WINTER crop prospects are mostly positive as much of eastern Australia has enjoyed the most positive start to the winter cropping season in several years, though parts of Western and South Australia would benefit from more rainfall, according to Rural Bank.

In its June Insights Update released today, the bank said many grain growing areas in New South Wales, Victoria and the eastern regions of SA had come into winter with above average soil moisture, and forecasts pointed towards above average rainfall in winter.

Much of WA and parts of SA had a dry start in comparison to eastern regions, however rainfall in late May provided a reprieve to flagging prospects, particularly in southern parts of WA.

Queensland and NSW were set to see the biggest turnaround in fortunes, with area planted to winter crops forecast to increase by 111 per cent and 53pc respectively year-on-year.

At a national level, the bank said the winter crop area was set to increase by 13pc, with planted area in other states much steadier.

Improved yields are expected to see total winter crop production jump by 35pc, year-on-year.

Wheat, pulses dominate

Rural Bank predicts wheat and pulses will be the biggest movers, with forecast production increases of 59pc and 45pc respectively.

This will bring back production back to levels where there is significant exportable surplus, meaning that world prices will have a much larger impact on local prices compared to recent years.

Whilst yield estimates contain a degree of uncertainty at this time of year, favourable weather in coming months has the potential to push final production well above current estimates.

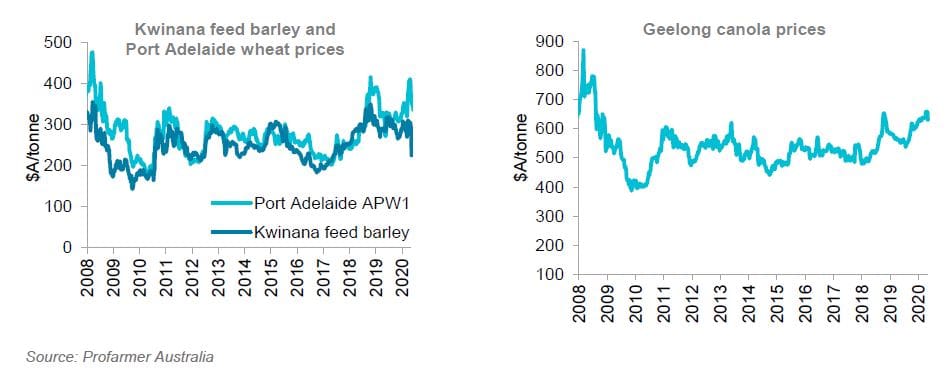

China barley tariffs

News that China would look to place import and other tariffs of 80.5 per cent on Australian barley sent shockwaves through the grains industry in May.

In the past five years, China has accounted for 70pc, or around 4.1 million tonnes of Australian barley exports per year.

With winter crop planting already well progressed, and completed in some areas, there was limited scope for grain growers to switch area away from barley, meaning that barley markets will need to work out where to allocate grain which would have previously gone to China.

There may be some scope to increase imports to Saudi Arabia (the world’s largest barley importer), Japan, and other markets, as well as a limited capacity for increased domestic use of barley for stock feed.

With the high barley prices seen in recent years having priced Australia out of many exports markets, including Saudi Arabia, lower prices over the coming season is almost certainly an implication of this situation.

Record world wheat stocks

Internationally, Rural Bank said CBOT (Chicago Board of Trade) wheat futures had been taking their time in deciding whether their next big move would be up or down.

Early estimates have world wheat stocks reaching new record highs in the coming season and this continues to place downward price pressure on global wheat prices.

Wheat end stocks among major exporting nations are also set to increase by 3pc year-on-year.

However, wheat stocks in key Black Sea exporting nations are still going to be some way off levels seen three to four years ago, when downward supply side pressures were particularly strong.

An interruption in export pace from this part of the world is quite possibly the best chance of world wheat prices seeing meaningful price support in the back half of this year.

Source: Rural Bank

HAVE YOUR SAY