 at $A 7,204 million and production volume 24.193 million tonnes.

In 2015-16 and in 2014-15, Australia was the world’s 5th-largest wheat exporter, behind the Black Sea region, the European Union, Canada and United States of America.

HAVE YOUR SAY