A cargo of Victorian barley is due to berth at the G3 terminal at Three Rivers in Quebec, Canada, later today. Photo: Port de Trois-Rivières

CANADA is importing around 100,000 tonnes of Australian barley this year to help it fill deficits left by last year’s drought, and there could be more to follow.

Australian shipping stems indicate one cargo was shipped in February, with a second due to berth today at the G3 terminal in Three Rivers, Quebec.

A third is now on its way from the Victorian port of Geelong, and includes barley loaded in South Australia.

The sales are part of a remarkable period in global barley trade in which China, the world’s biggest malting barley importer, closed the door in 2020 to Australian barley.

Since the 1990s, Australia has been one of China’s biggest, if not its biggest, supplier.

World markets have also felt the impact from last year’s drought in Canada, which has reduced its exportable surplus, and prompted it to make atypical purchases from Denmark and France as well as Australia to shore up domestic requirements.

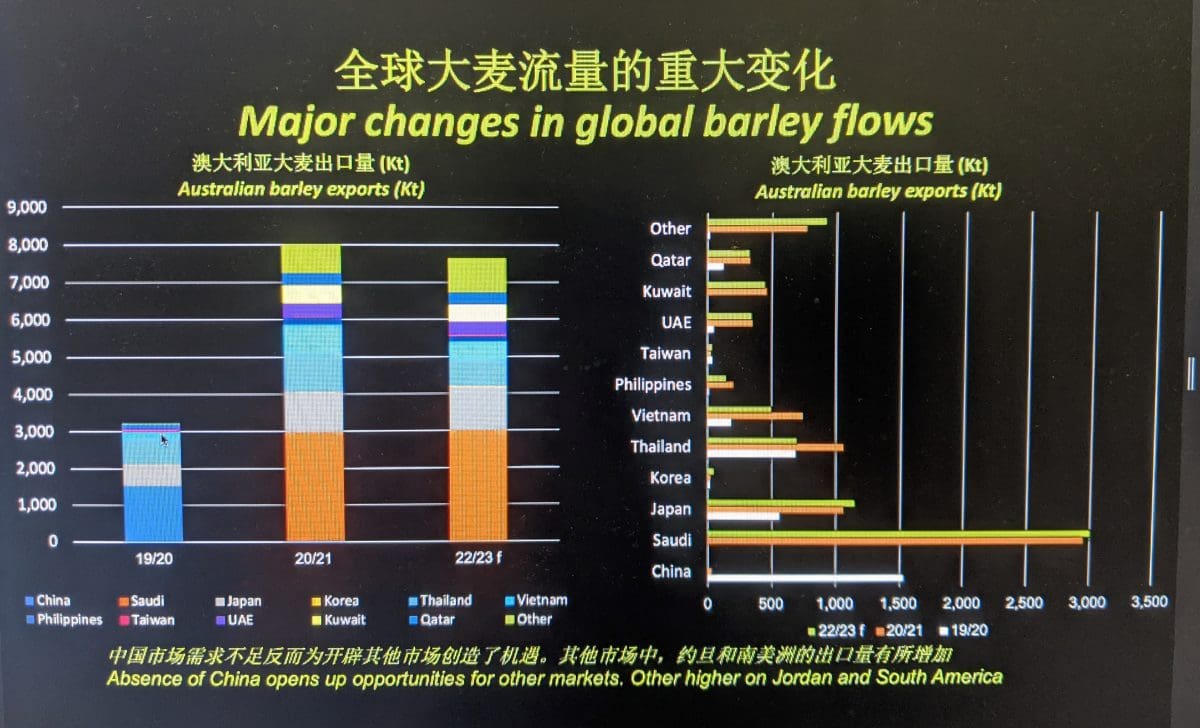

Russia’s invasion of Ukraine and resulting blockades of Ukraine’s Black Sea ports have come as the latest reshaper of barley trade flows, which were outlined yesterday by Ag Scientia principal Lloyd George during an Australian Export Grains Innovation Centre malting barley technical webinar.

“What we actually have seen in the ’21-22 season is the emergence of some new destinations,” Mr George said.

“Some of this is malting barley, certainly heading into South America.”

Mr George said drought in Canada has also made an impact.

“There’s Australian barley heading into Canada now.

“Traditionally, we’d never see that; there’s a little bit going into Europe as well.

“We’re also seeing evidence of countries that were reliant on Black Sea barley in the past starting to emerge.”

“Jordan has emerged as a significant importer of Australian barley in the ’21-22 season as well.”

Destinations for Australian barley exports in 2019-20, 2020-21 and 2021-22, not 2022-23 as shown on graph. Source: Ag Scientia

Maltsters likely users

Inquiries made by Grain Central to possible counterparties on Australian barley sales to Canada have yielded nothing, but ASX announcements by the GrainCorp spin-off United Malt Group (UMG) indicate it is a or the buyer, and further Australian cargoes to Canada may be seen.

A UMG announcement dated April 26 provides some detail.

“The significantly reduced Canadian crop has resulted in the company incurring additional logistics costs to import barley into our processing plants in Canada from Denmark and Australia.”

UMG estimates the cost of this exercise in the 12 months to September 30, or FY22, to be approximately A$10-$12 million, and said around $2.5 million has been incurred in the first half.

In its outlook beyond FY22, UMG CEO and managing director Mark Palmquist said the external challenges for the company included the condition of the Canadian barley crop, as well as cost inflation, and supply-chain disruptions.

“We have seen a further impact of these external factors since February, particularly the deterioration in the quality of the Canadian barley crop,” Mr Palmquist said.

“We are addressing this issue for our customers through our ability to source barley by leveraging our international operations in key barley growing regions.”

Available Australian Bureau of Statistics data indicates the 33,000t of barley shipped to Canada in February, and the second reported cargo in April, also of 33,000t, was feed rather than malting.

However, industry sources are adamant the grain will be malted, and will be good-quality BAR1 barley with very little to separate it technically from malting grade.

Drought conditions boost protein to undesirably high levels, so the Australian barley is very likely to be blended with the local grain to produce a stack average within required parameters.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY