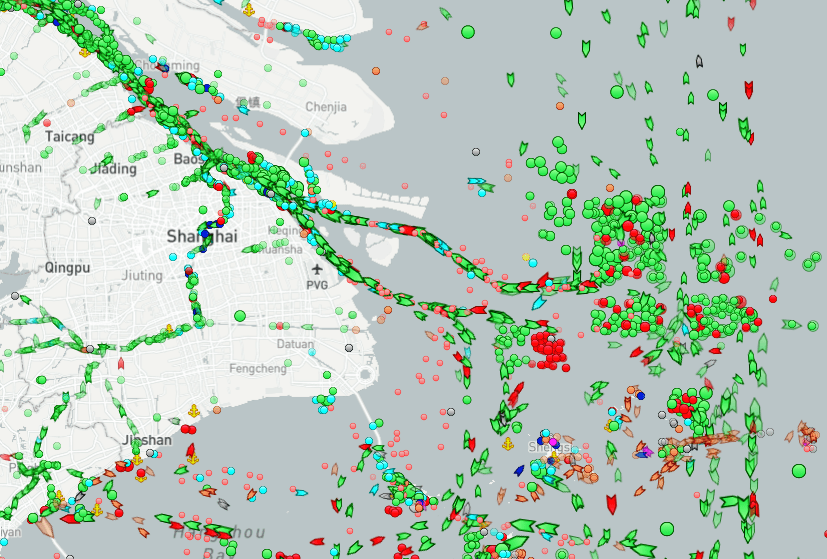

Hundreds of vessels are at anchor off Shanghai and up the Yangtze River because of COVID lockdowns affecting port operations. Image: Marine Traffic

STRICT COVID-related lockdowns in place in many major cities in China are affecting not just resident citizens but China’s trading partners including Australia, according to agribusiness banking specialist Rabobank.

Speaking in a recently-recorded podcast, What’s the Impact of China’s Lockdown

Wave? RaboResearch general manager for Australia and New Zealand Stefan Vogel

said four impacts of the lockdowns are set to have increasing ramifications for Australian agribusiness.

Freight logistics

Mr Vogel said the already-stressed global container logistics situation is becoming more complicated due to “massive delays around the Shanghai port”.

“The dry container index, which tracks average prices paid for the transport of dry bulk

materials across more than 20 international routes, increased five-fold through 2021 as a

result of COVID lockdowns in different parts of the world.

“While the index has since declined and is down 16 per cent since early March and 25pc down from the September 2021 highs, it looks likely that the ongoing COVID lockdowns in China will add to continued container logistics issues and keep container freight well above historic levels for 2022 and also likely to remain elevated well into 2023.”

Corn plantings delayed

Mr Vogel said disruptions to corn plantings in China – the world’s second-largest corn

producer and also the world’s primary corn importer – were also raising more concerns

in an already extremely-tight global grains markets.

“Chinese corn planting faces delays in two key provinces as some farmers are stuck in

major cities and are unable to access their fields due to the COVID lockdowns.

“We understand the lockdowns have created delays in planting this important feed crop

in some parts of Jilin and Liaoning provinces, and these two provinces account

combined for 20 per cent of China’s corn acreage.

“The delay in planting increases the risk of frost damage later in the season, but at this

point it is too early to say what the impact will be on yields. It will depend on the weather

through the season.”

Mr Vogel acknowledged that delays in planting Chinese corn –and China’s

feedgrain import needs more generally – were not the biggest driver of current global

grain prices.

Rather, Chicago Board of Trade (CBOT) corn prices had hit a 10-year high in April

this year, and remain above US$8 per bushel, driven primarily by concerns about the early arrival of the dry season in Brazil, and below-normal rainfall forecast for the next three months which could reduce Brazilian corn yields.

In addition, Mr Vogel said cool and wet conditions for corn planting in the US and an expected reduction of well over 50pc in Ukrainian corn production, coupled with its export uncertainty, this year were also putting upward pressure on global grain

prices, he said.

Dairy, pork demand impacted

The spread of the Omicron variant and China’s “dynamic zero-COVID” policy were also

bringing strong headwinds to consumption in the country’s food-service sector, resulting in reduced dairy demand.

“Dairy demand in food service is slowing in China while, according to our calculations,

dairy products in China produced from imported Oceania whole milk powder are

more expensive than those from locally-produced dairy for the first time in eight years.”

“After a record-breaking 2021 in milk powder imports by China, the demand uncertainty

from COVID restrictions is likely to dampen the ‘dragon’s’ import appetite going forward.”

Mr Vogel said Oceania’s record dairy prices may also make it more difficult for Australian

and New Zealand exports to be competitive into China.

China’s COVID restrictions have also resulted in a big drop in food-service sales of

meat products, as well as supply-chain disruptions, which have impacted hog production

and prices.

“Chinese hog producers have liquidated herds to avoid further losses, imposing further

downward pressure on Chinese pork prices which can also impact China’s feed grain

import needs.”

Source: RaboBank

I am wonder that a country like China, with such well audited and controlled administrative might and technology, CAN NOT plan a proactive logistical solution to divert this traffic nightmare upward/ elsewhere to other Chinese ports, to expedite turn around and relief such congestion!?!?

What if 2 other major cities stalls and have COVID. Will that mean a much higher congestion/ prices/ …etc?